Our Terms & Conditions | Our Privacy Policy

3 textile stocks to watch out for as UK-India sign big trade deal – Stock Insights News

As the UK and India inch closer to finalising a Free Trade Agreement (FTA), investor interest is gradually returning to export-focused sectors, and the textiles sector is one of the key beneficiaries. The UK is India’s fourth-largest export destination for textiles and apparel, contributing over ₹100 billion annually. The trade deal could remove existing tariffs of 8–12%, making Indian products more competitive compared to those from Bangladesh, China, and Turkey.

In this backdrop, a few listed textile players with strong export exposure and products aligned with UK demand trends are coming back into focus. Apart from this, the expected agreement with America will also be beneficial for the sector. But the key question remains: Should you buy now?

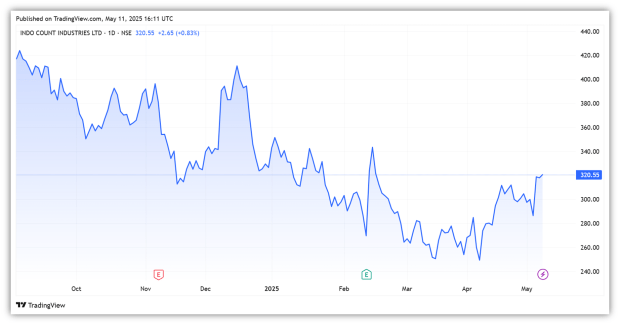

#1 Indo Count Industries

India Count Industries is the largest global home textile bed linen company and one of India’s top three bed linen suppliers and exporters. The company has a comprehensive product portfolio in the premium segment, which includes bed sheets, fashion bedding, utility bedding, and institutional bedding.

It serves a wide range of clients, including global retailers and international brands. It is among the leading bed sheet suppliers in the US, the world’s largest home textiles market, where about 70% of its revenue is generated.Walmart, its top customer, contributes 20% to its top line, and the top five customers account for about 50% of total revenue. Beyond the US, it exports to over 50 countries.

The US remains the company’s largest export destination. It is followed by the UK and Europe, contributing around 12% to total sales. While the UK’s contribution is modest compared to the US, the company aims to grow its market share significantly once the FTA with the UK is approved.

Indo Count’s total income in 9MFY25 increased 26% from last year to ₹31.6 billion, driven by an 18.5% volume jump. Margin, however, dipped two percentage points to 15.3% due to higher shipping costs and investments. Consequently, net profit declined 5% to ₹2.3 billion.

Looking ahead, the company aims to double its revenue by 2028 from FY24 revenue of ₹35.6 billion. It plans to achieve this through organic growth and entering newer segments like utility bedding and branded offerings. The company has also expanded into new markets such as Canada, Australia, and Japan.

To strengthen its presence in the US, it is setting up a greenfield manufacturing facility in North Carolina. With this third facility in the US, the company has expanded its utility bedding capacity to 31 million pillows, from 18 million pillows. This facility has an annual revenue potential of $90 million and is expected to contribute from September 2025.

In parallel, it is also developing its branded business by leveraging labels such as Wamsutta, Fieldcrest, and Waverly to target $100 million in branded sales over the next 3 years.

The company has also recently diversified into value-added products like fashion, wedding, utility, and institutional bedding, a segment with a $11 billion market in the US.

From a valuation perspective, the company trades at a price-to-equity (PE) multiple of 19x, a premium to the 10-year median multiple of 13x.

#2 KPR Mills

KPR Mills is one of the largest integrated textile companies, with operations across the textile value chain, from cotton yarn to processed fabric and garment manufacturing. Its product portfolio includes readymade knitted apparel, fabrics, and polyester.

The spinning division has a production capacity of 100,000 MTPA (metric tonnes per annum), while the fabric division can produce 40,000 MTPA of different kinds of fabric.

KPR is one of the largest apparel manufacturers in India, with an annual capacity of 157 million pieces. It exports knitted garments for men, women, and children—including casual wear, T-shirts, and nightwear—to leading global brands across over 60 countries.

The company’s revenue is well-diversified across segments. In 9MFY25, apparel contributed 45% of the total revenue, followed by the yarn and fabric segment at 33%. The remaining revenue came from the sugar, ethanol, and power business.

Geographically, 36% of revenue comes from exports. Of this, 56% is from Europe, mainly driven by garments, with the rest from North America, Australia, Asia, and others. Thus, with the FTA, KPR will gain an edge in pricing, benefiting the company immensely.

In terms of financials, the company’s revenue in 9MFY25 surged 6% from last year to ₹46.2 billion. Yarn and fabric sales grew 10.4% to ₹152 billion, driven by an 8% volume expansion. Garment sales rose 17% to ₹21 billion, led by a 17% volume expansion.

Sugar and ethanol sales contributed the balance. Margins declined by 80 basis points to 20.9%, primarily due to a fall in ethanol sales. As a result, net profit rose by just 3.2% to ₹6.1 billion.

Looking ahead, the company is adding 30 million of garment capacity through brownfield expansion. This additional capacity and improved export demand will support future growth.

On the valuation front, KPR trades at a PE of 55x, over 3x higher than the 10-year median of 18x. The share price has surged 25% in the last five trading sessions.

#3 Vardhman Textiles

Vardhman Textiles manufactures Yarn, Fabric, Acrylic Fiber, and Garments. It holds a strong position in the cotton yarn and fabrics segment. It is India’s largest spinner, with an installed capacity of 1.2 million spindles, accounting for 2% of the installed capacity in India.

The company is among the top three woven fabric manufacturers, with grey fabric capacity of 220 million metres per annum (MMPA) and 180 MMPA. In the acrylic fibre segment, it is one of the largest domestic players with a capacity of 21,000 tonnes per annum (TPA).

It supplies to global apparel brands including Walmart, H&M, Tommy Hilfiger, and Aditya Birla Fashion. The top five customers account for about 10% of total revenue.

In FY25, the textile segment contributed 97.3% of overall revenue, while acrylic fibre contributed the remaining 2.7%. The company is also geographically diversified, with exports accounting for 41% of revenue. It exports to 62 countries, including the US, Europe, and the UK.

Vardhman is positioning itself as a reliable partner for global buyers, looking to benefit from India’s tariff advantage. Post-New Year, there has been an uptick in export demand, especially from the US and UK.

In FY25, the company’s sales increased 3% from last year to ₹97.8 billion, driven mainly by a 3% increase in textile segment revenue. The textile segment’s profit before tax and interest increased 46% to ₹11.4 billion. With improving margins aided by a fall in input costs, the company’s net profit surged 39% to ₹8.9 billion.

The company is increasing fabric production capacity by 38% by the end of 2025. It also expands into synthetic and technical textiles, which are expected to be operational in Q3FY26. Overall, it has guided for 10% top-line growth in FY26 and 30% in FY27, all else equal.

On the valuation front, the company trades at a PE of 16x, at a 60% premium to 10-year median of 10x.

Conclusion

The UK-India trade deal may benefit export-focused textile stocks like Indo Count, KPR Mills, and Vardhman. Though their outlook is positive, current valuations appear high for some as they have already risen post-deal. It might be more reasonable to track how the deal progresses before making investment decisions.

Disclaimer

Note: Throughout this article, we have relied on data from Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.