Our Terms & Conditions | Our Privacy Policy

Nifty falls below 24,000. Here are two stocks for your watchlist

This downward momentum, which saw the Nifty50 decline by 6.22% in October, has been primarily driven by significant selling pressure from foreign institutional investors (FIIs), who offloaded shares worth ₹1,14,446 crore. In contrast, domestic institutional investors (DIIs) managed to purchase shares worth ₹1,07,254 crore, yet their efforts have been insufficient to prop up the markets amidst prevailing negativity.

As November opens with concerns about a prolonged bearish trend, retail investors are wondering if the end of a bullish market cycle is imminent.

The recent sell-off has raised alarms among retail investors, with many questioning the sustainability of previous bullish trends.

However, we are entering a phase where sector-specific performance will be critical rather than a uniform market direction presenting a potential trader’s market, where short-term gains of 8-10% may be more feasible than the longer-term investor expectations of 25-30% returns.

The Nifty50 has retraced approximately 9% from its all-time high of 26,277. Despite this decline, certain sectors, particularly cement, show bullish trends and have established solid support areas on their charts.

Seasonality analysis of cement index

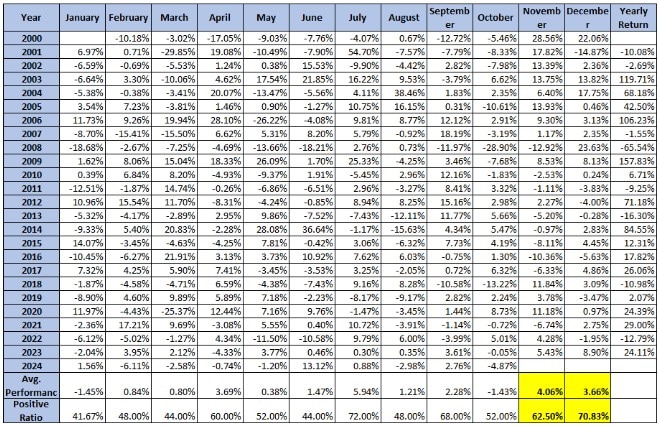

To better understand the potential of the cement sector, we have constructed an equal-weighted index (EQW) consisting of 31 cement stocks since the National Stock Exchange (NSE) or BSE do not have a dedicated cement sector index.

View Full Image

Source: RZone, Definedge Securities

Analysing historical data over the past 24 years reveals that the Definedge EQW cement index averages a performance of 4.06% in November and 3.66% in December, with positive close ratios of 62.50% and 70.83%, respectively. This historical performance suggests a strong possibility of positive trends as we move deeper into November and December.

Chart check for cement index

View Full Image

Definedge EQW Cement P&F Chart (Source: Zone, Definedge Securities)

The daily 0.25% X 3 point-and-figure (P&F) chart shows that the index has breached its previous swing low but has also displayed a sharp reversal pattern, indicating a bear trap. This breakout from a double top breakout (DTB) pattern confirms the potential for bullish reversals in the index.

View Full Image

Definedge EQW Cement Bar Chart (Source: Zone, Definedge Securities )

The bar chart analysis indicates a bullish trend, supported by Dow Theory, as the index forms higher highs and lowers. The yellow rectangle marks a significant accumulation zone, suggesting traders enter positions as the index rebounds from this support area.

Also Read: Mint Explainer: What consolidation in cement industry means for smaller players

Additionally, the 200-day exponential moving average (DEMA) channel reinforces this bullish sentiment, as the index has historically rallied after touching this moving average channel over the past 27 months.

Stock watchlist

Given the bullish indicators for the cement sector, here are two stocks to consider for your watchlist:

Ultratech Cement

On the daily price chart, Ultratech Cement is currently experiencing a resistance-turned-support level of around ₹10,500. This area is identified as an accumulation zone.

View Full Image

Source: Zone, Definedge Securities

The stock’s price has recently tested the 200 DEMA channel and is beginning to trend upward. The Relative Strength Index (RSI) has also shown signs of recovery, moving north from oversold levels, which indicates that bulls are starting to buy the dip.

Sagar Cements

The weekly chart for Sagar Cements reveals a formation of higher lows, suggesting ongoing bullish sentiment among traders.

View Full Image

Source: Zone, Definedge Securities

The stock price consistently bounces off the 200-week exponential moving average (WEMA) channel, indicating a solid demand zone. If the stock continues to accumulate in this area, upward momentum could potentially be seen in the coming weeks.

For more such analysis, read Profit Pulse.

While the overall market may face bearish pressure, the cement sector appears poised for potential gains. The readers should consider these opportunities with historical seasonality data favouring positive performance in the coming months and solid technical indicators backing bullish reversals.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

As per Sebi guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Definedge may or may not own these securities.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with the likes of UTI, Asit C. Mehta, and Edelweiss Securities. Presently he is an analyst at Definedge.

Disclosure: The writer and his dependents do not hold the stocks discussed here. However clients of Definedge may or may not own these securities.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.