Our Terms & Conditions | Our Privacy Policy

Ather, Ola, TVS, Bajaj et al and India’s Shift to e-2Ws: Should Investors Throw Their Hat in the Ring?

Hero MotoCorp’s VIDA e-scooter was launched in FY23 and its 4 per cent share today, deserves a mention. Outside the listed space, the Japanese OEMs Suzuki and Honda have launched their e-Access and e-Activa line-ups recently.

OEMs in this space will have to put up with intense competition and thrive. Per Vahan data, there were over 150 unique OEMs whose e-2Ws were retailed in FY25. While a lot of them were Chinese imports, some of them are Indian start-ups such as Ultraviolette (TVS has a 30 per cent stake), River Mobility, Tork Motors, Oben Electric and Simple Energy, which could scale up and become the Olas and Athers of tomorrow.

Further, legacy OEMs such as Hero VIDA, Honda and Suzuki are relatively new to the market and the impact of their products on the market remains to be seen. These players along with TVS and Bajaj come with distribution clout and cash to splurge and gain market share – something that pure-play OEMs need to contend with.

But where Ola and Ather shine and stand out is when it comes to tech and features on board, which are leaps ahead of the competition. The convenience of such features lures buyers and could turn them loyal towards the brand. However, they cannot put their feet up yet, as their USPs could be emulated by peers over time.

Opportunities, challenges

The primary opportunities for EV players arise from the long runway of growth ahead, given current penetration at 5.5 per cent. As per report by Crisil Intelligence, this is expected to increase to 35 per cent by FY31.

But this is not all. EV players score over traditional OEMs from their ability to generate recurring revenue.

First, today’s e-2Ws use copious amounts of software (on-board navigation, integration with phone, etc). The makers charge a premium for the convenience features that such software stacks offer. Ather charges ₹14,000-20,000 per vehicle, Bajaj charges ₹3,000-5,000 and Ola charges close to ₹8,000. From the OEM’s perspective, the direct costs associated with such offerings are largely-sunk R&D costs and hence, as buyers increasingly opt for such subscriptions, the revenue therefrom will flow straight to the EBITDA line.

On the flip side, challenges come in terms of recent speedbumps in scaling up and that most of the benefits from falling cost of cells are behind now. Demand-side subsidies declining also compounds the challenges.

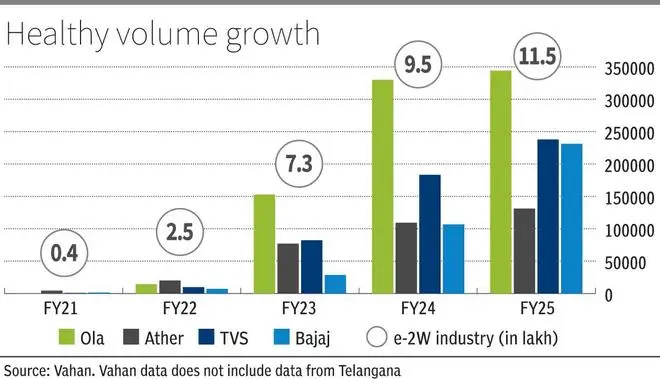

Though the year-on-year growth in volume sold by the players is strong, the EV penetration needle hasn’t moved much (see market share infographic), though there is improvement there. E-2W penetration in FY22 was 1.8 per cent. It went up sharply to 4.5 per cent in FY23 and has shown flattish growth since, moving up only to 5.5 per cent in 9M FY25. This is extremely crucial because pure-play EV OEMs such as Ather and Ola are banking heavily on scaling up to turn EBITDA-positive.

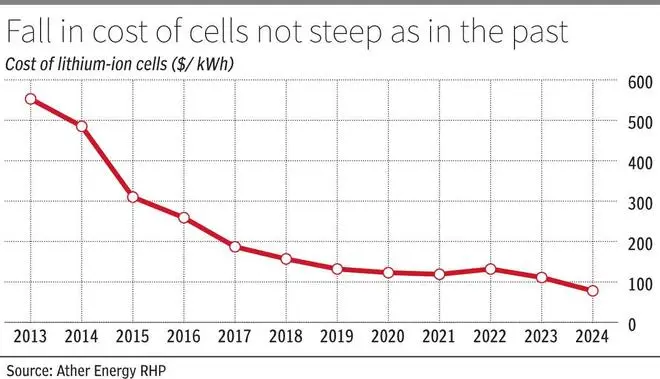

Regarding cells, almost all OEMs import cells, and they cost about $78 per kWh today (per Ather’s RHP). The same took five years to become one-third of what it was in 2013. In the next six years leading up to 2024, the prices only halved from 2018-levels. This is clearly a sign that the drop in prices is slowing down, and a bottom may be nearby. As seen above, the battery pack with the BMS forms about one-third of the BoM.

In-house cell manufacturing is also unlikely to significantly help on the cost side. Cell manufacturing is an extremely capital-intensive business requiring massive scale to make any investment sense. For instance, LG Energy Solutions (Korea) that supplies cells to Ather and Ola, makes a net profit margin of just 4 per cent, though operating on a scale of close to 300 GWh. CATL of China makes a higher margin of 11 per cent on a similar scale, probably supported by State subsidies. Other players with smaller scale make just 1-3 per cent.

Ola has a Gigafactory to make cells and it has also been granted approval under the government’s advanced cell chemistry PLI. Under the scheme, Ola has to achieve sales of 20 GWh by 2028 (with intermittent milestones of 5 GWh and 10 GWh). Not achieving could lead to reduced subsidy payouts, which could be crucial to make financial sense of the investment.

Hence economies of scale, must come from other parts, such as chassis and wheels. Further, any desperate attempt to raise prices of e-2Ws could slow down EV adoption.

As regards subsidies, the quantum of subsidy per vehicle has grown smaller over the years. Under FAME II in June 2021, the subsidy per vehicle was ₹15,000 per kWh, capped at 40 per cent of the vehicle cost. The same was reduced to ₹10,000 per kWh, capped at 15 per cent of the vehicle cost in June 2023. The EMPS (Electric Mobility Promotion Scheme) followed FAME II until September 2024 with a subsidy of ₹5,000 per kWh, capped at ₹10,000 per vehicle. The PM E-DRIVE scheme followed EMPS with the same quantum of subsidy until FY25. For FY26, the subsidy stands slashed to ₹2,500 per kWh, capped at ₹5,000 per vehicle.

Finally, concerns about the true life of a battery and range anxiety linger. The e-2Ws on road today are fairly new and hence there is only limited data on battery longevity, warranty claims honoured and resale value. This may get sorted over time.

However, the same cannot be said about range anxiety, which primarily stems from the absence of a dense public charger network. The network is growing rapidly though, from 11,600 e-2W chargers in FY23 to 18,326 in FY24. Data from Petroleum Planning & Analysis Cell of the Ministry of Petroleum & Natural Gas suggests there are 27,602 EV charging outlets (not just those meant for e-2Ws) as of March 2025. For context, this is roughly 25 per cent of the number of retail fuel stations (including CNG, LPG outlets) in the country. OEMs and other players in the ecosystem must continue the investment in public chargers to accelerate EV adoption.

Investor takeaways

The market position, prospects, strengths and challenges that each incumbent faces have been discussed in brief above. Information on volume growth, market share and profitability can be inferred from the infographics.

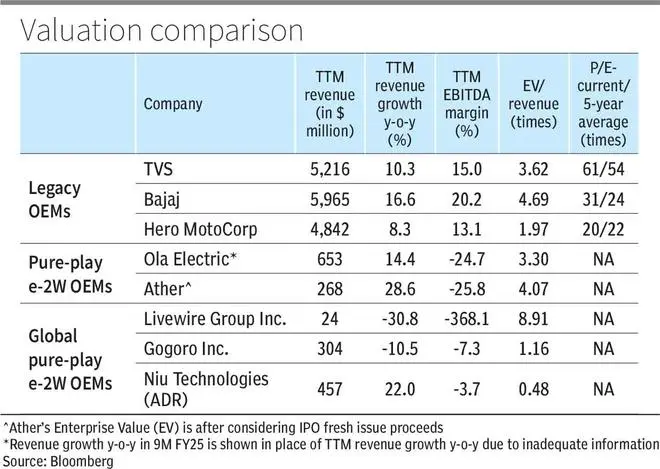

As can be seen in the Valuation infographic, Ola and Ather along with their global pure-play e-2W counterparts are yet to turn profitable. But they trade at richer valuations. Also, given the above challenges, their current valuations appear expensive.

Comparatively, legacy OEMs appear less expensive as they have a profitable business at the consolidated level. Their EV business’ profitability is not ascertainable with publicly-available information. But they come with the baggage of a relatively slow-growing ICE segment. Except for TVS, month-on-month sales of Bajaj and Hero have not been consistently growing. And rightly so, their sub-industry level volume growth in FY25 and their relative valuation to TVS mirror the same. On the other hand, having posted healthy growth, TVS is trading at a significant premium to BSE Auto index’s P/E of 23.4x and the stock’s own five-year average P/E of 54x.

There are a lot of moving parts with respect to the future of India’s e-2W market, and right now, it’s anyone’s guess which player might come to dominate it. Hence long-term investors interested in riding the electrification wave in 2Ws are better off waiting out for now, till the valuation signal turns green. The potential is high, but stocks appear priced perfectly for now. Investors need to keep track of fundamentals and be on the look for opportunities during the next bout of market correction.

Published on May 17, 2025

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.