Our Terms & Conditions | Our Privacy Policy

Can MSTR Stock Price Rally Send Bitcoin To A New ATH?

MicroStrategy, the world’s largest corporate holder of Bitcoin, is capturing all the attention with a mega MSTR stock price rally. On Friday, the MSTR share price surged 16% shooting all the way to $212.59 levels following a major breakout above $190 last week.

As MSTR widens its gap with BTC, analysts believe the public-listed firm can provide a SpaceX-like launchpad for the BTC price rally ahead. On Sunday, Elon Musk’s SpaceX successfully launched Starship test flight 5.

Can MicroStrategy Surge Trigger Next Bitcoin Rally

Following the recent rally and breakout in the MicroStrategy stock to new all-time highs, the MicroStrategy valuations have soared to $43 billion. With several key catalysts on the horizon, analysts at 10x Research suggest that the stock’s upward trajectory may continue.

This could create a “tail wags the dog” scenario, where MSTR stock performance influences the Bitcoin price, further reinforcing the company’s role as a key player in the Bitcoin ecosystem. As of press time, the BTC price is already trading at 1.75% up surging past $64,000 levels, a crucial resistance zone for the asset class.

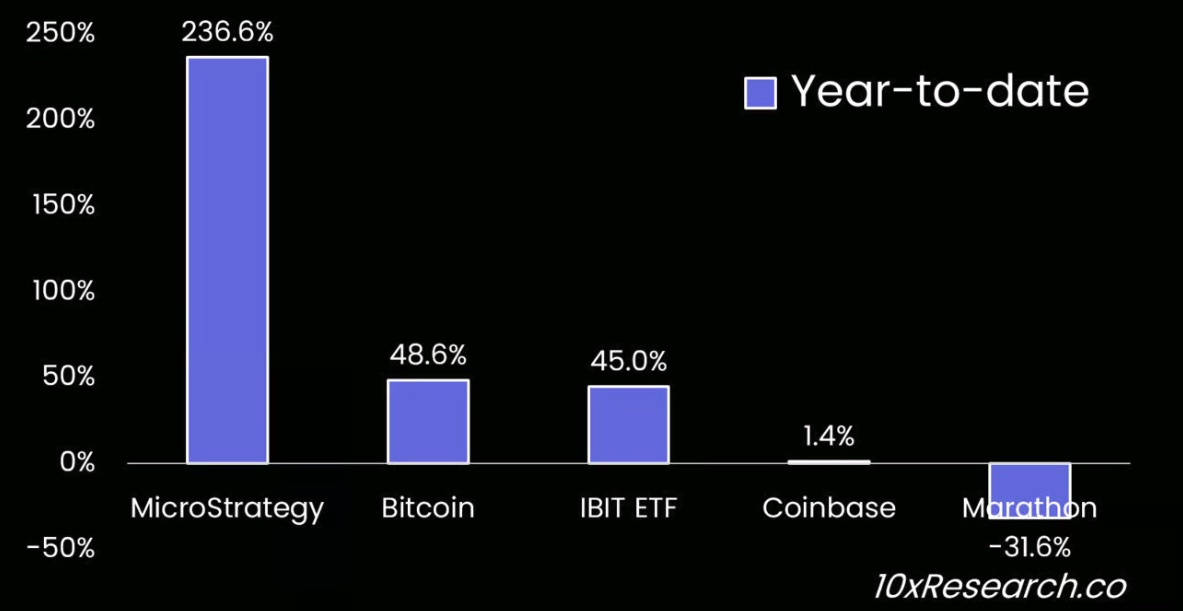

While the BTC price is up by 48.6% year-to-date, the MicroStrategy stock is up by a staggering 236% showing massive outperformance of more than 4x. Thus, if BTC catches up to these gains, the milestone of $100K would not be far from here.

Courtesy: 10x Research

Courtesy: 10x Research

Traders Remain Divided on MSTR Stock Movement

Popular Bitcoin investor Fred Krueger has issued a cautionary note on MicroStrategy (MSTR) shares highlighting the potential risks of the company’s soaring valuations. Currently valued at $43 billion, MicroStrategy holds 250,000 Bitcoin (BTC) worth $15.5 billion. Historically, the stock’s premium has fluctuated between 0.9 and 1.5 times its Bitcoin holdings.

Courtesy: Fred Krueger

Courtesy: Fred Krueger

Krueger warns that if the stock’s premium contracts to 1.4 times its BTC value, without a change in the BTC price, investors could see significant losses, potentially losing half their money. He advised caution when considering new share purchases at this elevated valuation.

On the other hand, “Bitcoin Guy” Rajat Soni has justified the valuations stating that MSTR share price offers higher risk-adjusted returns than spot Bitcoin ETFs. He explained that the current premium of MSTR stock is 2.7x to the value of Bitcoins they receive in return. Thus, for every 1 Bitcoin worth of shares issued, MSTR receives 2.7 Bitcoin worth of cash, allowing it to purchase more Bitcoin.

This mechanism effectively gives MSTR shareholders a Bitcoin yield, as each share becomes “backed” by an increasing amount of Bitcoin over time. As long as MSTR can continue finding buyers for new shares, it can print shares at will and buy more BTC, contributing to its upward price momentum. This cycle, according to Soni, could theoretically continue as long as the BTC price rises.

The premium for #Microstrategy shares is ~2.7x right now

I want to explain what this means in very simple terms:

Every time $MSTR issues NEW shares, investors buy those shares and give MSTR 2.7x the value of what they’re getting in return

MSTR receives 2.7 #Bitcoin worth of…

— Rajat Soni, CFA (@rajatsonifnance) October 13, 2024

In a recent interview, founder and executive chairman Michael Saylor revealed his bold vision for the company’s future, aiming to transform MicroStrategy into Bitcoin bank.

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.