Our Terms & Conditions | Our Privacy Policy

Weekly Energy Market Situation—October 14, 2024

Globalization Also Drives Propane Pricing

- Propane market globalization increasing significantly

- U.S. record propane production offset by exports

- Propane export data now market-moving news

- Futures market expresses bearish view on NG demand

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

U.S. companies affected by changes in the price of propane have long had to account for factors such as weather, crop size, petrochemical demand, oil & gas production levels, and the overall health of the U.S. economy. In the last few years, another factor has joined that list. U.S. propane exports now exert a significant effect on the wholesale price.

While total U.S. propane and propylene production jumped to a record high of 561 million barrels across the first seven months of 2024 (versus 526 million barrels over the same period last year), domestic inventories were only moderately above normal for this time of year. U.S. propane exports have surged by 32 million barrels over the first seven months of this year preventing a massive inventory buildup. China increased their U.S. propane imports by approximately 16 million barrels and Japan by nearly 10 million barrels. To put things in comparison, in 2015, exports accounted for under 50% of U.S. propane demand. In 2024, exports are more than 70% according to the EIA.

How significantly does propane export news affect the market? A little over two weeks ago, a major propane export facility announced a multi-week maintenance shut down and the cash market prices fell by nearly 15% in anticipation of a glut of supply.

Propane marketers should view these developments as an opportunity. As a market grows more complex, customers may feel more unsure of what to do. A savvy marketer can address these concerns with an appropriate fixed-price or cap price plan.

Using financial hedges may also deliver significant improvement to the marketer’s bottom line. Please reach out to Powerhouse to learn how.

Supply/Demand Balances

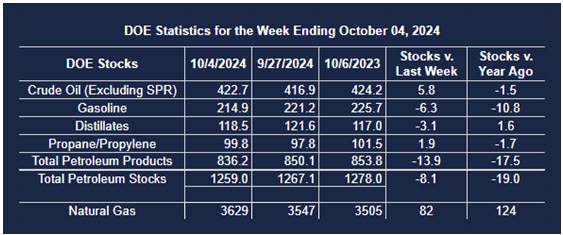

Supply/demand data in the United States for the week ended October 4, 2024, were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased () 8.1 million barrels to 1.259 billion barrels during the week ended October 4th, 2024.

Commercial crude oil supplies in the United States were higher () by 5.8 million barrels from the previous report week to 422.7 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down () 0.9 million barrels to 7.8 million barrels

PADD 2: Up () 2.8 million barrels to 106.2 million barrels

PADD 3: Up () 2.9 million barrels to 239.9 million barrels

PADD 4: Down () 0.5 million barrels to 22.1 million barrels

PADD 5: Up () 1.5 million barrels to 46.7 million barrels

Cushing, Oklahoma, inventories were up () 1.2 million barrels to 24.9 million barrels.

Domestic crude oil production increased () 100,000 barrels from the previous report to 13.4 million barrels per day.

Crude oil imports averaged 6.239 million barrels per day, a daily decrease () of 389,000 barrels. Exports decreased () 84,000 barrels daily to 3.794 million barrels per day.

Refineries used 86.7% of capacity; a decrease () of 0.9% from the previous report week.

Crude oil inputs to refineries decreased () 101,000 barrels daily; there were 15.590 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased () 169,000 barrels daily to 15.890 million barrels daily.

Total petroleum product inventories decreased () by 13.9 million barrels from the previous report week, down to 836.2 million barrels.

Total product demand increased () 1,338,000 barrels daily to 21.185 million barrels per day.

Gasoline stocks decreased () 6.3 million barrels from the previous report week; total stocks are 214.9 million barrels.

Demand for gasoline increased () 1,133,000 barrels per day to 9.654 million barrels per day.

Distillate fuel oil stocks decreased () 3.1 million barrels from the previous report week; distillate stocks are at 118.5 million barrels. EIA reported national distillate demand at 4.031 million barrels per day during the report week, an increase () of 394,000 barrels daily.

Propane stocks rose () 1.9 million barrels from the previous report to 99.8 million barrels. The report estimated current demand at 996,000 barrels per day, an increase () of 117,000 barrels daily from the previous report week.

Natural Gas

The last price rally topped out with an intraday high at $3.019 on October 4th, short of the summer high set on June 11th. Currently the March-April ‘widow maker’ spread is historically narrow. These facts point to market participants’ bearish view on natural gas demand for the upcoming winter.

From a technical perspective, should front-month futures price fail to hold near $2.50/mmbtu, then $2.35/mmbtu becomes the next support level. The Relative Strength Index (RSI) has been declining but has not yet reached oversold levels.

From the EIA:

- Net injections into storage totaled 82 Bcf for the week ended October 4, compared with the five-year (2019–2023) average net injections of 96 Bcf and last year’s net injections of 85 Bcf during the same week. Working natural gas stocks totaled 3,629 Bcf, which is 176 Bcf (5%) more than the five-year average and 124 Bcf (4%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 58 Bcf to 80 Bcf, with a median estimate of 74 Bcf.

- The average rate of injections into storage is 25% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 9.6 Bcf/d for the remainder of the refill season, the total inventory would be 3,888 Bcf on October 31, which is 176 Bcf higher than the five-year average of 3,712 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2024 Powerhouse Brokers, LLC, All rights reserved

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.