Our Terms & Conditions | Our Privacy Policy

Two-Wheeler EV Sales Slowdown In Sept; Ola Electric’s Market Share Drops, Bajaj Overtakes TVS

SUMMARY

Bajaj Auto overtook TVS Motor with 18,933 two-wheeler EV registrations last month. Its market share also increased to a little over 21% last month from 19% in August

Ola Electric’s escooter registrations slipped 11% MoM to 23,965 units in September, while its market share fell to 27%

TVS Motor saw a 2% MoM increase in escooter registrations to 17,865 units, while IPO-bound Ather Energy’s registrations jumped over 15% to 12,579 units

Electric two-wheeler registrations in India seem to be witnessing another trend shift as the escooter sales of Bajaj Auto touched an all-time high in September, surpassing TVS Motor and inching closer towards Ola Electric’s registrations.

Bajaj Auto recorded 18,933 EV registrations last month, growing from 16,650 units in August this year, as per Vahan data as of October 1. On a year-on-year (YoY) basis, the legacy automotive player witnessed a 166% jump in its Bajaj Chetak sales.

Its market share also increased to a little over 21% last month from 19% in August.

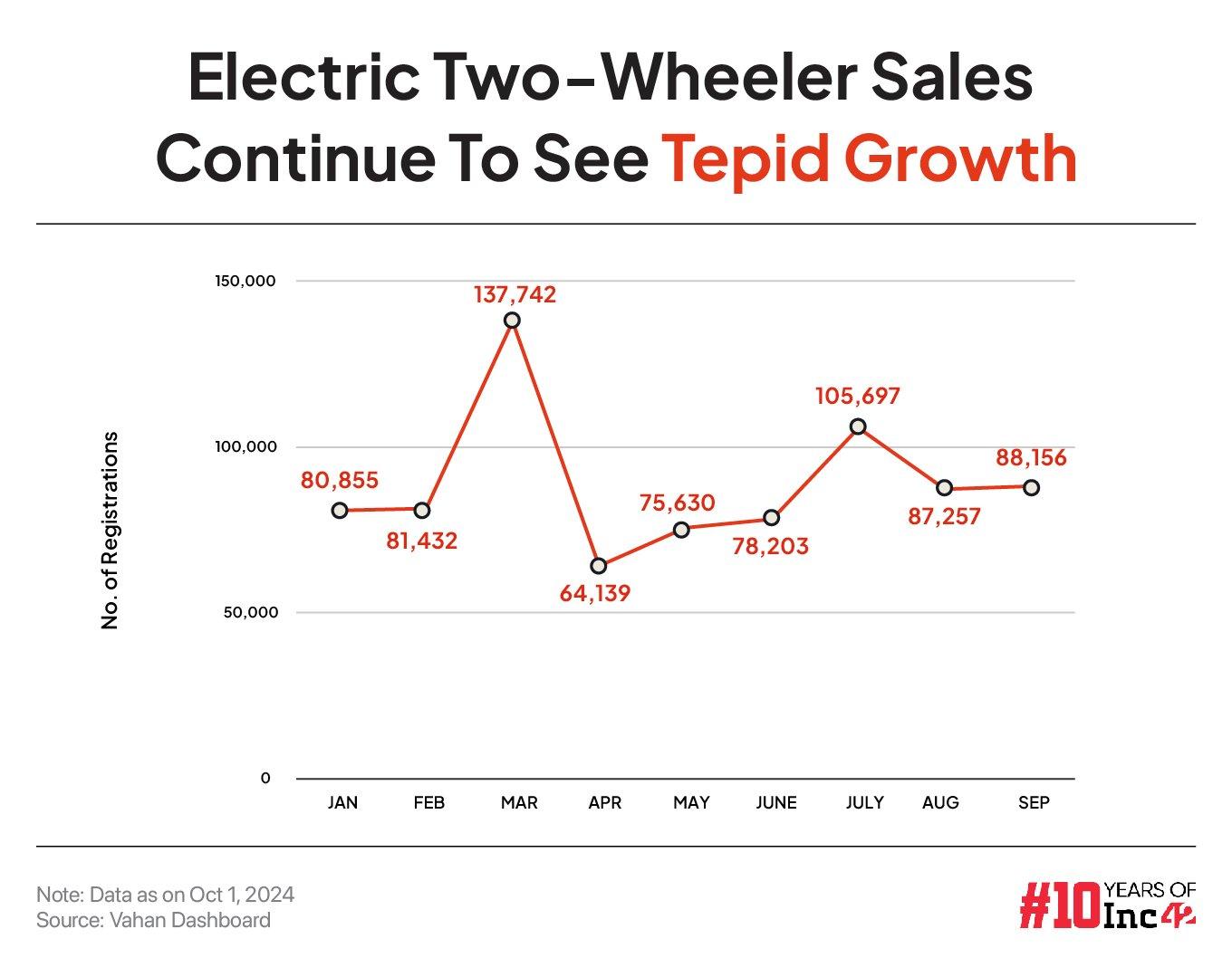

Overall, electric two-wheeler registrations grew marginally by 1% to 88,156 units in September from 87,257 units in August. On a YoY basis, registrations rose over 37% last month.

Recently listed electric mobility startup Ola Electric continued to maintain its top position last month, but its escooter registrations slipped 11% month-on-month (MoM) to 23,965 units. This was also the company’s lowest monthly vehicle sales since October last year, when registrations stood at 23,594 units.

Meanwhile, the Bhavish Aggarwal-led startup also continued to see decline in its market share in the electric two-wheeler market. From a little over 30% market share in August, the EV startup’s share fell to 27% in September.

To address this, Ola Electric recently launched “HyperService” to offer “one-day resolution” of service-related issues. It is pertinent to note that the company has been facing numerous complaints from customers about after-sales service on social media platforms.

Despite this, brokerage Bernstein believes that Ola Electric is on track to achieve EBITDA profitability. It also said recently that Ola Electric has the highest gross margin among its peers.

Though TVS Motor fell behind Bajaj, its escooter registrations rose 2% MoM to 17,865 units in September. The legacy motorcycle maker’s share in the electric two-wheeler market also increased marginally to a little over 20%.

On the other hand, ahead of its public market debut, Ather Energy is also seeing a rise in its EV sales and market shares. Despite an overall slowdown in escooter sales, Ather’s vehicle registrations jumped over 15% to 12,579 units in September from 10,919 units in the previous month.

Ather also saw an over 75% rise in its vehicle sales on a YoY basis, while its market share increased to over 14% in September as against 12% in August.

However, legacy automotive player Hero MotoCorp, which is also a major shareholder in Ather, continues to face pressure in the electric two-wheeler market. Though its EV sales have grown sharply compared to the beginning of the year, Hero MotoCorp’s electric two-wheeler registrations fell over 9% MoM to 4,174 units last month.

Its EV registrations stood at 4,596 units in August as against 4,945 units in July.

On the other hand, some of the newest electric two-wheeler startups, including River and Ultraviolette, are witnessing slow but steady growth. River’s EV registrations increased 7% MoM to 297 units in September, while Ultraviolette’s electric motorcycle registrations grew to 51 units during the month from 47 units in August.

It is pertinent to note that the sales of two-wheeler EVs underwent significant volatility this year amid the government lowering the demand subsidy under the FAME scheme. While the industry was waiting for the third iteration of the Centre’s FAME scheme, the cabinet approved a new scheme in September—the ‘PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme’.

The new scheme has an initial outlay of INR 10,900 Cr for a period of two years to support EV adoption. The scheme aims to support 24.79 Lakh electric two-wheelers (E2Ws), along with other vehicle categories. The Centre’s previous subsidy scheme FAME-II aimed to support 10 Lakh two-wheeler EVs.

Overall, total EV registrations in the country, across vehicle categories, stood at 1.66 Lakh units last month, growing from 1.65 Lakh units in August. With the festive season ahead, EV manufacturers will be hoping for a rise in sales in the coming months.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.