Our Terms & Conditions | Our Privacy Policy

Optimizing Partnerships for Fast Fashion Growth

1Priya Chandrashekhar, Post Graduate Academic Scholar, Department of Fashion Management Studies, National Institute of Fashion Technology, Ministry of Textiles, Govt of India, Daman Campus.

2Dr Vidhu Sekhar P, Assistant Professor, Department of Fashion Management Studies, National Institute of Fashion Technology, Ministry of Textiles, Govt of India, Daman Campus.

Abstract

This research explores strategic brand acquisition and partnership optimization within the garment manufacturing industry, with a specific focus on growth in the fast fashion sector. It examines key factors influencing brand-manufacturer relationships, including market trends, brand expectations, agility, and competitive positioning, using Paarth Clothing Pvt. Ltd. as a case study. Adopting a mixed-methods approach, the study combines quantitative analysis from industry surveys with qualitative insights from interviews conducted with senior brand managers and professionals in sourcing and merchandising. The research identifies actionable strategies for garment manufacturers to enhance their ability to attract and retain brands through strong operational execution and effective collaboration. The findings emphasize the importance of speed, flexibility, and alignment with brand goals in driving long-term partnerships. Recommendations are provided to strengthen internal processes, improve communication with clients, and support sustained growth in the dynamic fast fashion market.

Introduction

The global garment manufacturing industry is a complex and dynamic landscape, heavily influenced by the rapid fluctuations of the fast fashion sector. In this highly competitive environment, strategic brand acquisition and the cultivation of robust manufacturer-brand partnerships are paramount for sustained growth and success. This research project delves into the critical factors that underpin these partnerships, focusing on the optimization of brand acquisition strategies within the context of the fast fashion market.

Driven by the need for speed, agility, and cost-effectiveness, fast fashion brands place stringent demands on their manufacturing partners. These demands encompass not only competitive pricing and production capacity but also quality assurance, technological integration, and increasingly, ethical and sustainable practices. Understanding the nuanced dynamics of these relationships is crucial for garment manufacturers seeking to attract and retain prominent brand clients.

This study is particularly relevant in the context of Paarth Clothing Pvt. Ltd., an export house servicing established brands such as Nautica, Kenneth Cole, Here and Now, kook and keech and Marvel. Situated at the intersection of manufacturing capabilities and brand expectations, Paarth Clothing Pvt. Ltd. provides a valuable case study for analyzing the complexities of strategic brand acquisition in the garment industry. Through a mixed-methods approach, combining quantitative analysis of industry surveys and qualitative insights gathered from interviews with senior brand managers, this research aims to identify actionable strategies that Paarth Clothing Pvt. Ltd., and similar manufacturers, can employ to enhance their partnerships and drive growth.

Objectives

- Analyse key factors influencing brand selection and distribution channels to define brand requirements within the manufacturer’s target segment.

- Evaluate the manufacturer’s capabilities against identified market demands.

- Determine key brand factors influencing manufacturer selection within this sector.

- Formulate manufacturer-centric strategies for enhanced brand acquisition and strategic partnerships

Literature Review

The global garment manufacturing industry has evolved into a highly fragmented and competitive sector, characterized by its reliance on low-cost labor, complex supply chains, and high production volumes (Gereffi, 1999). Within this framework, the fast fashion segment has emerged as a dominant force, marked by short product lifecycles, rapid turnaround times, and consumer-driven trends (Tokatli, 2008). Fast fashion brands rely heavily on efficient partnerships with manufacturers to maintain responsiveness and cost control while upholding quality and delivery standards (Bhardwaj & Fairhurst, 2010). As the fashion calendar shrinks, the role of strategic collaboration with manufacturers becomes increasingly central to a brand’s market agility and growth.

Strategic partnerships and brand acquisitions are rooted in theories of resource dependency and relational exchange, where firms align to gain mutual benefits such as market expansion, technology access, and production capacity (Dyer & Singh, 1998). In the context of apparel manufacturing, these alliances allow brands to outsource non-core operations while focusing on innovation and marketing. Trust, transparency, and open communication are identified as core drivers of successful partnerships, particularly when navigating uncertain environments such as the post-pandemic global market (Anderson & Narus, 1990). Manufacturers that position themselves as reliable, communicative, and agile partners tend to attract stronger brand interest and investment.

The success of brand-manufacturer relationships hinges on several critical factors, including pricing efficiency, lead time adherence, and consistent product quality. While price competitiveness continues to influence sourcing decisions, modern partnerships increasingly value ethical sourcing, environmental sustainability, and compliance with social responsibility standards (Taplin, 2014). Production capacity, the ability to scale up rapidly, and lead-time flexibility are vital to meeting fast fashion’s operational demands. Furthermore, advancements in machinery, automation, and quality assurance systems enhance a manufacturer’s appeal to brand partners seeking consistency and innovation (Frazier, 1983).

Despite their benefits, these partnerships face challenges such as fragmented supply chains, frequent design changes, and rising input costs. Globalization has widened sourcing networks but also introduced risks related to geopolitical instability, raw material shortages, and logistical disruptions (Gereffi, 1999). Communication gaps, especially in cross-border partnerships, can result in errors and inefficiencies (Dyer & Singh, 1998). Moreover, differing organizational cultures and expectations often impede smooth collaboration, making it necessary for brands to invest in relationship management and training systems.

To enhance brand-manufacturer synergy, companies are increasingly turning to digitalization and integrated production platforms. Real-time data sharing, predictive analytics, and collaborative software tools improve forecasting, minimize wastage, and streamline decision-making (Brynjolfsson & McAfee, 2014). Implementing vendor scorecards, key performance indicators (KPIs), and long-term relationship models can lead to sustained improvements in quality, delivery, and cost control (Christopher, 2016). Brands such as Zara have demonstrated the efficacy of vertically integrated systems and close supplier alignment in achieving superior market responsiveness (Caro & Gallien, 2010).

Research Methodology

This study uses a mixed-methods approach, including questionnaires with sample size 50 industry professionals in sourcing, merchandising, and management. The research aims to identify best practices and challenges in brand-manufacturer relationships, utilizing real-time data and industry reports. The findings will help garment manufacturers strengthen partnerships with fashion brands in the competitive fast fashion market.

Data Analysis and Interpretation

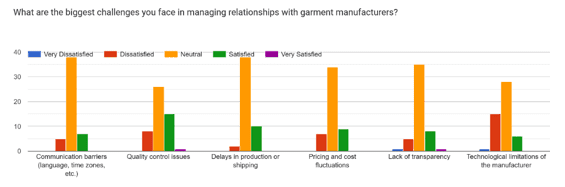

The bar chart reveals that Delays in production or shipping, pricing and cost fluctuations, and lack of transparency are the most significant challenges faced in managing relationships with garment manufacturers, as indicated by the higher number of neutral and dissatisfied responses compared to other factors. While communication barriers and technological limitations also present concerns, they appear less critical than the issues related to timelines, costs, and openness. Quality control issues show a more positive sentiment overall.

Based on the responses, the most crucial certifications for ethical sourcing and sustainability demanded from garment manufacturers are OEKO-TEX Standard 100 and SA8000 (Social Accountability 8000), indicating a strong focus on textile safety and social responsibility. The Global Organic Textile Standard (GOTS)is also a significant requirement for over half of the respondents. While Fair Trade Certification is considered by a notable portion, Bluesign® and the Higg Index are less frequently mandated by this group.

The data reveals that referrals are the most effective way for respondents to discover new garment manufacturers, with trade shows and online platforms also being highly valued. Industry publications are generally seen as a neutral resource, while direct outreach from manufacturers is considered the least effective method among those listed.

Pearson’s Correlations-1

H0: There is no significant relation between Primary sales locations and Brand’s consideration Technological Capabilities

H1: There is significant relation between Primary sales locations and Brand’s consideration Technological Capabilities

The analysis reveals a statistically significant, moderate positive correlation (r = 0.408, p = 0.003) between the primary sales locations of brands and their Brand’s consideration Technological Capabilities when selecting manufacturers. This suggests that brands with certain primary sales locations tend to place greater emphasis on product quality.

Pearson’s Correlations-2

H0: There is no significant relation between Primary sales locations and Brand’s consideration [Quality of Products]

H1: There is significant relation between Primary sales locations and Brand’s consideration [Quality of Products]

The Pearson correlation analysis revealed a statistically significant, moderate positive correlation (r = 0.408, p = 0.003) between the primary sales locations of brands and the level of consideration they give to the quality of products offered by garment manufacturers. This finding suggests that brands with certain primary sales location profiles tend to place a greater emphasis on the quality of the manufactured garments when making sourcing decisions.

Pearson’s Correlations-3

H0: There is no significant relation between Price Point and Referrals

H1: There is significant relation between Price Point and Referrals

The correlation analysis demonstrates a statistically significant, moderate positive relationship (r = 0.361, p = 0.01) between the price point of garment manufacturers and the number of referrals they receive. This finding suggests that manufacturers with higher price points tend to be referred more often by brands, potentially due to factors associated with higher pricing such as superior quality, reliability, or service.

Pearson’s Correlations from the below chart

The correlation analysis reveals significant relationships between a manufacturer’s price point and various factors influencing brand decisions. Notably, higher price points show a statistically significant positive correlation with brand consideration for production capacity (r = 0.274, p = 0.027), quality of products (r = 0.237, p = 0.049), flexibility in minimum order quantity (MOQ) (r = 0.315, p = 0.013), communication (r = 0.371, p = 0.004), reliability (r = 0.353, p = 0.006), and technological capabilities (r = 0.267, p = 0.03). This suggests that brands tend to place greater importance on these factors when working with manufacturers that have higher price points.

Findings

Primary sales locations are most frequently categorized as “2”. Distribution channels show distinct patterns, with E-commerce (Own Website) primarily categorized as “4,” E-commerce (Third-Party Platforms) as “3,” and Physical Stores (Own and Wholesale) as “1”. Brand’s consideration factors vary, with Price Competitiveness mostly rated “3” and “4,” Production Capacity, Quality of Products, Lead Time Adherence, Flexibility (MOQ), Communication, and Reliability generally rated “4” and “5,” and Technological Capabilities mostly rated “3”. Significant correlations are observed, including a positive correlation between Price Point and Referrals (r = 0.361, p = 0.01), Primary Sales Locations and Brand’s consideration for Quality of Products (r = 0.408, p = 0.003), Primary Sales Locations and Brand’s consideration for Technological Capabilities (r = 0.252, p = 0.039), and Price Point and various Brand’s consideration factors.

Suggestions

Garment manufacturers need to adapt to the changing landscape of fashion distribution by tailoring their production and logistics to the specific requirements of different channels (e-commerce, physical stores, wholesale). They should also prioritize enhancing capabilities that brands value, such as quality, lead time, and communication, while improving in areas like price competitiveness and technology.

To gain more brand clients and create strong partnerships, manufacturers should recognize how pricing affects brand perception and referrals. It’s also important to understand the unique needs of brands in different sales locations, especially regarding quality and technology. Ultimately, success depends on offering a combination of competitive pricing and strong operational abilities.

Conclusion

Strategic brand acquisition in garment manufacturing relies on strong operational capabilities, quality, and clear communication. Manufacturers like Paarth Clothing Pvt. Ltd. can attract and retain fast fashion brands by aligning with their expectations, offering flexibility, and investing in technology. Building trust and adapting to market needs are key to long-term partnerships and sustainable growth. The study reveals that garment manufacturers must adapt to the evolving distribution landscape by tailoring production and logistics to specific channels, such as e-commerce and physical stores. To succeed, manufacturers should prioritize enhancing capabilities valued by brands, including quality, lead time, and communication, while improving price competitiveness and technological capabilities. Understanding the impact of pricing on brand perception and referrals is crucial for building strong partnerships with brands. By offering a combination of competitive pricing and strong operational abilities, manufacturers can gain more brand clients and thrive in the competitive garment industry.

References

Anderson, J. C., & Narus, J. A. (1990). A Model of Distributor Firm and Manufacturer Firm Working Partnerships. Journal of Marketing, 54(1), 42–58.

Bhardwaj, V., & Fairhurst, A. (2010). Fast fashion: response to changes in the fashion industry. The International Review of Retail, Distribution and Consumer Research, 20(1), 165–173.

Brynjolfsson, E., & McAfee, A. (2014). The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W. W. Norton & Company.

Caro, F., & Gallien, J. (2010). Inventory management of a fast-fashion retail network. Operations Research, 58(2), 257–273.

Christopher, M. (2016). Logistics & Supply Chain Management. Pearson UK.

Dyer, J. H., & Singh, H. (1998). The Relational View: Cooperative Strategy and Sources of Interorganizational Competitive Advantage. Academy of Management Review, 23(4), 660–679.

Frazier, G. L. (1983). Interorganizational exchange behavior in marketing channels: a broadened perspective. Journal of Marketing, 47(4), 68–78.

Gereffi, G. (1999). International trade and industrial upgrading in the apparel commodity chain. Journal of International Economics, 48(1), 37–70.

Taplin, I. M. (2014). Global Commodity Chains and Fast Fashion: How the Apparel Industry Continues to Re-Invent Itself. Competition & Change, 18(3), 246–264.

Tokatli, N. (2008). Global sourcing: insights from the global clothing industry—the case of Zara, a fast fashion retailer. Journal of Economic Geography, 8(1), 21–38.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.