Our Terms & Conditions | Our Privacy Policy

Is the time for in-car payments finally here?

In-car payments are finally gaining traction after years of development and early failures. Automakers like BMW and Mercedes are pushing the boundaries of connected vehicles, turning cars into secure digital hubs for seamless payments. Could this be the moment in-car payments become mainstream?

© zipop – Adobe Stock

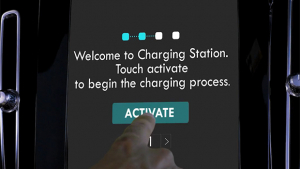

In recent years, in-car payment systems have emerged as a key innovation in the automotive industry, fueled by the rise of connected vehicles and advances in digital technology. These systems enable drivers to pay for services such as fuel, parking, car wash, tolls, and even food. The growing integration of digital payment technologies like NFC, biometric authentication, and cloud-based tokenization frameworks has made this seamless experience possible. Leading automakers, payment service providers, technology companies, and retailers are working together to make this a widespread reality, addressing the need for convenience in today’s fast-paced, digitally-driven world.

In-vehicle payments are not a new thing but early attempts in this space were not always successful. Early efforts, such as GM’s Marketplace, aimed to integrate in-car commerce but failed to gain significant consumer traction due to technological limitations and a lack of widespread adoption. At the time, issues like poor GPS accuracy, unreliable connectivity, and a fragmented user experience made these solutions clumsy.

Better technology and a more solid ecosystem involving all parties are driving a more cohesive user experience, allowing for seamless integration across regions and services, which is why companies like BMW, Citroen, and Mercedes-Benz are now seeing success where earlier attempts faltered.

Earlier this month, BWM launched an in-car payment solution that allows over 500,000 drivers in Germany to pay for fuel and parking through the vehicle’s infotainment system. This service works with several major fuel brands, including Aral, Esso, and HEM, and is part of BMW’s broader push to expand this technology across Europe. BMW iX5 drivers will soon be able to pay for hydrogen at H2 MOBILITY Deutschland stations via the new system.

© Mercedes-Benz

Its German, and global, competitor Mercedes-Benz was the world’s first car manufacturer to use Visa’s Delegated Authentication and Cloud Token Framework technology to enable secure native in-car payment, launching Mercedes Pay+. Later that year, the OEM signed another partnership with MasterCard to expand the reach of its service to more than 3,600 service stations in Germany. By 2026, Mercedes-Benz expects more than 4.7 billion in-car payment transactions worldwide.

Richard Campion, Head of Fleet & Mobility at Visa Europe, sees the vehicle as another form factor, just like the phone or a watch. The appropriate payment credential in the vehicle opens up various use cases.

“I believe this will scale significantly in the coming years. Many vehicle manufacturers have made announcements about embedding payments within vehicles. Parking and tolls are fundamental, and vehicle refueling is a powerful use case – being able to identify which pump you’re at and unlocking it while remaining in the vehicle, is significant. Additionally, vehicle servicing and maintenance are other areas that could benefit,” he explains.

These advancements come at a time when the automotive industry is increasingly moving toward seamless, digital-first experiences. The rise of autonomous driving, vehicle electrification, and IoT is pushing automakers to rethink the car as a digital hub, with in-car payments becoming a key component of this transformation.

In March this year, Spanish energy company Repsol followed suit, introducing in-car payments at 100 service stations in Portugal in partnership with ryd, a software company specializing in connected car solutions. ryd has been expanding its network across Europe, partnering with brands like EG Group, Aral, and WashTec, significantly increasing its footprint in the in-car payment market.

© Sheeva.ai

One company at the forefront of this transformation is Sheeva.AI, which recently partnered with Citroën to launch in-car payment capabilities in India. Through Sheeva’s technology, Citroën drivers can now pay for fuel at over 32,000 stations across the country. This service, available via the MyCitroën Connect app, leverages Sheeva’s patented high-accuracy location technology to identify the driver’s location in relation to a fuel station, ensuring that payments are precise and efficient.

Evgeny Klochikhin, CEO and founder of Sheeva.AI, decided to develop the product after a bad experience paying for parking while his pregnant wife was waiting. “Why can’t my car just pay for me if it knows where I am?” he wondered. Today he believes the biggest challenges for in-vehicle payment are consumer adoption and the pace of the market.

“The real challenge is inertia in the market, especially with OEMs. They sell cars through dealerships and don’t have a direct relationship with consumers, except for premium brands like Mercedes and BMW. Getting them on board to push this new market is probably the biggest hurdle,” says Klochikhin.

As in-car payment systems continue to evolve, their potential seems vast. In the future, these systems could be integrated with smart home devices, enabling drivers to pay for a wide array of services, from vehicle maintenance to entertainment subscriptions. The global market for these transactions, which was approximately $1.12 billion in 2022, is projected to grow to more than $6 billion by 2030, according to a study by Worldline and Orange. However, widespread adoption will depend on resolving challenges around standardization, interoperability, and security, as well as proving the technology’s value to consumers and automakers alike.

Related contents

Discuss

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.