Our Terms & Conditions | Our Privacy Policy

Buying the Dip: 4 High-Growth Stocks Down More Than 30% to Watch Out – Stock Insights News

Have you ever experienced a fall of more than 30% in your portfolio stock within a matter of few days due to some adverse news/law change/industry slowdown?

These stocks typically belong to companies that are expanding rapidly, driving innovation, and positioning themselves for future success.

However, market volatility can cause even the most promising growth stocks to experience steep declines. Identifying growth stocks that have experienced a notable dip can be a savvy investment move.

In this article, we will explore four growth stocks that have seen their share prices drop by more than 30% but still show promising potential for the future.

These companies might be undervalued at the moment, making them worthy of a place on your watchlist.

Whether you’re a seasoned investor or just starting to build your portfolio, understanding these opportunities could help you make well-informed decisions and potentially unlock significant growth in the years ahead.

Read on…

#1 Polycab India

Polycab is India’s leading manufacturers of cables and wires and allied products such as uPVC conduits and lugs and glands.

The company has a range of cables and wires for every application. Recently, Polycab has also launched a wide range of consumer electrical products like fans, switches, switchgears, LED lights, and luminaries, solar inverters, and pumps.

Polycab enjoys a market share of 22-24% in the domestic organised wires and cables business. The company derives 89% of its revenues from wires and cables segment, 9% from fast moving electrical goods, and the balance 2% from other businesses.

The company derives 90% of its revenues from domestic market and balance 10% from exports.

Polycab expanded its global footprint to 76+ countries. Out of the exports, 46% are to North America and 20% to Europe.

In India, the company has a strong presence with 4,300+ distributors, 205,000+ Retail outlets, 23 warehouses and depots, 4 regional offices, 9 local offices, and 17 experience centres.

Coming to the financials, Polycab reported a 23.9% growth in revenue in 9MFY25.

EBITDA growth came in at 12% and the EBITDA margins deteriorated from 13.9% in 9MFY24 to 12.6% in 9MFY25.

Going ahead, for FY26 the company has guided to achieve a sales of Rs 200 bn through its Project Leap.

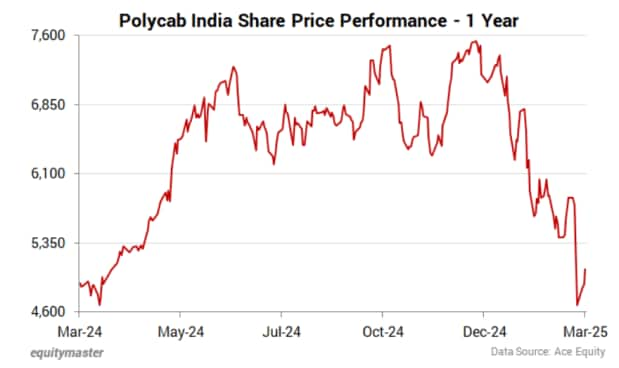

Polycab India stock made a high of Rs 7,607 and is currently trading at Rs 5,072, a correction of roughly 33.3%.

This fall in share price is due to a recent announcement by Ultratech Cement whereby they are entering the cables and wires business which will amount to increased competition for Polycab India.

#2 Tips Music

Tips Industries Limited, incorporated in 1996, is engaged in the business of production and distribution of motion pictures and acquisition and exploitation of music of rights.

The company is also a leading producer of Punjabi films in the country.

Tips Music has a large music library with a collection of over 30,000 songs across various genres and regional languages.

It has produced around 40 Hindi films in the past 20 years and also sells the theatrical, satellite, and various other rights to distributors, broadcasters, etc.

The company earns 100% of its revenue from license fees. 75% of the revenue is from digital platforms, wherein 45-50% is through YouTube, and the remaining 25-30% through other digital platforms.

The remaining 25% of revenue is generated through TV and public performances.

Tips Music derives 27% of its revenues from the domestic market and 73% from international markets where it distributes products to countries like South Africa, Israel, and Malaysia.

The team of distributors of the company serves more than 1,000 wholesalers across the length and breadth of the country who, in turn, serve more than 400,000 retailers.

Coming to the financials, TIPS reported a 30.2% growth in revenue in 9MFY25 on the back of strong growth for their music across digital platforms.

EBITDA growth came in at 32.1% with margins improving to 72.9% from 71.9% in 9MFY24.

Going ahead, the management is optimistic about the growth trajectory, projecting a continued 30% growth in revenue for the next financial year.

Tips Music stock made a high of Rs 950 and is currently trading at Rs 620, a correction of 34.7%.

#3 Central Depository Services Ltd

Central Depository Services (CDSL) is the only listed depository in India and a key beneficiary of structural growth in capital markets.

There are only two depositories in India, the other being NSDL, which is not listed yet.

As a securities depository, CDSL facilitates the holding of securities in digital form and enables securities transactions (including off-market transfers and pledges) to be processed by book entry.

It generates income from annual issuer charges (annuity nature of the income), transaction charges (market dependent), IPO/corporate activity charges, online data charges (through its subsidiary CDSL Ventures) and others.

Moreover, the extensive network and the first-mover advantage have done wonders for the company, with the fintech megatrend adding fuel to the fire.

The company is one of the major beneficiaries of rising digitalisation. Notably, the surge in market activity, both in the secondary and primary segments, fuelled by a growing number of investors and traders, has led to a rising demand for depository service.

The expansion of CDSL’s market share for cumulative active demat accounts, from 40% in FY14 to an impressive 73% in FY23, underscores its dominance in the depository services sector.

Coming to the financials, CDSL Ltd reported a growth of 50.1% in its revenues for 9MFY25, and profit after tax grew by 44.7% for the nine month period. EBITDA margins remained stable coming in at 60% for 9MFY25 versus 59.7% in 9MFY24.

Stock price of the company made an all time high of Rs 1,990 and the share is currently trading at Rs 1,139 a correction of 43% from the top.

Shares of the company corrected as CDSL reported a degrowth in revenue and margins in Q3FY25 due to reduced market activity and rising costs impacting profitability.

#4 Zen Technologies

Zen Technologies Limited was incorporated in 1996. The company designs develop and manufacture combat training solutions and Counter-drone solutions for defence and security forces.

It is actively involved in the indigenization of technologies, which are beneficial to Indian armed forces, state police forces, and paramilitary forces.

Zen Technologies is headquartered in Hyderabad, India with offices in India, UAE, and the USA.

Product portfolio of the company includes training simulation equipment, counter drone solutions, and annual maintenance contracts.

Zen Technologies is a leader in manufacturing defence training solutions with over 95% market share in tank simulators.

Geographical revenue split is in the favour of domestic markets. The company derives 80% of revenues from India and balance 20% from the overseas markets.

The company boasts of a very high profile clientele consisting of the Ministry of Defence, Armed Forces, and the Paramilitary Forces.

Coming to the financials, Zen Technologies reported a robust growth of 117.3% in its revenues for 9MFY25, and profit after tax grew by 101.9% for 9MFY25. EBITDA margins however deteriorated from 43.7% in 9MFY24 to 36.3% in 9MFY25.

Going ahead management says that there is significant growth potential in the defence sector, with increased government emphasis on indigenous technology and procurement.

Post acquisition, the expected EBITDA margin is targeted to remain around 35%, with a PAT margin of 25%.

Share price of the company touched a high of Rs 2,628 and is currently trading at Rs 1,134 a correction of 56.8%.

The fall in share price is attributed to mixed performance in company’s Q3FY25 results.

Conclusion

While a decline of more than 30% in a stock’s price can be unsettling, it also presents potential opportunities for savvy investors.

The four growth stocks highlighted in this article—Polycab India, Tips Music, Central Depository Services, and Zen Technologies —have all experienced significant price corrections but still possess strong fundamentals and growth potential.

Whether due to increased competition, temporary market fluctuations, or changes in industry dynamics, these stocks could offer long-term value for those willing to weather the volatility.

As always, conducting thorough research and maintaining a well-diversified portfolio are key to navigating the unpredictable nature of the stock market.

With careful monitoring and patience, these companies may recover and deliver solid returns in the future, making them worthy additions to your watchlist.

Investors should remain vigilant, conducting thorough research and keeping abreast of market trends to ensure they make informed decisions.

Remember the challenges before diving headfirst.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.