Our Terms & Conditions | Our Privacy Policy

Have India’s top cement stocks entered the value buy territory?

Price hikes of ₹10-30 per bag have been implemented across regions, with the highest increases seen in East and Central India (one bag of cement is 50kg).

Currently, pan-India cement prices for the third quarter are up 3.5% quarter-on-quarter (q-o-q) but are still down 5% year-on-year (y-o-y).

The new price hikes offer a much-needed boost. However, the sector’s profitability hinges on other things too.

FY25 has been tough…

The first half of FY25 (1HFY25) was a difficult period for the cement industry. Extended monsoons and elections in tandem with weak consumer sentiment led to subdued demand.

While the festive season in October and early November usually brings hope for a recovery, it did not deliver any meaningful uptick this year.

Cement prices declined by 8-9% y-o-y in the second quarter of FY25. The impact varied across regions. While the northern and western regions were relatively stable, the southern and eastern regions experienced the sharpest price drops.

Labour woes added fuel to the fire, with limited availability further stalling construction activity in the first half.

But now, all eyes are on the second half to turn things around.

Positive signs ahead

The hope lies in a stronger second half of FY25. This is due to factors like the return of labour, receding monsoon disruptions, and accelerating infrastructure projects.

Cement companies are betting on these tailwinds, coupled with potential price hikes, hoping for a recovery in operating margins.

Companies remain optimistic about a turnaround. They are projecting 4-5% demand growth for FY25, with the second half likely to see a stronger 7-8% expansion.

Beyond this, a sustained recovery is expected in FY26, fuelled by a rebound in government capex and increased spending by independent home builders.

Despite some moderation in government spending from the high-growth years, the sector expects government capex to return to a growth trajectory driven by infrastructure projects. Overall, the industry anticipates cement demand to grow at 1.2-1.3x of gross domestic product (GDP) over the medium term.

Premium cement is steadily capturing a larger share of the market, further diversifying revenue streams for leading players. Moreover, consolidation within the sector, along with mergers and acquisitions (M&A), is expected to continue.

The leading cement producers are poised to strengthen their grip on the market, leveraging both organic growth and aggressive M&A strategies.

Consolidation in India’s cement sector picked up pace in 2023 as major players sought to expand their regional footprints and production capabilities.

Dalmia Bharat Cement acquired Jaypee Group’s assets in April 2023. Nirma also made strategic moves, acquiring a substantial stake in Sanghi Industries in 2023, enhancing its cement production capacity, particularly in Gujarat.

Meanwhile, the Adani Group continued the integration of ACC and Ambuja Cements, following its 2022 acquisition of Holcim’s stakes, solidifying its market position.

This trend of consolidation carried forward into 2024, with key deals shaping the competitive landscape.

In June, Ambuja Cements, part of the Adani Group, acquired Penna Cement for $1.25 billion (approximately ₹10,600 crore), strengthening its presence in Southern India.

UltraTech Cement followed suit, acquiring India Cements in July for $472 million, extending its dominance in the market.

December saw ACC acquiring a 55% stake in Asian Concretes and Cements for ₹ ₹420 crore, expanding its reach and capacity.

Pricing: Struggling to maintain momentum

While the cement prices are now higher than the second quarter’s average, the industry’s recent history with price rollbacks signals caution about whether these hikes will hold.

In the second quarter of FY25, cement prices declined by 8-9% y-o-y, with the South and East regions seeing the sharpest drops. This rollback followed earlier price hikes, highlighting the sector’s volatility and the challenges in maintaining consistent price increases across regions.

Looking ahead, the industry is hopeful that post-festive season demand recovery will lend support to price increases.

Over the medium term, the twin forces of demand recovery and consolidation could provide the foundation for further price growth.

Still, companies must contend with rising capacity and utilization rates, which could cap the sector’s pricing power in the near term. Moreover, cost pressures will play a major role in shaping the cement industry’s trajectory.

Cost savings: The key to margin recovery

Cost-saving measures remain at the forefront of the sector’s strategy for margin recovery. Companies are focusing on reducing lead distances with new capacity commissioning and increasing the usage of renewable power.

Currently, renewable power constitutes 15-25% of the energy mix across major players but could rise to 60% with improved blending and fuel mix adjustments.

Additionally, leading players have announced plans to cut costs by ₹150-400 per tonne over the next three to four years. These measures, alongside optimization of repair and maintenance expenses, are crucial for boosting margins in an environment where pricing gains remain limited.

However, current profitability levels do not justify greenfield expansions. New capacity requires profitability of ₹1,300 per tonne to break even, significantly higher than the current industry average of ₹700 per tonne.

Opportunities amid challenges

While 1HFY25 marked a period of slow growth and demand contraction, there is a possibility of a recovery in the second half of FY25 and further into FY26.

Market experts assume industry demand is expected to grow by 5% in FY25 and by 6-8% annually in FY26-27. This will largely be supported by infrastructure spending, rural housing demand and urban construction activity.

However, profitability is likely to see only muted improvement. With capacity additions pushing utilization rates to approximately 71%, pricing power remains constrained. This leaves cost-saving initiatives as the primary driver of margin recovery.

Over FY24-27, the industry’s profit pool is expected to mirror volume growth, with limited room for significant margin expansion. Cement players should be able to bear the burden, given the sector’s robust financial position, even in a capital-intensive industry.

Strong balance sheets and financial muscle

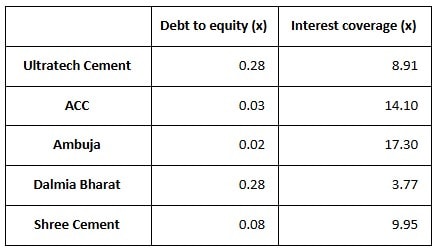

Most large players such as UltraTech, Ambuja Cement, ACC, etc. are comfortably positioned with manageable debt-to-equity ratios.

However, smaller competitors aren’t far behind in maintaining balance sheet discipline.

View Full Image

Cement companies debt profile-FY24 (Equitymaster)

What sets the sector apart is the cash reserves many companies have built during the good years. These reserves don’t just provide a safety net—they offer a war chest for expansion, whether through organic growth or acquisitions.

This financial flexibility gives the sector the confidence to ride out challenges while capitalising on future opportunities.

Valuations: Fairly priced or overlooked?

Despite headwinds, the cement sector trades at a premium to its historical median in enterprise value (EV) to earnings before interest, taxes, depreciation and amortization (Ebitda), or EV/Ebitda.

In this environment, companies with strong visibility on volume growth and profitability improvements are better positioned.

Most large, well-diversified players such as Ultratech Cement, ACC, and Ambuja Cement stand out in this regard. These companies leverage their scale, adopt cost-efficiency measures, and carry the ability to capitalize on demand recovery.

Despite the sector’s challenges, their strategic initiatives give them an edge to outperform their peers.

View Full Image

Cement companies financial snapshot–FY24 (Equitymaster)

Moreover, they justify their high valuations thanks to aggressive expansion strategies and strong regional footprints. Their ability to drive market share gains, even in challenging times, keeps them attractive to investors.

For long-term investors, the sector remains integral to India’s infrastructure growth story.

In conclusion

In the cement sector, the recent price hikes offer relief to the margins, but profitability depends on sustaining these gains and the demand recovery going forward.

Profit growth will rely on a balance of pricing, effective cost control, and improving demand. How well the sector manages these factors will shape its path forward.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.