Our Terms & Conditions | Our Privacy Policy

5 worst performing stocks in the Nifty 100 in 2024

The Nifty 100 is a benchmark stock market index in India that tracks the performance of the top 100 companies listed on the National Stock Exchange (NSE).

It is a broader index compared to the Nifty 50 and represents the combined performance of the Nifty 50 and Nifty Next 50 stocks.

The companies included in the index are leaders across various sectors including financial services, IT, consumer goods, healthcare, energy, and industrials.

In 2024, the Nifty 100 index exhibited a modest performance. The index moved from 21,934.7 on 1 January 2024 to 24,495.6 on 31 December 2024, reflecting an increase of 11.7%.

This growth was fueled by foreign investors turning net buyers in November 2024 after a period of record selling, boosting liquidity.

Political stability, India’s higher weighting in the MSCI All-Country World Index, and rising domestic investments bolstered investor confidence.

Strong sector performance in real estate, pharmaceuticals, and energy also contributed to the gains.

However, a few sectors like banking, fast-moving consumer goods (FMCG), and metals sectors underperformed compared to others.

Thus, we applied a screener to identify the biggest wealth destroyers from the Nifty 100 index.

These are not stock recommendations. Investors should do their own research and do due diligence before considering any investment in the stock market.

Also, investors should pay close attention to corporate governance while performing their due diligence.

So, let’s look at the five worst-performing stocks in the Nifty 100 in 2024.

#1 IndusInd Bank

IndusInd Bank is a commercial bank. It provides a wide range of banking products and financial services to corporate and retail clients besides undertaking treasury operations.

The bank recorded gross non-performing asset (GNPA) of 2.11% in Q2FY25 against 2.27% in FY22; net non-performing asset (NNPA) of 0.64% in Q2FY25 vs 0.64% in FY22 and net interest margin (NIM) of 4.08% in Q2 FY25 vs 4.2% in FY22.

In 2024, shares of IndusInd Bank fell 40%.

The bank’s stock faced selling pressure due to rising delinquencies, particularly in its micro, small, and medium enterprises (MSME) and commercial vehicle (CV) loan segments. This deterioration in asset quality led to increased provisions, impacting profitability.

Additionally, the Reserve Bank of India (RBI) imposed restrictions on the bank, including halting the onboarding of new customers and issuing fresh credit cards, due to IT deficiencies and compliance issues.

These regulatory actions raised concerns about the bank’s operational robustness.

However, if we take a longer period, the company’s revenue has grown at a compounded average growth rate (CAGR) of 16% in the last three years, while its net profit has grown at a CAGR of 45%.

This has resulted in healthy return ratios. The company’s three-year average return on equity (RoE) and return on capital employed (RoCE) were 13.5% and 6.9%, respectively.

The bank’s management remains cautiously optimistic about asset growth, particularly in microfinance and vehicle finance.

Going forward, IndusInd Bank will maintain a balanced approach to secured asset growth while being cautious in unsecured lending.

#2 Asian Paints

Asian Paints is one of the largest home decor companies in India. The 80-year-old company has major brands like Asian Paints, Berger, Apco, etc. under its umbrella.

The company is into wall paints, wall coverings, waterproofing, texture painting, wall stickers, mechanized tools, adhesives, modular kitchens, sanitaryware, lightings, soft furnishings, and uPVC (polyvinyl chloride) windows.

In 2024, shares of Asian Paints fell 33%.

The company’s stock faced selling pressure due to sluggish demand in both urban and rural markets, leading to lower sales volumes.

This downturn was attributed to a slowdown in the real estate sector and reduced consumer spending on discretionary items.

Additionally, there was a significant increase in the prices of raw materials, particularly crude oil derivatives, which are essential in paint production. The elevated input costs compressed profit margins, adversely affecting the company’s profitability.

Nevertheless, if we take a longer period, the company’s revenue has grown at a CAGR of 18% in the last three years while its net profit has grown at a CAGR of 20%.

This has resulted in healthy return ratios. The company’s three-year average RoE and RoCE were 27.8% and 33.6%, respectively.

Its debt-to-equity ratio was as low as 0.1 on 31 March 2024.

Since new products contribute to 12% of revenue; a strong focus on innovation remains a key strategy for the company.

As of Q2 FY25, Asian Paints’ major capex for brownfield expansion stands completed and backward integration projects are on track.

The company expects improved margins in the second half of the financial year as the full realization of recent price increases is anticipated.

For the third quarter of the financial year, Asian Paints had a cautious outlook due to a high base from last year and current demand conditions.

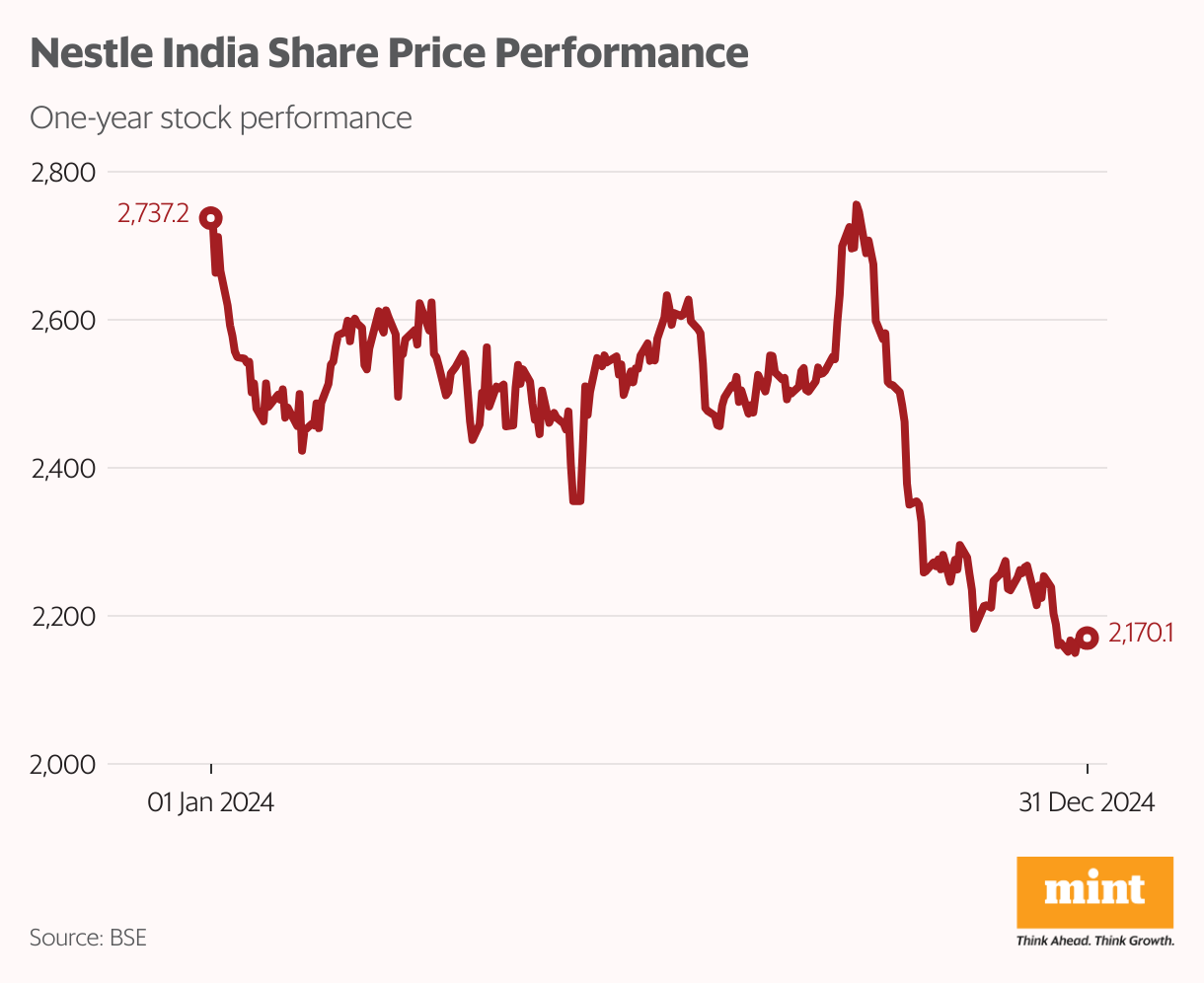

#3 Nestle India

Nestle India is a subsidiary of Nestle SA which is a Swiss multi-national company (MNC), holding a 62% stake.

The company is primarily involved in the FMCG business which incorporates product groups such as milk products and nutrition, prepared dishes and cooking aids, powdered and liquid beverages and confectionery.

It owns brands such as Nescafe, Maggi, Milkybar, Kit Kat, Milkmaid, etc.

In 2024, shares of Nestle India fell 21%.

The company’s stock faced selling pressure due to reports in 2024 alleging that Nestlé’s baby food products in India contained higher sugar levels compared to those sold in Europe.

This raised health concerns and attracted regulatory scrutiny, negatively impacting investor sentiment.

Additionally, in October 2024, the company reported a marginal decline in its profit after tax (PAT) for the September quarter, which led to a nearly 4% drop in its share price. This decline was attributed to rising input costs and competitive pressures affecting profitability.

The company’s revenue has grown at a CAGR of 5% in the last three years while its net profit has grown at a CAGR of 7%.

Despite such low growth rates, the company boasts robust return ratios. The company’s three-year RoE and RoCE were 121% and 152%, respectively.

To top it off, its debt-to-equity ratio was as low as 0.1 on 31 March 2024.

Recently, the company has invested in a new factory in Odisha to showcase the future of food processing.

Going forward, as part of its strategy to shore up volume growth, Nestle India plans to expand its distribution network, aiming to increase touch points from 5.1 million to 6 million over the next 4-5 years, enhancing market penetration.

Having already reached 200,000 villages, the company will now start to stabilise because the incremental cost of distribution is to be met with incremental revenue.

Thus, it will now focus more on depth of distribution rather than increasing the number of villages.

Currently, the premium products category is generating 12-13% of overall sales. Nestle expects to grow that number to 15-16% in the medium term and 20% in the longer term.

Recently, the company has also entered a joint venture (JV) with Dr. Reddy’s to take a plunge in the health sciences business. The industry has an opportunity of more than ₹230-240 billion in the country.

#4 Tata Consumer Products

Tata Consumer Products has a presence in the food and beverages business in India and internationally. It is among the top 10 FMCG companies in India.

Some of its renowned brands are Tata Salt, Tata Tea, Tetley, Himalayan bottled drinking water, Eight o Clock coffee, Tata Sampann, etc.

Tata Starbucks is a joint venture between Tata Consumer Products and Starbucks Corp. of America wherein the company is working towards expanding the presence of Starbucks retail coffee stores in the subcontinent of India.

In 2024, shares of Tata Consumer Products fell 14%.

The company’s stock faced selling pressure due to muted financial performance.

In Q2 FY25, the company reported a modest 0.9% increase in consolidated net profit to ₹3.7 bn, primarily impacted by elevated tea costs in the Indian market.

Despite a 12.9% increase in revenue to ₹42.2 bn, the modest profit growth led to a nearly 10% drop in the share price.

Additionally, the broader consumer goods sector faced challenges, as highlighted by significant declines in major consumer stocks. For instance, Godrej Consumer Products experienced a 10.2% drop due to a weak sales and margin forecast, which negatively impacted the entire sector, including Tata Consumer Products.

Coming to the financials, the company’s revenue has grown at a CAGR of 9% in the last three years while its net profit has grown at a CAGR of 10%.

This has resulted in mediocre return ratios. The company’s three-year average RoE and RoCE were 7.3% and 9.7%, respectively.

However, its debt-to-equity ratio was as low as 0.2 on 31 March 2024.

Recently, tea costs have increased 25-30%, and the company has not fully passed these costs onto consumers yet. A staggered price increase strategy is being employed for tea and salt to mitigate the rising costs.

The international business of the company, particularly in the UK, is performing strongly, with Tetley becoming the second-largest branded tea player.

The newly acquired businesses of the company, Capital Foods and Organic India, are showing positive growth trends. Capital Foods grew 25% quarter-on-quarter and Organic India, 45%.

The integration of these businesses is complete, with a focus now on scaling and leveraging synergies for improved profitability.

Tata Starbucks has expanded to 457 stores across 70 cities, but traffic has been a concern, with revenue growth of only 2%. New initiatives are being rolled out to drive traffic, including a new classic range of food and beverages to attract consumers.

The company’s management expressed cautious optimism regarding the recovery in volumes and profitability amid rising input costs and competitive pressures.

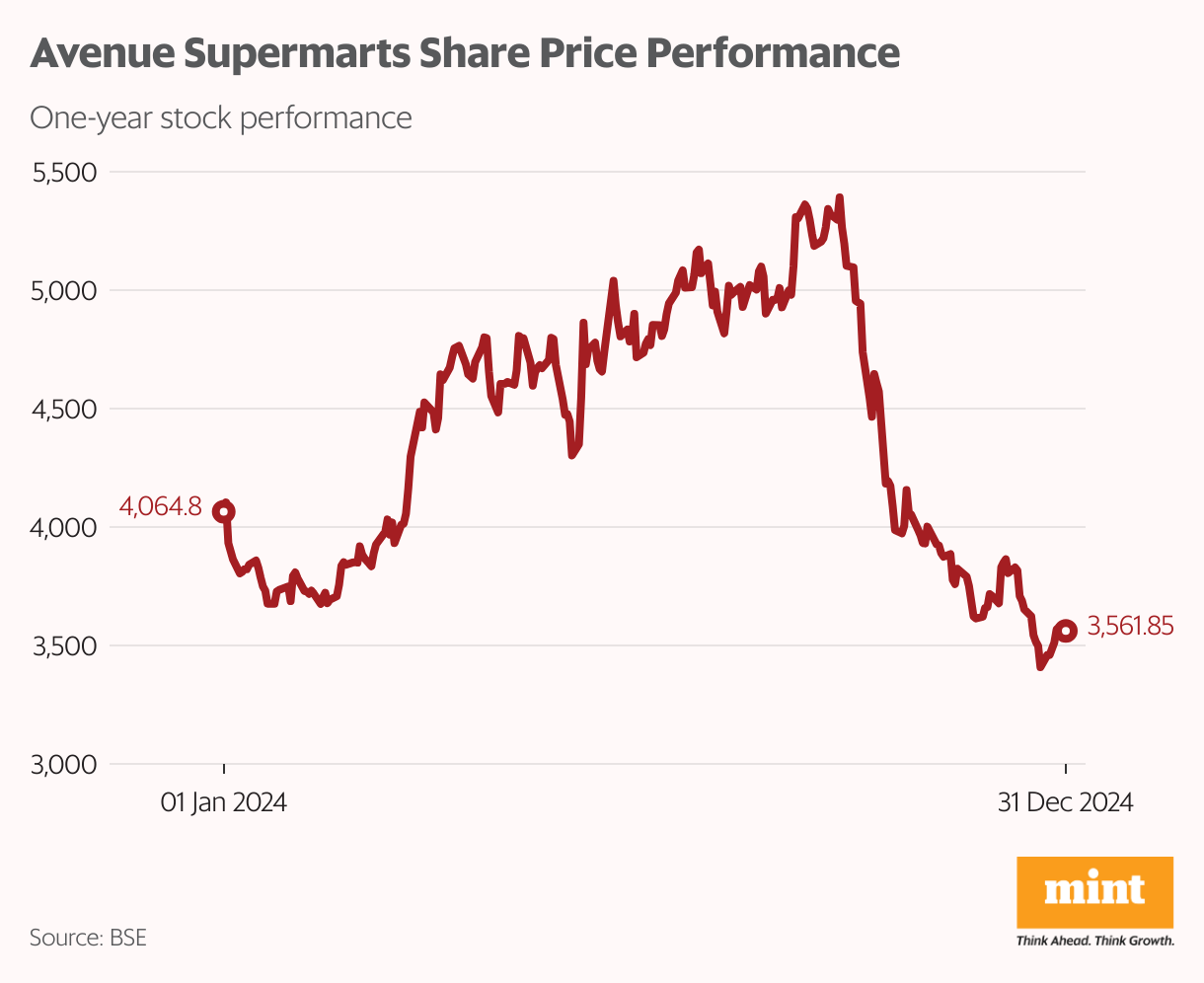

#5 Avenue Supermarts

Avenue Supermarts (DMart) is a national supermarket chain, with a focus on value-retailing. It offers a wide range of products with a focus on foods, non-foods (FMCG), general merchandise, and apparel product categories.

It follows the “everyday low cost – everyday low price” strategy, focusing on competitive procurement, operational efficiency, and cost-effective distribution to offer value-for-money pricing to customers.

In 2024, shares of Avenue Supermarts fell 12%.

The company’s stock faced selling pressure due to disappointing Q2FY25 financial results. The company reported a consolidated net profit of ₹6.6 billion, marking a modest 5.8% YoY increase.

Revenue rose by 14.4% to ₹144.4 billion. However, these figures fell short of market expectations, leading to a significant drop in share price.

To top it off, Avenue Supermarts faced operational hurdles, including a slowdown in same-store sales growth and pressure on earnings before interest, tax, depreciation and amortisation (Ebitda) margins, attributed to higher operating expenses aimed at improving service levels.

Additionally, the rapid expansion of online grocery services, particularly in metropolitan areas, intensified competition. This shift in consumer behavior impacted DMart’s sales growth and profitability.

The company’s revenue has grown at a CAGR of 28% in the last three years while its net profit has grown at a CAGR of 32%.

This has resulted in healthy return ratios. The company’s three-year average RoE and RoCE were 14.1% and 18.4%, respectively.

Its debt-to-equity ratio was as low as 0.1 on 31 March 2024.

Going forward, the company plans to add 40-50 stores annually with a long-term goal of increasing this number to 60-70 stores per year.

The current average store addition rate is around 40 stores per annum, which management indicates may not support a 15-20% CAGR growth rate.

DMart Ready, the company’s e-commerce arm, has seen a reduction in pickup points from 573 to 341, with a strategy shift to improve operating leverage by increasing the range of services.

Due to this, the company’s management has emphasised a cautious approach to scaling the DMart Ready business, prioritising model refinement over rapid revenue generation.

DMart maintains a gross margin range of 14-15.5%, with low expectations to return to higher levels seen pre-covid (27-28%).

Overall, the company is optimistic about long-term growth but acknowledges the need to address current challenges, particularly in-store additions and operational efficiencies.

Snapshot of Worst Performing Stocks in the Nifty 100 in 2024

Apart from the stocks listed above, here’s a table that shows the worst performing stocks in the Nifty 100 in 2024.

View Full Image

…

Conclusion

Overall, certain sectors and companies in Nifty 100 did face challenges amid broader market growth in 2024.

Factors such as economic pressures, sectoral underperformance, and company-specific issues contributed to their decline.

While these stocks may have struggled last year, investors need to recognise that market conditions can shift, and potential opportunities may arise for those willing to navigate volatility.

Monitoring these stocks and their fundamentals will be crucial for identifying potential recovery or exit points in the future.

Additionally, it’s essential to conduct due diligence by assessing a company’s financial health, growth potential, and corporate governance practices.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.