Our Terms & Conditions | Our Privacy Policy

Dengue Claims: Insurance Cos See 40%-80% Drop In Dengue Claims | Kolkata News

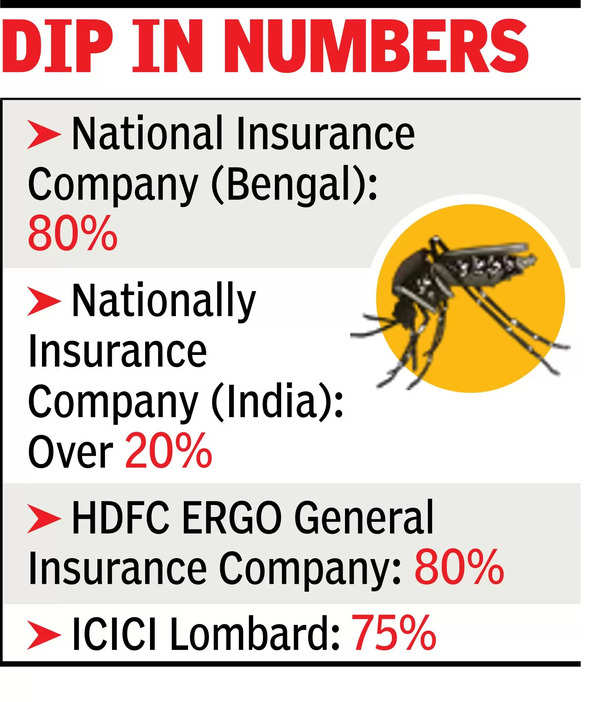

Kolkata: All insurance companies have witnessed a drop in claims from dengue patients across the city in Aug and Sept so far, though this period usually sees a spike in hospitalisation for the vector-borne disease. From April 1 till Sept 22, insurance companies recorded a 40%-80% drop in dengue claims in Bengal compared to that in the same period last year, the highest in India.

A National Insurance Company official said last year, they got 1,183 claims from April to Sept 22, but the figure decreased to 211 this year. Their pan-India applications decreased from 10,744 to 8,693. Other insurance firms, too, registered a similar decline. Parthanil Ghosh, director and chief business officer, HDFC ERGO General Insurance Company, pointed out they received 80% less insurance claim applications for malaria and dengue in Bengal than that last year. “Major factors contributing to this decline in dengue hospitalisation is the late onset of monsoon this season and rain deficit,” he said. HDFC ERGO furnished IMD data that confirmed a 40% rain deficit in Gangetic Bengal till Aug.

According to Bengal figures by ICICI Lombard, insurance applications for dengue hospitalisation came down by over two-third of last year’s applications between April and the first week of Sept. While the company got 96 applications till Aug-end in 2023, the figure was 26 this year.

Doctors, too, agreed dengue cases had been much fewer, especially the severe ones. Prasenjit Ghosh, a director at Dreamland Nursing Home, said, “Last year, at least 50% of our patients had dengue. This time, most tests are throwing up negative dengue results.”

Bhaksar Nerurkar, head, health admin team, Bajaj Allianz General Insurance, said, “While claims for urological disorders saw a slight rise between Aug last year and this Aug, fever and infection-related claims have seen a decrease.” Jyotirmay Kundu, network manager, Heritage Health Insurance TPA, added there were 30%-35% drop in dengue applications till the third week of Sept.

We also published the following articles recently

Insurance firm fined for refusing claim

The Kasaragod consumer dispute redressal commission has ruled that Bajaj Allianz Insurance must pay Rs 25000 in compensation to a local resident for denying reimbursement of his son’s hospital bill. Additionally, the insurer is required to reimburse the bill with an 8 percent interest and Rs 5000 for litigation costs within a month.8 malaria deaths in Maha this month; dengue claims two lives

The state reported eight malaria deaths and two dengue deaths in September, raising this year’s toll to 34. Chikungunya cases have surged by 50%, prompting a rapid action team to investigate. Improved surveillance is cited as a reason for the increase in mosquito-borne disease cases compared to last year.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.