Our Terms & Conditions | Our Privacy Policy

Share Market Update – Shriram Finance Share Price Target 2025 – ldccbank

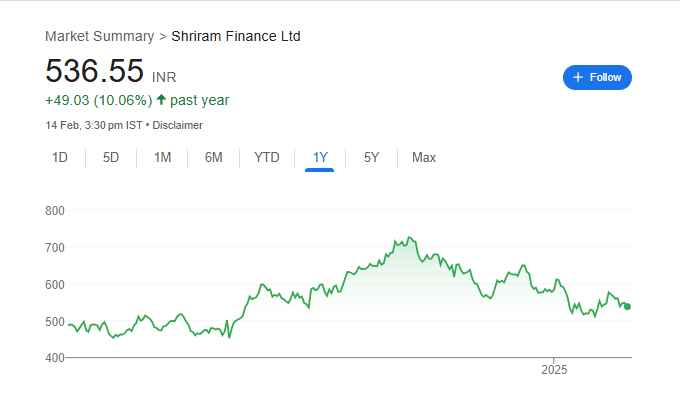

Shriram Finance Share Price Target 2025:- Shriram Finance’s share price target for 2025 will depend on its strong presence in vehicle and MSME loans, supported by India’s growing economy. The company’s focus on expanding its customer base, improving digital services, and managing asset quality will drive growth. Shriram Finance Share Price on NSE as of 15 February 2025 is 536.55 INR.

Shriram Finance Ltd: Current Market Overview

- Open: 550.95

- High: 554.95

- Low: 526.80

- Mkt cap: 1.01LCr

- P/E ratio: 10.79

- Div yield: 1.68%

- 52-wk high: 730.45

- 52-wk low: 438.60

Shriram Finance Share Price Chart

Shriram Finance Share Price Target 2025 (Prediction)

| Shriram Finance Share Price Target Years | Shriram Finance Share Price Target Months | Share Price Target |

| Shriram Finance Share Price Target 2025 | January | ₹544 |

| Shriram Finance Share Price Target 2025 | February | ₹560 |

| Shriram Finance Share Price Target 2025 | March | ₹580 |

| Shriram Finance Share Price Target 2025 | April | ₹600 |

| Shriram Finance Share Price Target 2025 | May | ₹620 |

| Shriram Finance Share Price Target 2025 | June | ₹640 |

| Shriram Finance Share Price Target 2025 | July | ₹660 |

| Shriram Finance Share Price Target 2025 | August | ₹680 |

| Shriram Finance Share Price Target 2025 | September | ₹700 |

| Shriram Finance Share Price Target 2025 | October | ₹710 |

| Shriram Finance Share Price Target 2025 | November | ₹720 |

| Shriram Finance Share Price Target 2025 | December | ₹735 |

Shriram Finance Shareholding Pattern

- Promoters: 25.4%

- FII: 53.08%

- DII: 15.94%

- Public: 5.58%

Key Factors Affecting Shriram Finance Share Price Growth

Here are five key factors affecting Shriram Finance’s share price target for 2025:

-

Strong Loan Portfolio: Growth in vehicle loans, MSME financing, and personal loans can drive Shriram Finance’s revenue and profitability.

-

Economic Growth: A stable and growing Indian economy will boost demand for loans, especially in rural and semi-urban areas where Shriram Finance has a strong presence.

-

Asset Quality Management: Effective management of non-performing assets (NPAs) and maintaining healthy asset quality will be crucial for growth.

-

Digital Transformation: Adoption of digital platforms for loan processing, collections, and customer service can enhance operational efficiency and attract new customers.

-

Expansion Strategy: Increasing its branch network and customer base, especially in underserved regions, will support future growth.

Risks and Challenges for Shriram Finance Share Price

Here are five key risks and challenges for Shriram Finance’s share price target in 2025:

-

Rising NPAs: Any increase in non-performing assets due to defaults, especially in vehicle and MSME loans, could impact profitability.

-

Regulatory Changes: Changes in lending regulations, interest rates, or compliance requirements could affect the company’s operations and margins.

-

Economic Slowdown: An economic downturn could reduce demand for loans and increase defaults, impacting the company’s financial health.

-

Competition: Intense competition from banks, NBFCs, and fintech players may affect market share and margins.

-

Liquidity Risk: Maintaining adequate liquidity to meet loan disbursement and operational needs is critical, and any shortfall could pose challenges.

Read Also:- Share Market Update – Greaves Cotton Share Price Target 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.