Our Terms & Conditions | Our Privacy Policy

Metaplanet Secures 4 Billion JPY Raise for Bitcoin Buying; Stock Enters MSCI Index

Japan’s MicroStrategy Metaplanet has announced a successful fundraise of 4 billion Japanese Yen through the issuance of 0% unsecured bonds. the firm said that it will use the entire proceeds for additional Bitcoin purchases. Furthermore, the company also disclosed allocating over $700 million to BTC purchases for its previous plan of adding 21,000 BTC to its Treasury by the end of 2026.

Metaplanet Announces JPY 116.3 Billion Bitcoin Investment Plan

Metaplanet Inc. disclosed plans to allocate JPY 107.3 billion ($717 million) for Bitcoin purchases through February 2027, with an additional JPY 5 billion for Bitcoin income generation business through December 2025. Furthermore, the company has already revealed its Bitcoin buying plan of acquiring 21,000 BTC by the end of 2026.

The announcement follows the company’s JPY 4 billion bond issuance to EVO FUND. The firm currently holds 1,761.98 BTC, valued at approximately JPY 27.9 billion. The funding modification includes JPY 4 billion for bond redemption scheduled for August 2025, to be secured through new stock acquisition rights.

Metaplanet cites Japan’s economic challenges – including high debt, negative interest rates, and yen depreciation – as key factors driving its Bitcoin adoption strategy. The company views Bitcoin as a primary reserve asset to hedge against inflation and yen devaluation.

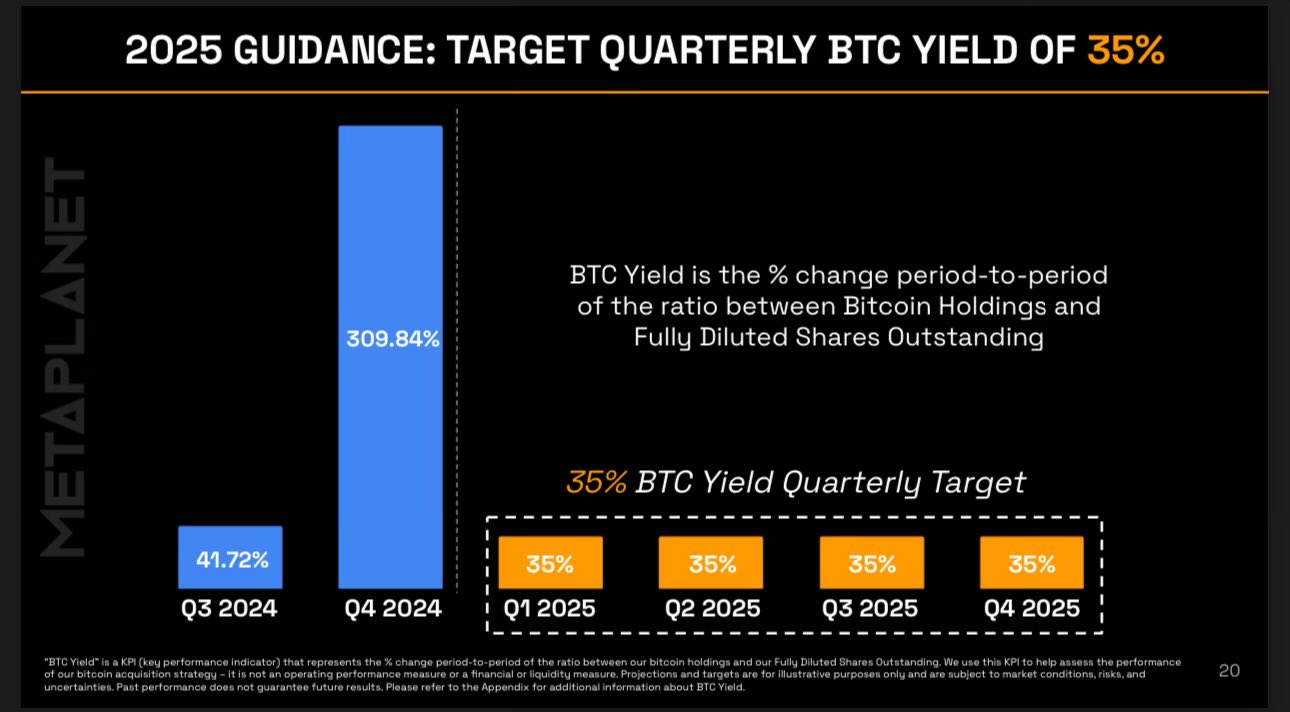

Furthermore, the company has set an ambitious target of 35% quarter-over-quarter growth for 2025, signaling a more aggressive approach to yield generation in the upcoming months.

Source: Metaplanet

Source: Metaplanet

Entering the MSCI Japan Index

The Metaplanet stock has witnessed an unprecedented 4000% surge ever since adopting the Bitcoin strategy and adding BTC to its balance sheet. The stock price touched a fresh all-time high of 7,020 JPY on Wednesday, with the move appreciated by Microstrategy’s Michael Saylor.

Company CEO Simon Gerovich announced the inclusion of its stock in the prestigious MSCI Japan Index, effective at the close of February 28, 2025. The MSCI Japan Index is one of the world’s leading stock market indices, tracking large and mid-cap stocks in Japan.

This move is set to bring Metaplanet increased visibility and exposure to institutional investors, as the company’s stock will now be included in many funds and ETFs that track MSCI indexes. With the potential for passive inflows, Metaplanet could see a rise in demand for its shares.

Gerovich expressed that the inclusion is a significant validation of the company’s growth and its progress in executing its Bitcoin strategy.

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.