Our Terms & Conditions | Our Privacy Policy

Bitcoin Price Hits $65K Since August, Will BTC Reach $80K in ‘Uptober’?

The Bitcoin price has hit $65,000 for the first time since early August, thanks to several recent developments that provide a bullish outlook for the flagship crypto. These developments are also why there is the belief that this BTC rally can extend, with its price rising to $80,000 in Uptober, a term used to describe Bitcoin’s bullish nature in October.

Bitcoin Price Can Reach $80,000 In Uptober

Several factors support the Bitcoin price reaching $80,000 in October. One is the macro side, which has provided a major boost for the crypto market, with investors again allocating a significant amount of their capital to risk assets. These macro developments began with the US Fed rate cuts last week when the Federal Reserve cut interest rates by 50 basis points (bps).

This week, the People’s Bank of China (PBoC) also announced interest rate cuts and stimulus policies to improve the country’s economy. CoinGape reported that that move was bullish for BTC, noting that the Bitcoin price targets $100,000 following China’s stimulus package and its crypto trade with Russia.

Meanwhile, the latest US GDP data and jobless claims showed that the US economy is healthy, supporting the Fed’s move to cut interest rates by two more 25 bps this year. These world governments will continue adopting monetary easing policies to boost their economies.

In line with this, more liquidity will flow into the BTC ecosystem in October. A Coingape report states that this market liquidity will aid Bitcoin’s surge, which is one of the reasons why its price is likely to keep rallying in October.

From A Historical And Technical Perspective

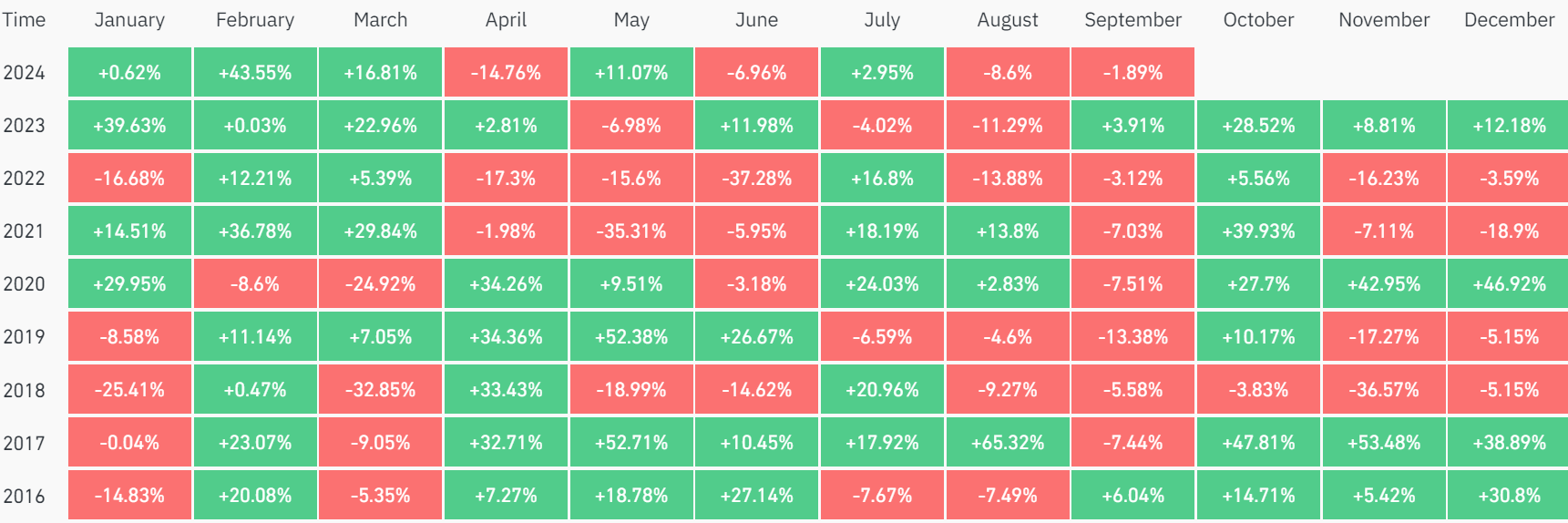

From a historical and technical perspective, the Bitcoin price also looks poised to rally to $80,000. Coinglass data shows that October has been one of the most profitable months for BTC in the last eight years.

For context, the flagship crypto has only recorded monthly losses once in October over this period. Moreover, Bitcoin’s gains in October have been double digits. The only time the crypto recorded a single-digit gain was in 2022 when it closed the month with a 5% gain.

In his recent analysis, crypto analyst Jelle suggested that Bitcoin can reach $80,000 in October. The analyst noted that the market structure is now bullish, considering that BTC has breached the $65,000 resistance level. The analyst’s accompanying chart showed that $80,000 was the price target as the flagship crypto continues its uptrend.

Market Volatility Ahead Of October

A lot could still happen between now and Uptober, with the Bitcoin price gearing up for heavy market volatility. CoinGape reported that 89,027 Bitcoin options will expire today, with a notional value of $5.8 billion. The put-call ratio is $0.64, which suggests a bullish sentiment ahead.

The US Core PCE inflation data is also set to be released today by 1:30 p.m. UTC. This could also spark a lot of volatility for the BTC price. The current forecast is that the PCE price index rose by 0.2% in August.

For now, $65,000 remains the key level that Bitcoin bulls must defend if the BTC rally is to extend. Crypto analyst Ali Martinez revealed that 57.77% of Binance users with open positions are currently shorting BTC. This is also something to watch out for, although Bitcoin is currently on course to record its most profitable September ever, having surged by over 10% this month.

At the time of writing, the BTC price is at around $65,400, up over 2% in the last 24 hours. Trading volume is up over 57%, with $39 billion traded during this period.

✓ Share:

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.