Our Terms & Conditions | Our Privacy Policy

Bajaj, TVS Motor Overtake Ola Electric In 2-Wheeler EV Sales In December

SUMMARY

Bajaj Auto surpassed Ola Electric to become India’s top electric two-wheeler player in December in terms of escooter sales and market share

TVS Motor’s vehicle registrations fell almost 37% month-on-month to 17,231 units in December, but its market share rose to 23.5%

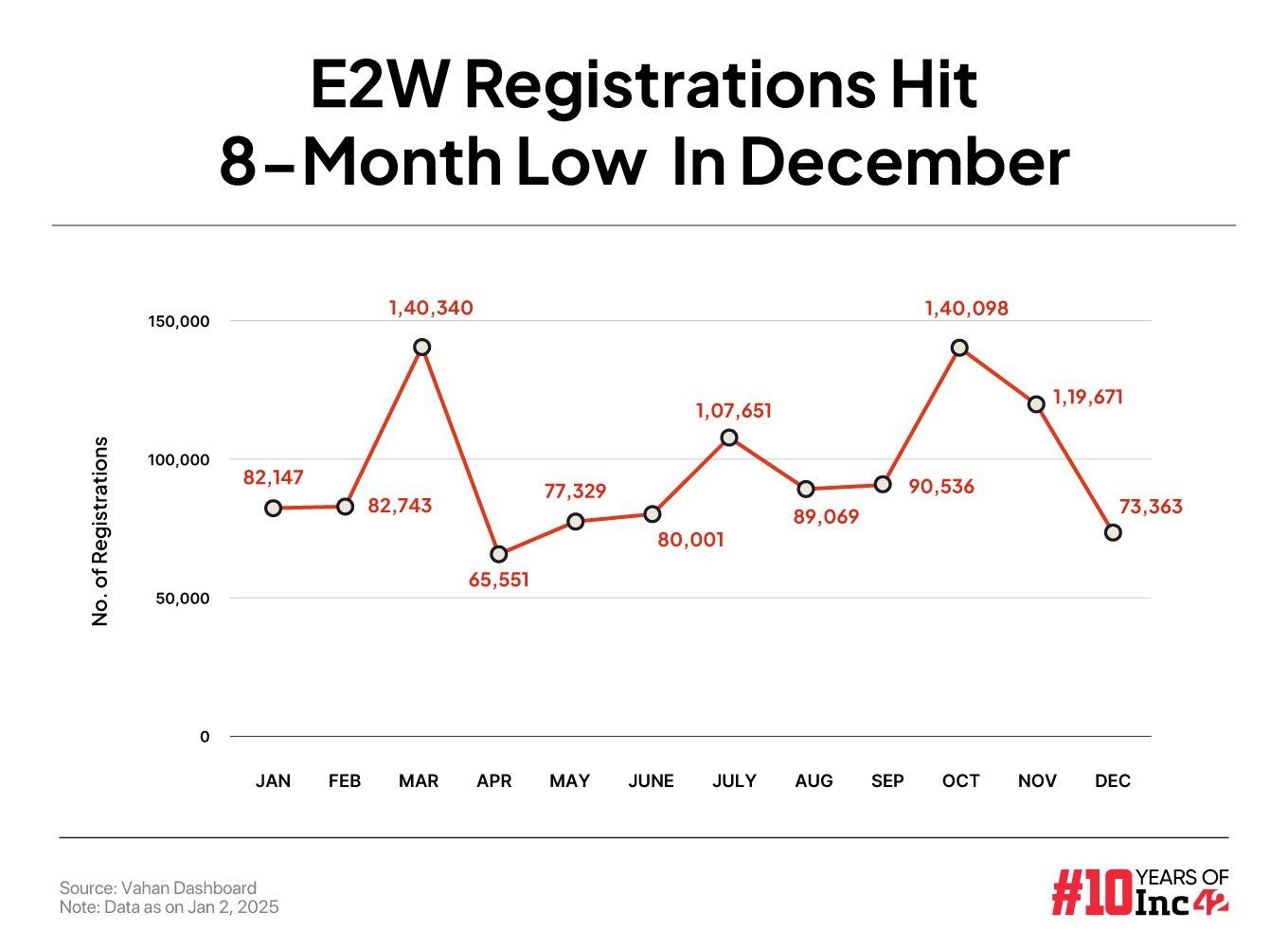

Meanwhile, total electric two-wheeler registrations fell to an 8-month low in December at 73,363 units. This was a decline of 38.7% compared to November

Legacy automotive players Bajaj Auto and TVS Motor leapfrogged Bhavish Aggarwal-led Ola Electric to become India’s leading electric two-wheeler (E2W) manufacturers in December in terms of escooter sales and market share, signalling the beginning of a new era in the country’s E2W landscape.

Meanwhile, total EV two-wheeler registrations hit an 8-month low in December at 73,363 units, down 38.7% from 1,19,671 units in November. On a YoY basis, registrations dipped over 3% from 75,945 in December 2023.

Overall, electric two-wheeler registrations jumped 34% to 11.48 Lakh units in 2024 from 8.60 Lakh units in 2023, despite a reduction in government subsidies.

Bajaj Auto recorded 18,295 EV two-wheeler registrations last month, down 30.6% from 26,358 in November, as per Vahan data as of January 2, 2025. On a year-on-year (YoY) basis, the auto giant witnessed a 75.5% surge in the sale of its Bajaj Chetak escooters.

The company’s market share climbed to about 25% last month from a little over 22% in November.

TVS Motor emerged as the second-largest EV two-wheeler (2W) player in the country last month. While its vehicle registrations fell almost 37% month-on-month to 17,231 units in December, its market share rose to 23.5% last month from 22.7% in November.

With competition heating up in the E2W space and consumer complaints mounting about its after-sales service, recently listed electric mobility startup Ola Electric has been witnessing severe volatility in its escooter sales in recent months.

Its electric 2W registrations slumped 53% to 13,770 units last month from 29,257 units in November. Amid the decline in sales volume, Ola Electric’s market share tumbled to 19% in December from over 24% in November.

Earlier this year, brokerage Jefferies said that the launch of lower-priced electric vehicles and an aggressive discounting play by Bajaj and TVS was helping them win the market share from Ola Electric.

However, the Aggarwal-led company’s upcoming Roadster series of electric motorbikes, expected to hit the roads this month, is likely to give it an edge over its competitors. In November, it also unveiled S1 Z and Gig escooters for gig economy workers and price-conscious consumers.

Recently, Ola Electric also expanded its existing network of showrooms and service centres to 4,000 and announced the launch of its limited edition Ola S1 Pro Sona escooter.

Meanwhile, IPO-bound Ather Energy saw a little over 19% drop in its vehicle registrations to 10,429 units last month from 12,909 units in November.

It must be noted that Ather Energy is set to become the second homegrown EV startup to go public after Ola Electric, which made its stock market debut in August last year. Market regulator SEBI recently approved Ather’s public issue, which will comprise a fresh issuance of shares worth INR 3,100 Cr and an offer for sale (OFS) of up to 2.2 Cr shares.

Another automotive giant Hero MotoCorp, which saw strong growth across internal combustion engine and EV categories in the October-November festive season, registered an 86% month-on-month decline in its electric two-wheeler registrations last month to 1,020. Its registrations stood at 7,344 and 7,352 in November and October, respectively.

While most electric 2W players witnessed a decline in sales last month, Hyderabad-based Pure EV, Bengaluru-based Oben Electric, and ebike maker Ultraviolette Motive logged an increase in sales last month, albeit on a much smaller scale.

Pure EV saw its registrations almost triple month-on-month to 1,087 units in December, while Ultraviolette posted a more than twofold jump in its registrations to 60 units during the same period. Oben Electric logged a 15% increase in its vehicle registrations to 60 units last month from 52 units in November.

Overall, total EV registrations in the country across categories declined about 26% to 1.48 Lakh units last month from 1.99 Lakh units in November.

[With inputs from Tapanjana Rudra]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.