Our Terms & Conditions | Our Privacy Policy

3 Medical Instruments Stocks Winning Big With GenAI Amid Global Gloom

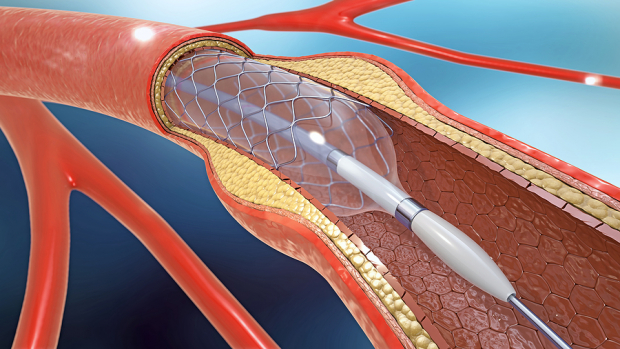

Image: Bigstock

Over the past year, advancements in artificial intelligence (AI) and predictive analytics have rapidly revolutionized the Medical Instruments industry, driving innovation in diagnostics, patient monitoring, and personalized treatment. AI-powered devices now process large datasets in real time, delivering accurate predictions and actionable insights. Predictive analytics supports early disease detection, risk assessment, maintenance optimization, and cost reduction.

According to a January 2025 NSF.org report, genAI is already generating synthetic medical images, simulating disease progression, and accelerating drug discovery. However, it also introduces new regulatory challenges around safety, transparency, and data integrity. In response, the FDA is implementing a Total Product Lifecycle (TPLC) oversight model with a risk-based approach and enhanced post-market monitoring.

Going by data, global AI in the healthcare market is projected to witness a CAGR of 38.5% from 2024 to 2030. However, a deteriorating geopolitical situation, tariffs, and supply chain bottlenecks, resulting in a tough situation related to raw material and labor costs, freight charges, as well as healthcare staffing shortages, have put the industry in a tight spot again.

Meanwhile, industry players like Penumbra (PEN – Free Report), Integer Holdings (ITGR – Free Report), and AngioDynamics (ANGO – Free Report) have adapted well to changing consumer preferences, and they have recently been witnessing an uptrend in their stock prices.

The Industry’s Description

The Zacks Medical – Instruments industry is highly fragmented, with participants engaged in research and development (R&D) in therapeutic areas. This FDA-regulated sector encompasses a vast array of products, from transcatheter valves and orthopedic devices to advanced imaging equipment and robotics.

Recent trends highlight the integration of AI in diagnostics, the expansion of telemedicine, the rise of robotic-assisted surgeries, and developments in 3D printing, continuous glucose monitoring systems, gene editing, and nanomedicine. The emergence of generative AI is also reshaping MedTech, prompting the FDA to adopt a TPLC regulatory approach.

3 Trends Shaping the Future of the Medical Instruments Industry

GenAI Revolution: Over the past couple of years, there has been a significant increase in the adoption of genAI within the medical instruments space, with “hyper-personalization” being the primary feature of genAI-driven treatment options. Adding to this, genAI is rapidly paving the way for efficient operational management within the industry. GenAI, while analyzing vast and complex genetic and molecular data, is expected to help healthcare reach new heights in terms of predictive treatment options and smart hospital systems.

A December 2024 report said that global genAI in the healthcare market was valued at $1.8 billion in 2023, and it is expected to witness a CAGR of 33.2% from 2024 to 2032. Rapid advancement in deep learning and natural language processing, increasing demand for personalized treatment, growing investment in healthcare AI, and rising healthcare data volumes are the major growth factors. The application of AI in the diagnostics space is growing enormously, with the market expected to witness a CAGR of 24.6% by 2034.

M&A Trend Continues: The medical instruments space has been benefiting from the ongoing merger and acquisition (M&A) trend. It is a known fact that smaller and mid-sized industry players often attempt to compete with the big shots through consolidation. The big players typically attempt to enter new markets through a niche product.

Going by a J.P. Morgan report of 2025, in 2024, MedTech acquisition activity exceeded the previous two years in both deal count and total announced value. A total of 305 M&A transactions were announced, totaling over $63.1 billion for companies in medical devices, diagnostics, therapeutic digital health, and commercial research tools, up from 134 deals in 2023.

In 2025 so far, notable examples of M&A include Stryker’s $4.9 billion acquisition of Inari Medical to expand its peripheral thrombectomy portfolio, Thermo Fisher’s $4.1 billion purchase of Solventum’s Purification & Filtration business, and Boston Scientific’s $664 million acquisition of Bolt Medical to strengthen its position in intravascular lithotripsy solutions.

Business Trend Disruption: Per IMF’s April 2025 World Economic Outlook, global growth is expected to remain lackluster over the next couple of years. At 2.8% in 2025 and 3.0% in 2026, the forecasts for growth are below the historical (2000–19) average of 3.7%.

A few countries, especially low-income developing countries, have seen sizable downside growth revisions, often as a result of increased conflicts and recent tariff shocks. The good news is that global headline inflation is expected to decline to 4.3% in 2025 and to 3.6% in 2026, with advanced economies reaching the targets sooner than emerging market and developing economies.

However, the IMF appends that the current policy-generated disruptions to the ongoing disinflation process could interrupt the pivot to easing monetary policy, with implications for fiscal sustainability and financial stability. Further, there are chances of higher nominal wage growth, which in some cases reflect the catch-up of real wages, accompanied by weak productivity, which could make it difficult for firms to moderate price increases, especially when profit margins are already squeezed.

The Zacks Industry Rank Indicates Dull Prospects

The Zacks Medical Instruments industry’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. The industry, housed within the broader Zacks Medical sector, carries a Zacks Industry Rank #131, which places it in the bottom 46% of 244 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and recent valuation first.

The Industry Underperforms the S&P 500, Outperforms the Sector

The industry has underperformed the Zacks S&P 500 composite but outperformed the sector in the past year.

The industry has declined 12.7% compared with the broader sector’s decline of 14.7%. Meanwhile, the S&P 500 has surged 12.8% in a year.

One-Year Price Performance

Image Source: Zacks Investment Research

The Industry’s Recent Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry has been trading at 29.04X compared with the broader industry’s 19.18X and the S&P 500’s 21.83X.

Over the past five years, the industry has traded as high as 40.60X, as low as 25.62X, and with a median of 32.52X, as the charts below illustrate.

Price-to-Earnings Forward 12-Month Ratio

Image Source: Zacks Investment Research

Price-to-Earnings Forward 12-Month Ratio

Image Source: Zacks Investment Research

3 Stocks Winning Big with GenAI

Presented below is a brief overview of the previously-mentioned stocks to keep an eye on.

Integer Holdings

Plano, TX-based Integer Holdings is a medical device contract development and manufacturing organization. Its strategic focus on portfolio optimization, including the divestiture of its Non-Medical business, supports its long-term inorganic growth plans. Integer Holdings has established a solid position in the MedTech industry and continues to invest in research and product development, which bodes well for innovation and future revenue growth.

The Zacks Consensus Estimate for this Zacks Rank #1 (Strong Buy) rated company’s 2025 sales is pegged at $1.87 billion, indicating a 7.7% rise from 2024. The consensus mark for Integer Holdings’ 2025 EPS is pegged at $6.33, indicating an increase of 19.4% from 2024.

Price and Consensus: Integer Holdings

Image Source: Zacks Investment Research

AngioDynamics

Headquartered in Latham, NY, AngioDynamics’ solid prospects with NanoKnife and the company’s increased focus on cancer treatment markets are encouraging. The company boasts a robust product pipeline and strong momentum in geographic expansion. Continued strong sales of Auryon, AlphaVac, and NanoKnife products further strengthen AngioDynamics’ outlook.

The consensus estimate for this Zacks Rank #1 (Strong Buy) rated company’s fiscal 2026 sales is pegged at $305 million, indicating a 6.3% rise from fiscal 2025. The consensus mark for AngioDynamics’ fiscal 2026 EPS is pegged at a loss of 24 cents, indicating an improvement of 14.9% from the year-ago period figure.

Price and Consensus: AngioDynamics

Image Source: Zacks Investment Research

Penumbra

Alameda, CA-based Penumbra’s consistent revenue growth momentum is being driven by strong patient outcomes with Lightning Flash 2.0, Lightning Bolt 7 and RED 72. The company’s vascular and neuro businesses are showing encouraging growth trends. Penumbra’s Immersive Healthcare business is making progress as well.

The Zacks Consensus Estimate for Penumbra’s 2025 sales is pegged at $1.35 billion, indicating a 13.4% rise from 2024. The consensus mark for Penumbra’s 2025 EPS is pegged at $3.72, indicating an improvement of 67.6% from the year-ago period figure. Penumbra has a Zacks Rank #2 (Buy) rating.

Price and Consensus: Penumbra

Image Source: Zacks Investment Research

More By This Author:

3 Retail REITs To Consider Amid Growing Optimism In The Industry

4 Non-Ferrous Metal Mining Stocks To Watch In A Promising Industry

Stocks To Watch As May’s Jobs Report Beats Economists’ Expectations: PCTY, MMS

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.