Our Terms & Conditions | Our Privacy Policy

Once a flagship killer, OnePlus is now really struggling in India

Not so long ago, OnePlus was seen as a flagship killer in India. A brand that not only challenged the likes of Samsung and Apple, but also emerged as a true alternative to them, a feat very smartphone brands have been able to achieve in India. So much so that OnePlus started to make its own device ecosystem. It launched wearables, smart TVs, accessories and more.

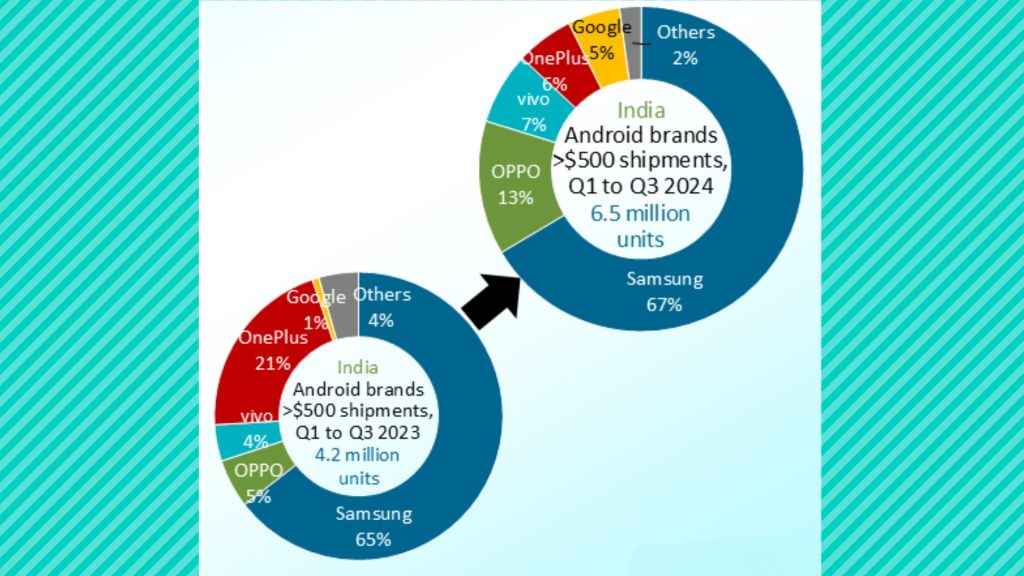

Everything seemed to be on track until it wasn’t. Its market share has gone from 6.1% in 2023 to 3.9% in 2024, a drop of 36% as per IDC India. Another market research firm, Canalys noted that OnePlus went from a commanding 21% market share in (Q1-Q3) 2023 to a mere 6% in 2024, signalling a downward spiral amid intensifying competition from rivals like iQOO and Motorola, which seems to be the biggest gainers of OnePlus’ decline.

Canalys Smartphone Analysis Estimate, 2024

Canalys Smartphone Analysis Estimate, 2024

The Rise and Fall of OnePlus Market Share in India

It all began with OnePlus having mastered a unique formula: offering flagship specifications at not-so-flagship prices, wrapped in a near-stock Android experience called OxygenOS that its customers adored. In its first five years, it had achieved a loyal following that most brands could only dream of.

Navkendar Singh, Associate Vice President, IDC India notes, “It [OnePlus] started its journey as a mid-premium flagship killer; however soon realized the importance of having mass products for a market like India, and launched affordable devices to garner more volumes, thus directly competing with established players like Xiaomi, Realme, Oppo, Vivo etc, while the competition was largely Samsung in the premium Android space earlier.”

Faisal Kawoosa, Chief Analyst and Founder, Techarc elaborates, “OnePlus was one such lucky brand which in just its first 5 years had been able to gather loyalists. Especially the youth with technology understanding. Youth who wanted to do more with their smartphones. This position is no longer enjoyed by OnePlus.”

Tech Analyst and Market Insights Expert, Yogesh Brar says, “OnePlus initially gained popularity as an aspirational brand, serving as a stepping stone for consumers before they moved on to premium brands like Apple and Samsung.”

Like many great stories, this one took an unexpected turn. “The main reason for this dip in my opinion has been the product, Kawoosa explains. “After the OnePlus 7, there has been a consistent dip in the product performance, which they attempted a bit to revive in the OnePlus 12, and have achieved significantly with the OnePlus 13. I would consider the dropping product performance at the centre of this decline, and then many peripheral issues added to it.”

OnePlus Display Issues and Retailer Boycott

The first cracks appeared in the form of a mysterious green line creeping across phone displays. What started as scattered complaints soon turned into a social media storm.

Shilpi Jain, Senior Analyst, Counterpoint Research says, “The ‘green line issue’ hurts the brand equity. Retailers faced challenges when disgruntled customers came and complained of how they sold a bad, faulty phone.”

“While issues like green line displays affected several brands, OnePlus kind of became the poster brand for this issue and its aftermath including warranty and servicing,” Kawoosa added.

In May 2024, 4,500 retailers, the very people who put OnePlus phones into consumers’ hands, staged an unprecedented boycott. Jain elaborates on the underlying issues: “Like other brands, OnePlus also expanded offline; however, the strategy did not work as retailers were not happy with the margins, brand support and delays in warranty processing leading to retailers’ boycott in some regions tarnishing brand image further.”

The offline channel conflict became particularly acute. “OnePlus buyer cohorts have been historically online buyers and we have to recognize here that Amazon has played a great role in OnePlus’ growth. Offline issues of course hampered its participation in the remaining 50% of the contributing channel,” Kawoosa explains.

| Year | 2021 | 2022 | 2023 | 2024 |

| OP share | 2.50% | 4.10% | 6.10% | 3.90% |

| ASP(US$ excl GST) | 400 | 384 | 348 | 306 |

| Rank | 10 | 7 | 7 | 9 |

IDC’s data shows OnePlus’s journey

Volume vs Premium Brand Identity

OnePlus made a strategic gamble with its Nord series, which was meant to be its bridge to the masses. Instead, it became a double-edged sword. As Shilpi Jain explains, “The launch of Nord series generated volumes but diluted its image as a premium brand. And now with competition increasing in the upper mid-tier (20-30K), even Nord series became less appealing to consumers.”

“The most significant blow came from Apple’s intensified focus on the Indian market. Through partnerships with e-commerce platforms, festive discounts, and No-Cost EMI options, iPhones became significantly more affordable, directly competing with OnePlus’s price segment,” said Brar.

Singh tells us, “The brand continues to hold its recall and loyalty, especially with the fast-moving NORD series, but the major issues like the green line, and software bugs on Oxygen OS impacted flagship device sales. The offline retailer boycott also impacted offline sales, however, the majority (over 70%) of OnePlus shipments were still online and were driven by the Nord series.”

Kawoosa says, “Brands such as iQOO by Vivo, Reno by Oppo and Edge by Motorola fared well over these years along with the preference of people to consider an iPhone in the range even if that meant buying an older generation iPhone”.

“The majority decline was witnessed in the higher >30K segment, where Apple was the major gainer, while even Samsung and vivo share declined and OPPO and iQOO gained significant share in 2024. OnePlus share in the sub-30K segment was 7%, as per IDC in 2024,” Singh added.

What many fans considered the ultimate betrayal then came: the merger of their beloved OxygenOS with OPPO’s ColorOS. For the tech purists who had championed OnePlus from its early days, this was like watching their favourite indie band go mainstream.

Kawoosa reflects that “OxygenOS was a key differentiator and USP for OnePlus. It did create a doubt in the minds of consumers as to how the transition would work and how will it impact the product.” However, he adds that “today ColorOS has acquired most of the good elements of OxygenOS and is as smooth as the latter was known for. I think it will take a bit more for consumers to experience this.”

“It’s worth highlighting that OP still holds a strong brand value in the mid-premium Android space just after Samsung and will be able to mitigate the issues in the upcoming quarters,” Singh notes.

Can OnePlus Reclaim Its Premium Smartphone Status in 2025?

Looking ahead, analysts see potential for recovery. Singh predicts, “In 2025, with the launch of OnePlus 13 series and the efforts around fixing green line issues with Project Starlight, expanding retail footprints through multiple channels, more service centres, free lifetime replacement schemes etc, are expected to help bounce back the lost ground.”

Also Read: OnePlus 13 Review: Back in form?

Kawoosa outlines the path forward: “Performance, Experience and Personalisation (PEP) are what OnePlus needs to focus on. It has a community which understands tech and at the same time wants a lot of freedom to do more with tech. This is where OnePlus has to excel and regain.”

However, he cautions about the Nord series: “My only suggestion has been that it seriously needs to think about Nord series. I still believe it’s a distraction for OnePlus and its focus on developing premium experiences in the mid-premium market gets diluted along with the brand identity. It should not be a brand after volume share.”

“Despite these setbacks, OnePlus retains a strong brand presence in the Indian market. It is still considered a key ‘Premium’ brand, alongside Apple and Samsung. While competitors like Vivo, Xiaomi, and OPPO offer superior hardware, they have struggled to gain traction in the over-Rs 50,000 price segment, a space where OnePlus still holds some influence,” Brar concludes.

Siddharth Chauhan

Siddharth reports on gadgets, technology and you will occasionally find him testing the latest smartphones at Digit. However, his love affair with tech and futurism extends way beyond, at the intersection of technology and culture. View Full Profile

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.