Our Terms & Conditions | Our Privacy Policy

Foreign investors bet big on India: $11 billion inflows in nine months

Overseas buyers net invested $5.9 billion into domestic stocks this month alone so far, according to data from Bloomberg, attracted by the country’s economic fundamentals and beginning of the rate cut cycle in the US. By comparison, Indonesia received $1.92 billion, Thailand $1 billion and Malaysia $256 million. South Korea, Taiwan and Brazil recorded net outflows of $5.4 billion, $4.6 billion and $4.7 million, respectively, in the month.

In the year so far, India attracted $11 billion of overseas investments, outperforming other emerging markets. South Korea received $10.7 billion, while Indonesia and Malaysia attracted $3.7 billion and $952 million, respectively, during the period.

This was despite the Indian market trading at 25.7 times its earnings compared to Malaysia’s 16.0 times, Vietnam’s 14.8 times and South Korea’s 14.2 times.

“While Indian market valuations may seem stretched in the short to medium term, the country’s long-term prospects make it a safe haven for global investors,” said Kranthi Bathini, director of equity strategy at Mumbai-based WealthMills Securities. “Despite these high valuations, foreign inflows persist due to India’s strong growth potential, political stability, favorable geopolitical landscape, and ongoing reform initiatives.”

Taiwan, South Africa and Vietnam have seen overseas investors pull out $11.8 billion, $4.8 billion and $2.2 billion, respectively, from the equity markets so far this year.

“FPI inflows into India are being driven by a combination of both global factors and domestic strengths,” said Vishad Turakhia, managing director at Equirus Securities. “India’s relative stability amidst global uncertainty and a steady currency further enhance its attractiveness.”

Also read | Mid-, small-cap stocks take a breather—is this the perfect time to buy?

India’s robust macroeconomic fundamentals also play a key role in drawing foreign investors. “India’s strong GDP (gross domestic product) growth, driven by its middle class, consumption patterns and young population, provides very compelling long-term opportunities,” said Anirudh Garg, a partner and fund manager at Invasset. “Government initiatives like the production-linked incentive (PLI) scheme and infrastructure development efforts have bolstered investor confidence. Additionally, with interest rates remaining low in developed markets, investors are increasingly looking to India for higher returns.”

Shifting focus to primary markets

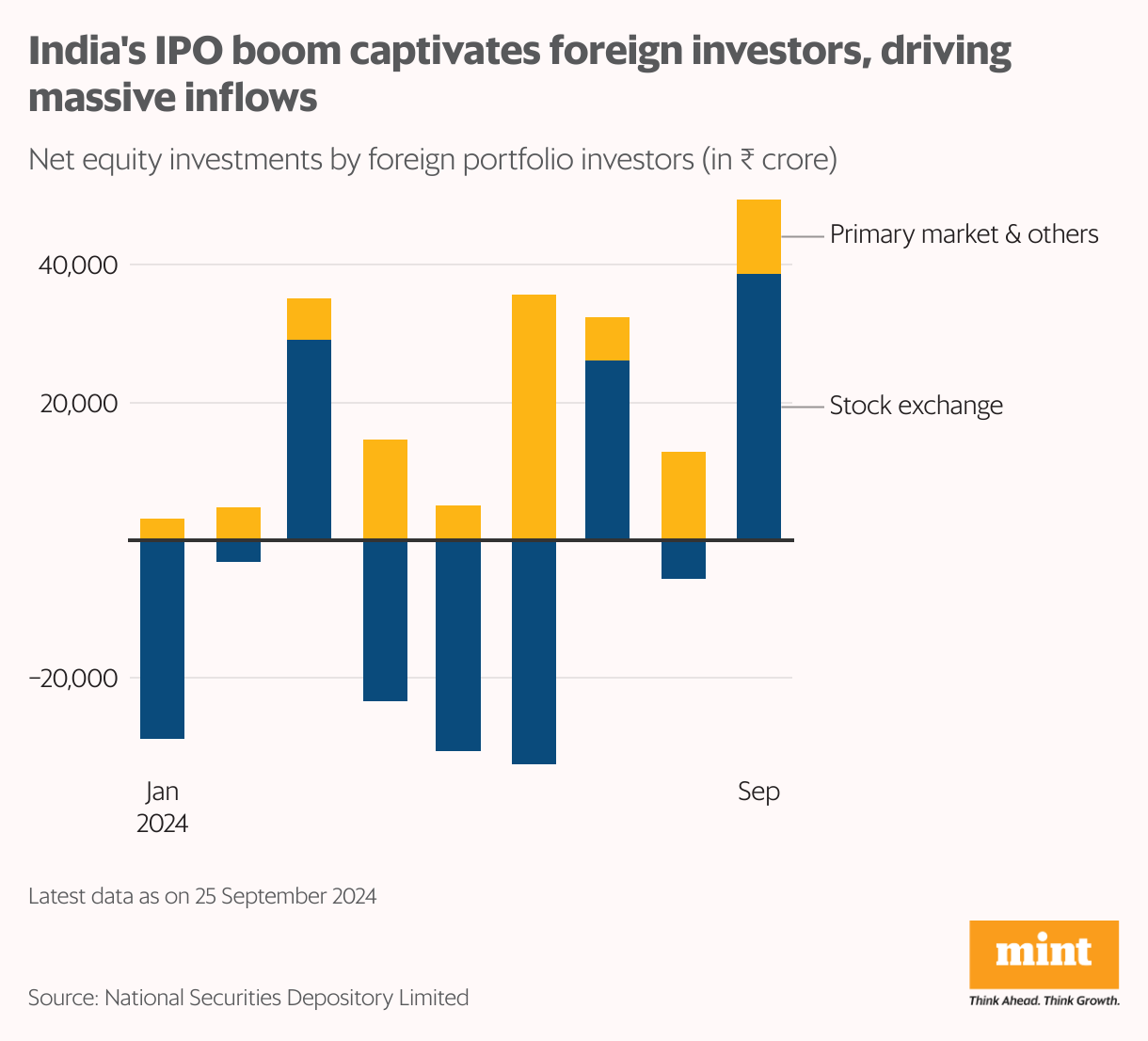

Moreover, the allure of India’s initial public offerings (IPOs) has foreign investors racing to get a piece of the action, leading to unprecedented inflows. In September alone, the primary market received ₹10,781 crore from these overseas investors, accounting for almost 22% of the total monthly inflows of ₹49,459 crore.

This trend has persisted throughout the year 2024, with the primary market consistently receiving positive inflows even during months of net outflows from the secondary market. For instance, in August, the secondary market experienced an outflow of ₹5,552 crore, while the primary market recorded an inflow of ₹12,872 crore from FPIs.

“FIIs are increasingly shifting their focus to the primary market, marking a clear preference for new listings over the often-overvalued secondary market,” said Turakhia. “Upcoming IPOs (initial public offerings) from major companies like Hyundai Motor India and Swiggy, coupled with a strong pipeline of other mid-market IPOs (expected to raise over ₹63,550 crore), indicate that the primary market will remain a significant draw for foreign investors.”

Also read The IPO roulette has more spinners and fewer winners, what’s your fate?

Sector-wise foreign inflows

Foreign portfolio investments have shown interest in a diverse array of sectors, showcasing their confidence in the growth potential of the Indian economy. Year-to-date, the telecommunications sector has attracted the highest flows of ₹30,905 crore, followed by the consumer services sector that received inflows amounting to ₹29,318 crore.

Additionally, the capital goods, healthcare and realty sectors have emerged as key beneficiaries of foreign investment with an inflow of ₹27,239 crore, ₹21,177 crore and ₹12,349 crore, respectively.

Also read Indian companies junk private deals, take the IPO route for higher valuations

“FPIs have been more cautious in the secondary market, particularly in sectors like banking, metals, and automobiles, where concerns over valuations, global economic factors, and profitability are prompting some selloffs,” said Turakhia. “However, sectors like IT, healthcare, FMCG, and telecom have continued to see strong inflows. In the year so far, these overseas investors have pulled their money from sectors such as financial services and construction. Sectors like automobile, technology, FMCG, and manufacturing are expected to thrive with government policies playing a pivotal role in shaping their growth trajectories.”

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.