Our Terms & Conditions | Our Privacy Policy

PwC Survey – Artificial Lawyer

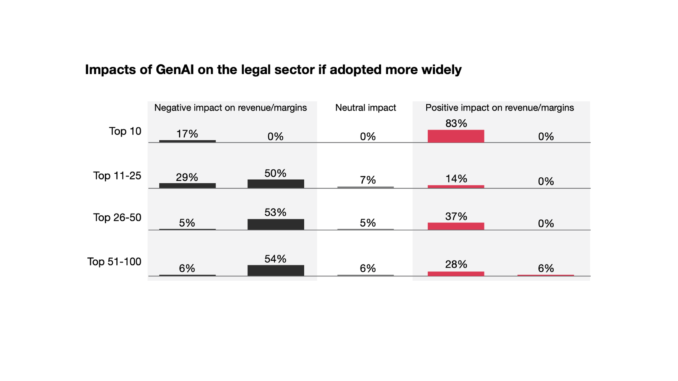

This year’s comprehensive PwC UK 100 law firm survey has found that the Top 10 largest firms see genAI as providing increased profits and revenue, but about half of smaller firms expect a negative impact.

As shown in the table below, there is a sharp difference between the views of the ten largest firms based in the UK, (by revenue), and those below that group. 83% of those in Top 10 firms were optimistic about genAI and agreed that they ‘will be able to use increased productivity to do more work for the same clients’. That in turn will increase revenue and profits.

PwC data, 2024

PwC data, 2024

Meanwhile, firms from 11 to 100, saw 50% or more of respondents saying they believed that ‘clients will have the same volume of work, but will expect reduced prices from improved efficiency gains’. I.e. the work they do will become commoditised, or perhaps we can say ‘industrialised’, and hence client expectations on pricing will change.

In short, the top firms, which handle the largest, most complex matters, see genAI as allowing them to do more of that work, even if some of their output is commoditised. Meanwhile, the firms from 11 to 100, see a world where less complex matters reduce in value to the client – at least if still using the billable hour, as the work is done more quickly – and they may not necessarily be able to easily ‘move up market’ to compensate, as the Top 10 will fiercely hold onto this more complex work.

What does this mean long-term?

If what you do will be commoditised due to technology, and the clients won’t necessarily start giving you more work that is more bespoke, then you have several choices, or at least that’s what this site sees happening:

- Cut your operating costs so that commoditised work can be done more profitably. This may actually mean using more genAI tools.

- Increase marketing efforts to bring in a greater share of this commoditised work, i.e. expand market share. That in turn could lead to mergers in order to improve economies of scale.

- If possible….try to focus more on specialised, high value work, which will drive up profits. However, that could prove hard to do if the vast majority of income is from commoditised matters. A solution would be for some partners to create a smaller, niche firm, while the remaining partners double down on commoditised work, i.e. a strategic split.

- That if commoditised work evolves in this way, it may make sense to move to a new business structure, e.g. a more corporate format. Taking external investment to grow the business may also help, as market share will become a critical factor.

For the Top 10 firms, it’s a very different picture. They will seek to do all of a matter, but absorb the commoditised elements as a ‘loss leader’, making their money on the most complex aspects, or at least that’s how Artificial Lawyer sees things happening eventually.

To keep hold of the best matters, these firms will likely continue to increase associate salaries to compete in the talent war, as well as keep raising hourly rates in order to generate profits that will retain the top partner talent.

As noted, they may start to see more commoditised aspects of their work as a ‘value add’, i.e. effectively done for free, in order to retain the most valuable work for clients that is not price sensitive. Clients will continue to send whole matters to these firms and not split matters apart. They want these firms to take on the management and risk of large-scale, complex needs and if they can do the commoditised elements of a big project for free, or almost nothing, then that only makes the relationship better. Meanwhile, large corporates appear to be happy to pay very high rates for the most complex legal challenges they face.

There may also be more highly complex matters because the world is not getting any less complex, or less globalised. The top firms may however feel pressure from smaller firms that are seeking to take some of that high value work at lower rates, but they will plan on their brand and market position helping them to retain it – even at much higher chargeable rates.

In short, the split we have in the legal market, which is already pronounced will accelerate and grow even deeper, with multi-billion pound firms embracing genAI and not worrying about commoditisation, while many other smaller firms, with revenues in the 100s of millions or less really feeling the impact of tech-driven commoditisation if they cannot adapt…..But, they can adapt and there are plenty of ways they can do this. They may also benefit from Jevon’s Paradox and the rise in equality of arms (more on those two another day).

GenAI Adoption

The survey also found that genAI adoption is coming along at a steady pace in the UK, which matches other surveys we have seen. Copilot is most popular, which is no surprise, as it’s the easiest to get started with. But, 39% of the UK 100 are also either using or trialling legal tech company genAI applications, such as Harvey or Spellbook.

PwC Data, 2024

PwC Data, 2024

Meanwhile, 55% of firms are also developing their own LLM-connected services ‘using the firm’s own data’, for example Fleet AI at Dentons, and many others across the market.

So, there you go. There’s a lot more in the survey and this site will dig back into it again as there is so much there. It can be found here.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.