Our Terms & Conditions | Our Privacy Policy

The road to lasting stability

Pakistan’s economy stands at a critical juncture as the International Monetary Fund (IMF) warns of growing risks to the country’s financial and economic stability.

In its recent report, the IMF expressed concerns about Pakistan’s widening gap with its regional peers in terms of growth, competitiveness, and living standards. With political and economic instability, inadequate investment in human capital, and structural distortions hampering progress, the IMF highlights the urgent need for bold reforms to secure a sustainable future. Failure to act, the report suggests, could further strain the nation’s financial framework and international standing.

The international lender has expressed deep concern over Pakistan’s persistent economic lag behind its regional counterparts, emphasizing that immediate policy rectifications are imperative. In a report issued by its team, the IMF highlighted Pakistan’s declining standing in income levels, global competitiveness, and export prowess. From 2000 to 2022, Pakistan’s GDP per capita witnessed a modest annual growth rate of only 1.9%.

In sharp contrast, neighboring nations surged ahead: Bangladesh recorded an average of 4.5% growth, India reached 4.9%, Vietnam secured 5%, and China achieved an impressive 7.5%. When juxtaposed against its regional counterparts, Pakistan’s export trajectory has faltered, with its global competitiveness diminishing, owing to an inflated real exchange rate that outpaced the nation’s productivity progress. The IMF underscored that the recent economic stabilization presents a unique window to institute reforms capable of positioning Pakistan on a sustainable and inclusive growth trajectory, one that amplifies its export potential. Pakistan’s lackluster economic growth is a consequence of minimal contributions from human capital, insufficient physical infrastructure development, and dwindling productivity rates. Between 2000 and 2020, economic expansion was largely driven by physical asset accumulation and increased labor input, each contributing roughly 1.9% and 1.15% annually.

Moreover, Pakistan’s declining export performance, combined with limited engagement in international trade, continues to hinder its developmental prospects and external sustainability. Beyond sluggish export figures, the country has struggled to innovate and cultivate advanced, knowledge-based exports, further complicating its economic trajectory.

In addition to economic metrics, Pakistan lags considerably behind its regional counterparts in health and education outcomes, which has stunted growth, discouraged investment, and eroded productivity. Pakistan’s educational expenditure as a share of total government spending is notably lower than that of India, Bangladesh, and Nepal, exacerbating the nation’s developmental challenges.

Pakistan’s expenditure on healthcare, as a proportion of its GDP, is markedly lower than that of countries like Nepal and Sri Lanka. Pakistan suffers from the highest infant mortality rate in the region and alarming rates of stunted growth among children under five years old. In its analysis, the IMF stated that for Pakistan to shift towards a more prosperous economic path, the country must confront several structural distortions and significantly enhance both the quality and scope of public investment, particularly in human capital. The report stressed the necessity of dismantling the remnants of the old growth model, which relied on protective measures, preferential treatment, and various concessions. This legacy has stifled competition, suppressed incentives for innovation, and directed resources toward low-productivity sectors that only survive through state support, such as Special Economic Zones.

Eliminating these harmful protections, the IMF argued, would foster competition and innovation as new market players, including foreign investors, enter the economy. This would lead to a more productive allocation of resources, including labor, and support long-term growth. Additionally, the IMF pointed out the need to reduce the government’s crowding out of private sector investment and to create fiscal space for higher investments in both physical and human capital. This could be achieved by removing tax exemptions and concessions that currently benefit undertaxed sectors, thereby increasing government revenues.

However, the IMF cautioned that political and economic pressures from entrenched interests could delay or weaken reform efforts, jeopardizing the fragile stability the country has recently achieved. It also expressed concern that any resurgence of political or social unrest could undermine policy implementation and stall reforms.

Externally, Pakistan faces further challenges due to tight global financing conditions, fluctuating commodity prices, and heightened geopolitical tensions. Despite the incoming government’s stated intention to pursue deeper reforms under a new IMF-supported program, the political landscape remains uncertain, and there are strong pressures to relax policies, offer tax concessions, and provide subsidies.

The report cautioned that any policy slippages, especially in implementing crucial revenue-generating measures, combined with reduced external financing, could severely jeopardize Pakistan’s already fragile path to debt sustainability. Given the country’s substantial gross financing requirements, such missteps could exert pressure on the exchange rate and force domestic banks to finance the government, further marginalizing private sector investments and deepening the cycle of low growth and minimal financial development.

Geopolitical factors, such as increased commodity prices or more restrictive global financial conditions, could also strain Pakistan’s external stability. The IMF itself faces significant risks with the introduction of a new program. Among these, heightened business risks arise from the possibility of the program deviating from its intended path, compounded by Pakistan’s ongoing security challenges, which could deter foreign direct investment (FDI) and other crucial economic activities.

Additionally, reputational risks loom for the IMF. If the Fund is seen as treating Pakistan differently compared to other member nations that receive less support, it could face criticism. Conversely, choosing not to proceed with the program could also damage the Fund’s reputation, as new government officials or other nations may accuse it of unfairness, particularly following the successful completion of Pakistan’s Stand-By Arrangement (SBA).

While near-term financial risks have eased somewhat since the approval of the SBA, they remain significantly high. The IMF aims to manage these risks through phased disbursements, burden-sharing mechanisms, and assurances of adequate financing. However, operational risks persist, particularly concerning the safety of IMF staff on the ground. Despite these challenges, IMF activities are carefully coordinated with the United Nations Department of Safety and Security (UNDSS) to mitigate risks.

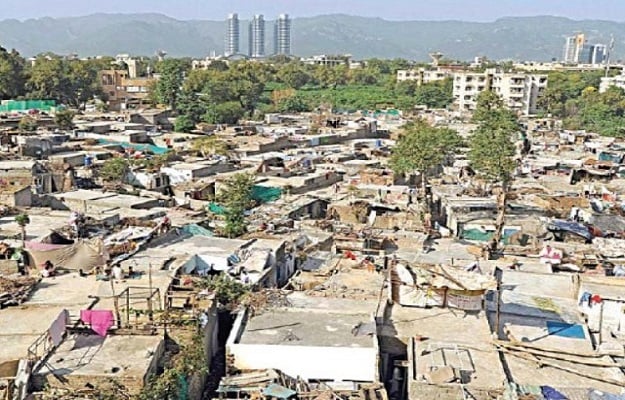

Despite recent progress, the report emphasized that Pakistan continues to grapple with deep-rooted structural problems that undermine its economic potential. Over the past few decades, Pakistan’s living standards have fallen behind those of its South and Southeast Asian counterparts, largely due to ineffective policies, insufficient investment in both human and physical capital, and distortions caused by the state’s excessive involvement in the economy.

Additionally, weaknesses in fiscal policies, coupled with a recurring cycle of economic booms and busts, have increased Pakistan’s external financing needs while depleting the country’s financial reserves. This leaves Pakistan with a very narrow margin for achieving fiscal and external stability. To build on the temporary stability gained over the past year, the report stressed that sound policies and reforms must not only be implemented but sustained over the long term.

Pakistan’s path to economic recovery and long-term stability hinges on addressing deep-seated structural challenges, boosting investment in human capital, and reforming outdated policies that stifle innovation and competition. The IMF’s report underscores that, while recent efforts have provided temporary stability, the window for meaningful reforms is narrow and must be seized with urgency. As the country grapples with geopolitical tensions, rising debt, and a fragile political climate, consistent and sustained policy implementation will be key to ensuring a prosperous future for Pakistan’s economy.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.