Our Terms & Conditions | Our Privacy Policy

BlackRock Bitcoin ETF Inflows Shoot to 5,613 BTC, $100K Recovery Soon?

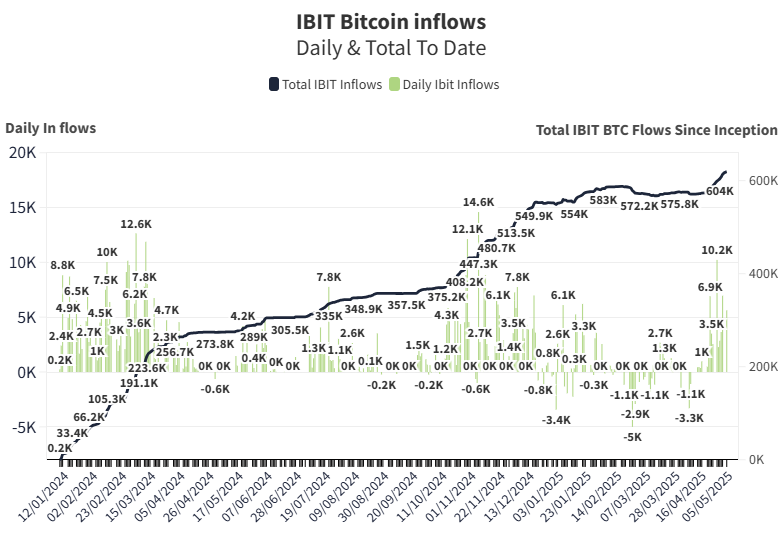

BlackRock Bitcoin ETF inflows have once again skyrocketed as the asset manager scoops up 5,613 BTC from the open market on Monday. This marks 15 consecutive days of inflows for BlackRock iShares Bitcoin Trust (IBIT), netting a total of $4.5 billion in this period. On the other hand, BTC price remains steady at $94,500 levels, with institutional interest highlighting an upside to $100K and beyond.

BlackRock Bitcoin ETF Inflows On the Rise

BlackRock’s iShares Bitcoin Trust (IBIT) has stormed the market once again with overall inflows for 15 consecutive days in a row. On Monday, the asset manager scooped an additional 5,613 BTC worth $530 million, with its total inflows since inception crossing $44 billion once again.

Source: Thomas Fahrer

Source: Thomas Fahrer

Additionally, data shows that asset manager BlackRock has significantly increased its stake in the iShares Bitcoin ETF, boosting its holdings by 124%, during the first quarter this year. This move brings BlackRock’s total investment in the ETF to an impressive $314 million, signaling a growing institutional appetite for Bitcoin exposure amidst evolving market conditions.

On Monday, the overall Bitcoin ETF inflows stood at $425 million. While BlackRock’s IBIT recorded $530 million in inflows, Fidelity’s FBTC, Bitwise’s BITB, Grayscale’s GBTC, and others saw net outflows yesterday, per data from Farside Investors. Bloomberg’s senior ETF strategist Eric Balchunas stated:

BlackRock’s “IBIT in the top spots, just like last year when ‘beta with a side of bitcoin’ was the big theme. $IBIT now 8th in YTD flows (was out of Top 50 at one point) with +$6.4b. Been hoovering up btc like a madman ever since the decoupling”.

Source: Eric Balchunas

Source: Eric Balchunas

BTC Price Eyes $100K Levels

BTC MVRV levels show that much of the froth has been removed as the Bitcoin price flirts around $94,500 levels over the past week, while setting the stage for gains to $100K levels. Popular crypto analyst Kyledopps reported:

“The froth is gone — the reset is real. Bitcoin’s MVRV just touched its long-term mean at 1.74 — a classic sign of flushed-out unrealized gains. Hold this level? It’s a clean reset and a setup for recovery”.

Source: Kyledoops | Glassnode

Source: Kyledoops | Glassnode

It will be interesting to see how soon BTC can resume its journey upwards of $100K as the CoinGape Bitcoin price prediction indicator shows the asset will flirt around $94,600 over the next month. However, continued inflows into Bitcoin ETFs can provide an additional catalyst for the rally ahead.

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.