Our Terms & Conditions | Our Privacy Policy

Can Bitcoin Miners’ Huge Sell-Off Ruin the $100K Bitcoin Price Expectations?

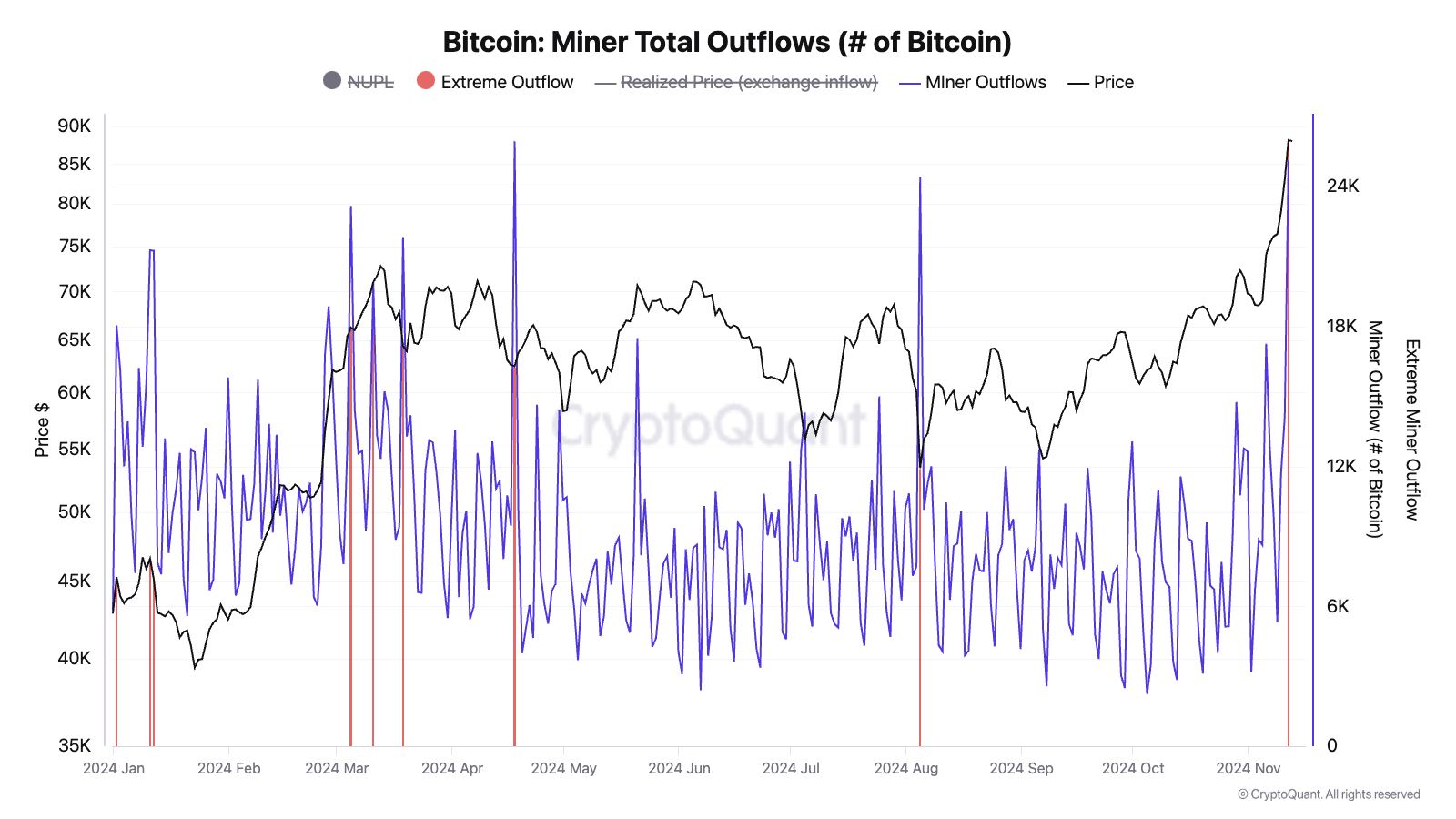

Bitcoin miners went into a sell-off mood and moved 25,000 Bitcoins from their wallets to crypto exchanges for profit booking in the recent rally. However, Bitcoin’s $100K goal could be further than it seems since this kind of behavior could pressure the rally and dampen expectations of reaching the $100K milestone.

Currently, BTC price is showing strength with a 22% weekly gain hitting a new all-time high above $91,000. However, bulls might face roadblocks for a rally to $100K as analysts predict a pullback to $74,000 before hitting this milestone.

Bitcoin Miners Heavily Selling Their BTC

Even though Bitcoin’s $100K seems to be just around the corner, Julio Moreno, the head of research at CryptoQuant noted Bitcoin miners are taking advantage of the recent price surge above $90,000. It is also evidenced by their transfer of a large part of their Bitcoin holdings out of their wallets. On Wednesday, a robust outflow of 25,000 Bitcoin was recorded, highlighting miners’ active selling as BTC price reached new highs.

Courtesy: CryptoQuant

Courtesy: CryptoQuant

Following the Bitcoin halving event in March 2024, the BTC miners sold heavily to overcome their rising operational costs and reduced profits. This led to a strong 200 days of Bitcoin price consolidation thereafter before giving a breakout from the previous all-time highs of $74,000. Now that the BTC price crosses $90,000, we might again see renewed selling pressure coming from the miners.

Additionally, Moreno also stated that traders’ unrealized profit margins have reached a high level of 47%. This could indicate a potential Bitcoin price correction or a crypto market crash moving ahead. Historically, elevated profit margins have preceded market pullbacks, with previous peaks at 69% in March and 48% in December 2023. The current level is raising caution among analysts as Bitcoin hovers near recent highs.

Courtesy: CryptoQuant

Courtesy: CryptoQuant

Just as Bitcoin hits a new all-time high, there have been growing calls for $100K. However, blockchain analytics firm Santiment reported greater chances of a countertrade that would delay this surge. It noted:

“The hype across social media platforms is calling the tops very reliably. Counter-trade the crowd with confidence while records are being broken right now. Historically, successful traders buy into crowd doubt if prices are causing retail to sell. And if the crowd floods social media with FOMO, this should be taken as a caution flag”.

Bitcoin Miners Could Spoil the $100K Party

Increased sell-offs from miners may weigh on Bitcoin’s current rally and muffle speculation about reaching the $100K target. What can rising miner profitability tell us about BTC’s valuation?

The Puell Multiple, which tracks miner profitability and valuation, suggests that Bitcoin still has much room for rallying even after flying well above $90,000. The Puell Multiple has spiked higher to reflect improved miner profitability but is still reading at 1—far below the critical orange band. Interestingly, the metric’s behavior so far mimics the 2020-2021 cycle.

Credit: BM Pro

Credit: BM Pro

In November 2020, the reading was also at one before surging to the orange band, coinciding with the $69K cycle top in early 2021. This means that if the pattern repeats, BTC could well reach a cycle top by Q1 2025.

Bitcoin at $90K represents something other than an overheated or overvalued state. On the other hand, a sharp increase in miners’ sell-off and an overheated Puell Multiple in early 2025 may signal looming challenges, hence making it an important metric to observe.

Mining Company Stocks on Freefall, What’s Next for BTC Price?

The US election rally for Bitcoin mining stocks has come to a halt ultimately as the companies’ Q3 numbers fall short of expectations. The stock price of top firms like Marathon Digital (NASDAQ: MARA), Riot Platforms (NASDAQ: RIOT), CleanSpark (NASAQ: CLSK), and others plummeted by 12-15% on Wednesday, November 13.

Some market analysts believe that this shouldn’t be much of a concern considering that the mining stocks have never moved in tandem with the Bitcoin price.

For those worrying about today’s price action vs Bitcoin: Miners will do their own thing.

Bitcoin mining stock returns have never been very highly correlated with Bitcoin returns over the last 3 years.

Some miners have a higher correlation than others, but none are above 0.6.… pic.twitter.com/2Ei5ANIhR4

— Matt Faltyn (@mattfaltyn) November 14, 2024

Others believe that Bitcoin might come to retest the previous breakout of $74,000, before making the final push to $100K levels, amid the ongoing Bitcoin miners’ selloff. Thus, investors might take a cautious stand before building any fresh positions. Also, inflows into Spot Bitcoin ETFs have been slowing after a mega boost last week.

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.