Our Terms & Conditions | Our Privacy Policy

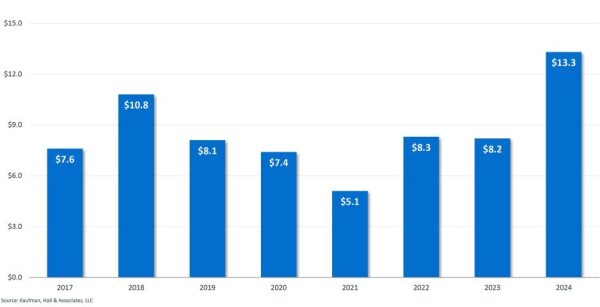

Hospital and health system M&A surged to $13.3 billion in Q3 2024

The volume of hospital and health system transactions surged in Q3 2024, with 27 announced deals marking the highest level of activity this year, according to a new M&A report from Kaufman Hall.

The increase aligns with pre-pandemic transaction levels, driven significantly by the bankruptcy of Steward Health Care, which accounted for 11 of the 27 transactions.

Among the notable deals, Health Care Systems of America took over operations at eight Steward hospitals, part of four “mega mergers” in Q3 where the seller’s revenue exceeded $1 billion. Other major transactions included Orlando Health’s acquisition of Brookwood Baptist Health from Tenet, Prime Healthcare’s purchase of eight Ascension-owned hospitals in Illinois, and the merger between Sanford Health and Marshfield Clinic Health System.

Excluding Steward-related deals, the 16 other transactions reflect activity consistent with pre-pandemic trends in 2018, 2020, and 2023.

Despite the number of large transactions, the average size of the seller decreased, with a drop in revenue from $984 million in Q2 to $492 million in Q3. Total transacted revenue, however, reached a record $13.3 billion for Q3 2024.

The Steward Health Care transactions highlight ongoing challenges for financially troubled hospitals, though buyers like CHRISTUS Health, Honor Health, and Boston Medical Center have picked up assets in key markets. Conversely, some facilities, particularly in Massachusetts, have closed due to an inability to find buyers.

Portfolio realignment continued across large health systems, with Community Health Systems and Tenet Healthcare making significant divestitures. Additionally, several systems expanded into new regions, including Orlando Health’s move into Alabama and Prisma Health’s entry into Tennessee.

Looking forward, Kaufman Hall notes that the high volume of distressed hospitals seeking partnerships underscores a broader concern about the viability of some healthcare facilities, as many continue to struggle with finding financial stability or new ownership.

Back to HCB News

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.