Our Terms & Conditions | Our Privacy Policy

An equity fund that helps engages across market-cap segments

Indian equity markets have been on a roller coaster ride over the last four months. The benchmark indices corrected notably after reaching their all-time peaks in September 2024. For instance, the Nifty 50 total return index (TRI), Nifty midcap 150 TRI and Nifty smallcap 250 TRI declined about 10 per cent during the period. Combination of factors include geopolitical tensions, disappointing corporate earnings and persistent FII selling.

For disciplined long-term investors, this may present a reasonably attractive opportunity through the SIP route. Multi-cap mutual fund schemes provide diversification by specific allocation across market capitalisation segments.

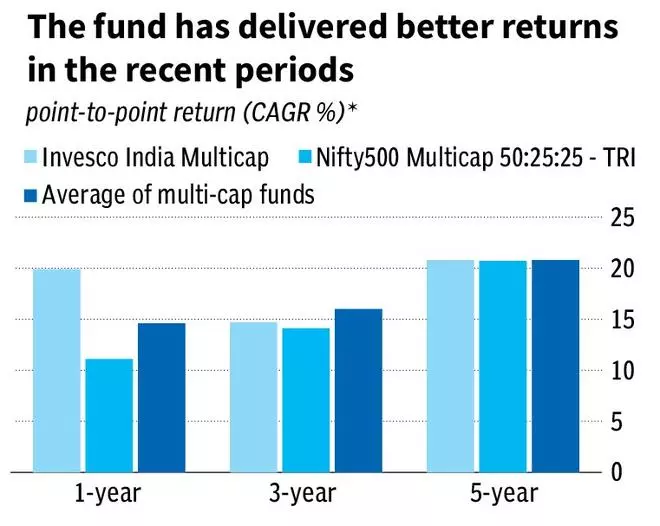

Under the multi-cap category, Invesco India Multicap Fund (IIMF) has done well in the recent periods. It has delivered returns close to those of its benchmark and category, consistently over the long run.

True diversification

The multi-cap category within the equity mutual fund classifications represents a true diversification in its allocation across various companies, sectors, and market capitalisation segments.

As mandated, the schemes under the multi-cap category allocate their assets at least 25 per cent each in large, mid and small-cap stocks. These schemes provide active exposure to well-established large-cap firms, mid-sized businesses with high growth potential, and up-and-coming small-sized companies.

They are suitable for investors seeking a fund with disciplined allocation to all market cap segments at all points of time.

The multi-cap category was introduced in 2018 as part of the re-categorisation process; however, it was made true-to-label after the capital market regulator SEBI introduced the flexi-cap category in 2021.

Twenty five of the 35 schemes that were originally in the multi-cap category were transferred to the flexi-cap category. The ten remaining schemes continued to be multi-cap funds. Since then, mutual fund companies have been lining up to launch new schemes under the multi-cap category, resulting in a total of 29 schemes in the basket, currently.

There has been a significant variation in the returns produced by the schemes in the category. With fresh portfolios set-up, many recently launched schemes were able to generate better returns, which led to a noticeable discrepancy in returns and inconsistent outperformance among the schemes in this category. Nevertheless, the older schemes, such as Nippon India Multi Cap and Quant Active, succeeded in delivering superior returns during specific timeframes.

IIMF is one such that delivered returns close to the category average in most of the timeframes. Despite not being a top performer in any of the category’s calendar year returns, the scheme has delivered decent returns over time.

Launched in March 2008, IIMF (formerly Religare Invesco Mid N Small Cap) was managed with a mid and small cap mandate, that was nearly identical to the current strategy followed by the multi-cap category. It has delivered a compounded annualised return of 16 per cent since its launch. Dhimant Kothari and Amit Nigam jointly manage the scheme. It manages assets of ₹3,389 crore as of December 2024.

Bets on domestic economy

IIMF follows a growth-based strategy, investing in 50 to 75 stocks, with a current range of 60 to 65 stocks. It focuses on active overweights of stocks above the benchmark weight. The portfolio is segmented into large, mid, and small-cap stocks, with current allocations of 35 per cent each.

Stocks are selected based on growth filters, return on capital and return on equity, aiming for a long-term return of 15 to 17 per cent. The portfolio is constructed with a three to five-year investment horizon.

It is largely the domestic economy-oriented sectors where the scheme is actively positioned, including consumer sectors, financial, industrial and real estate.

Four trends that the fund managers bet on currently are unorganised to organise shift, digitisation, Make in India and export opportunities in the form of China plus one.

The sectors that the scheme is currently underweights on are metals, energy and chemicals. The fund avoids meaningful cash positions, with only 1 to 2 per cent in cash in most timeframes.

Stocks that helped the scheme to deliver better returns in the last one year include Zomato, Multi Commodity Exchange Of India, Triveni Turbine, Max Healthcare Institute and Bharat Electronics.

Performance

The scheme has delivered returns that are comparable to the category and benchmark returns, despite not being a top performer in the category. For instance, the performance as measured by the one-year rolling returns calculated from the last six years’ data show that the IIMF delivered a compounded annualised return of 24 per cent while both Nifty 500 Multicap 50:25:25 TRI and the multi-cap category gave 25 per cent.

Due to its defensive strategy that large-cap exposure was larger than peers, IIMF underperformed within the category during the early post-Covid rise, which affected its performance in 2020–21.

The portfolio’s stock count increased from 50 in 2022 to 69 in 2024, that improved the scheme’s performance during the 2023 and 2024 broad-based rally.

In the last one, three and five-year timeframes, IIMF delivered 20 per cent, 15 per cent and 21 per cent respectively, while the multi-cap category posted 15 per cent, 16 per cent and 21 per cent, respectively.

Given its higher exposure to mid and small-cap stocks, IIMF is suitable for investors with a high risk profile. Considering the current volatility in the market, it is advisable to invest in a staggered manner through systematic investment plans. The minimum investment horizon should be seven years or more.

What’s on offer

Exposure to well-established large-cap firms, mid-sized businesses with high growth potential, and up-and-coming small-sized companies

SHARE

Published on January 18, 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.