Our Terms & Conditions | Our Privacy Policy

2 small-cap favourites of India’s Warren Buffetts just wiped off their debt. Are they on your watchlist? – Stock Insights News

The Warren Buffetts of India are known for their superior stock picking and dropping skills. When they buy fresh stakes, get additional stakes, partially or completely sell a holding, the investor circles go abuzz. But the smart investors who follow these super investors also keep an eye out on the milestones that these stocks hit. It gives them a fair idea of why the Warren Buffetts of India stay invested in them.

So, when less known companies backed by the Warren Buffetts hit new milestones, it deserves all the attention of any investor looking to follow the footsteps of the super investors. Two such small cap underdogs backed by the Warren Buffetts of India have just wiped of almost all of their debt. Also, they boast of solid returns on the capital they invest in the business.

Low debt means the company is free from the stress of making interest payments that otherwise eat into their profits, allowing them to use the money saved to take the business to the next level.

Here is everything you must know about these 2 stocks.

Aeroflex Industries Ltd

Incorporated in 1993, Aeroflex Industries Limited, is into manufacturing and supply of environment-friendly metallic flexible flow solution products.

With a market cap of Rs 2,383 cr, the company is one of the leading Indian manufacturers of metallic flexible flow solutions made with stainless steel used for controlled flow. They have 2,777 product SKUs.

Ace investor Ashish Kacholia has held a stake in the company since August 2023, and which he has steadily increased in small quantities, currently standing at 2% holding worth Rs 48 cr.

The company has been steady in making the most of the money it invests as capital. It is 5-year ROCE (Return on Capital Employed) is 27% and the current ROCE is 22%. The current industry median is just 14%. So, in simple words, for every Rs 100 Aeroflex spends as capital, it makes a profit of Rs 22 on it currently, while the overall industry averages just Rs 14.

Aeroflex had a debt of almost Rs 64 cr 5 years ago, which came down to Rs 39 cr in FY22. The current debt is just about Rs 58 lacs.

The company’s sales have grown from Rs 144 cr in FY20 to Rs 376 cr in FY25, logging in a compound growth rate of 21% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Aeroflex grew from Rs 22 cr in FY20 to Rs 80 cr in FY25, which is almost a 30% compounded growth.

As for the net profits, the company has shown some solid growth, from Rs 5 cr in FY20 to Rs 53 cr in FY25, logging in compounded growth of a huge 45%.

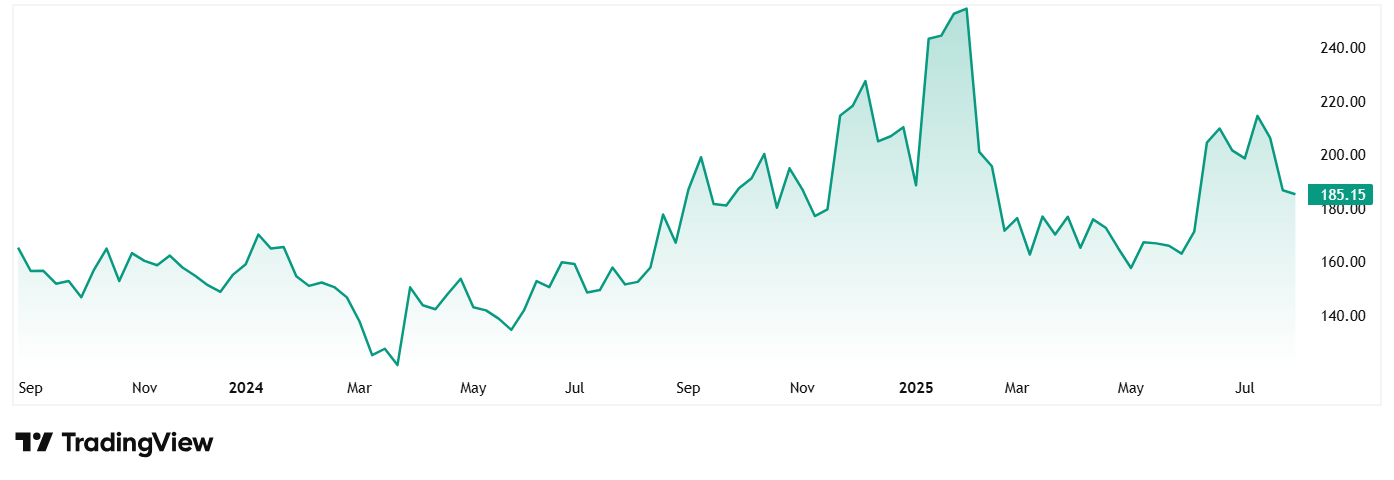

The share prices of Aeroflex Industries Ltd were around Rs 165 in August 2023 when it was listed. As of 6th August 2025, the price is Rs 184, which is a jump of just 12% since listing.

At the current price of Rs 184, the stock is trading at a discount of about 32% from its all-time high price of Rs 272.

As for valuations, the company’s current PE is 50x, while the current industry median is 24x, indicating that buyers are willing to pay a premium for the stock.

According to the latest concall, Q1 FY26 was a weaker quarter for Aeroflex due to external macro headwinds—primarily tariff-driven demand disruption in exports. However, the company is executing on key strategic initiatives, notably its entry into the fast-growing data centre liquid cooling segment and is expanding its metal bellows and Hyd-Air businesses. Management maintains a positive outlook, with expectations of normalization from Q2 and strong EBITDA growth for FY26.

Garuda Construction and Engineering Ltd

Incorporated in 2010, Garuda Construction provides end-to-end civil construction for residential, commercial, residential cum commercial, infrastructure, and industrial projects.

With a market cap of Rs 1,586 cr the company specializes in civil construction services that include project planning, resource mobilization, detailed engineering, and the complete execution of construction projects.

One of India’s Warren Buffetts, Utpal Sheth, holds a 2.3% stake in the company worth Rs 36 cr. Utpal Sheth is the CEO of Rakesh Jhunjhunwala established RARE Enterprises, a private equity investment firm. Sheth’s wife, Nipa Utpal Sheth, also holds a 1.5% stake in the company via her firm Chanakya Corporate Services Private Limited.

Just like Aeroflex, Garuda Construction is also capital efficient, as the current ROCE for the company is a at 30% and the 5-year ROCE is also a good 52%. Which means, for every Rs 100 it spends as capital currently, the company makes a profit of Rs 30 which is probably one of the highest when compared to industry peers. The current Industry median ROCE is 17%.

The company had a debt of Rs 31 cr until 5 years ago, which it reduced to Rs 12 cr in FY22. The current debt is close to just Rs 10 lacs.

The company’s sales jumped from Rs 124 cr in FY20 to Rs 225 cr in FY25, logging in a compound growth of 13% in the last 5 years.

EBITDA for grew at a compound rate 75% from Rs 4 cr in FY20 to Rs 66 cr in FY25.

As for the net profits, the company has shown solid growth from Rs 1 cr in FY20 to Rs 50 cr in FY25 logging in compounded growth of 102%.

The share price of Garuda Construction and Engineering Ltd was about Rs 106 when it was listed in October 2024. And as 6th August 2025, the price is Rs 170, which is a jump of 60%.

At the current price of Rs 170, the company’s share is trading at a discount of around 18% from its all-time high price of Rs 206.

Valuation wise, the company’s share is trading at a PE of 23x, which is same as the current industry median. The 10-year industry median is 18x.

Follow The Warren Buffetts of India?

The two companies we saw today, Aeroflex Industries and Garuda Construction are now probably on the watchlist for many investors. Given their solid performance in the last few years when it comes to Sales, profits, EBITDA, ROCE, gains etc, it all makes sense. Add to it that they have got rid of their debt and are backed by 2 of the most followed Warren Buffetts of India.

The question now is what should be the way forward? Will these companies be able to sustain the steady growth and keep the Kacholia and Sheth interested & invested? Or will they run out of steam. Only time can tell.

But smart investors must add these stocks to their watchlists, to see which way they move and if at all they are the next big thing.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.