Our Terms & Conditions | Our Privacy Policy

Is M&A Activity Poised for a Comeback?

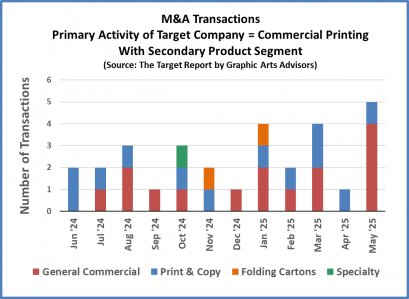

The pace of merger and acquisition activity in the commercial printing segment picked up in May 2025, prompting a timely question: Is the commercial print deal market poised for an accelerated pace as we head into the second half of 2025?

When the first Target Report Annual Review was published in 2019, there were 40 transactions in which the target company was primarily characterized as a commercial printing company. That number fell dramatically to just 27 in 2020 and remained relatively stable at 29 and 26 commercial-print transactions in 2021 and 2022, respectively. As the highly disruptive post-COVID period began to fade in late 2022, M&A transactions in the commercial print sector picked up, reaching 33 in 2023 and 34 in 2024. The recent uptick may very well be the harbinger of a new wave of consolidation in the commercial printing business, as stronger companies rationalize markets with overcapacity.

Commercial Print Deal Volume Notches Upward

Click to enlarge.

Among the most noteworthy transactions in the past year, Drummond, based in Jacksonville, Florida, and one of the more prominent practitioners of the regional roll-up strategy, executed a double-header in the Atlanta metro market. The company announced the acquisition of Tucker Castleberry Printing, a long-established commercial printer in Atlanta proper, and New London Communications, located just north in Alpharetta, Georgia. This move reinforces Drummond’s sustained growth strategy across the Southeastern US and adds to its presence in its key secondary metro market. (See The Target Report: Commercial Printing: Consolidation or Regional Expansion? – November 2019.)

While Drummond has not publicly disclosed any tuck-in or integration plans, the proximity and overlapping capabilities of these two companies suggest consolidation could be on the horizon. Either way, the deal signals confidence in the commercial print market, at least for those with scale, specialization, or regional dominance. It is also indicative of sellers deciding that the time has come to bow to the pressure to consolidate.

Drummond’s twin acquisition was not an isolated event. In total, five transactions in the general commercial printing segment were recorded in May, the highest monthly count in recent years. A review of the trailing twelve-month deal activity shows that while growth in the number of deals has been modest, it is on an upward trend, suggesting renewed confidence in the segment. At the very least, there is a resurgence of interest from owners willing to sell, and there are buyers willing and able to step up and acquire commercial printing companies.

Packaging as a Growth Avenue: Folding Carton Focus

Another trend with traction in commercial printing is the strategic move into folding carton production. While packaging is a distinct market with different customer expectations, regulatory requirements, and production workflows, it shares several core competencies with commercial printing. This is especially true when it comes to offset press operations that either have or upgrade to presses capable of handling thicker paperboard substrates.

This trend is not theoretical. Oliver Printing, formerly headquartered in the Cleveland area, offers one of the best case studies in this transformation from commercial printing to folding carton manufacturing. The company successfully reinvented itself over the past decade, transitioning from its five-generation history as a commercial printer to its current position as primarily a folding carton producer. This strategy led to successive private equity acquisitions and its evolution into a multi-location packaging operation. (See The Target Report: The Box is Back – January 2023.)

In the past year, Digital Color Concepts, based in Mountainside, New Jersey, with financial backing by private equity fund Sherburne Partners, acquired Tiger Press in Massachusetts. Tiger Press, formerly purely a commercial printing company, had entered the folding carton business in recent years. Another recent transaction that follows this pattern was RoyerComm’s merger with Prism Color in Pennsauken, New Jersey. In both cases, folding carton capabilities were cited explicitly as a key driver in the acquisition rationale.

These examples illustrate how forward-thinking commercial printers are not merely responding to the decline in traditional print volumes. Some are actively repositioning themselves toward growth segments, developing expertise in folding cartons, and in the process, enhancing their appeal as acquisition candidates. Others are using M&A to acquire those companies, to efficiently and effectively bring folding carton capabilities into their product mix.

Unique Product Specialization

Another notable transaction highlighted in the above chart, due to the target company having a significant secondary product, is Mittera’s acquisition of Rex3, a Florida-based commercial printer also known for its niche specialty: printing trading cards. With collectibles experiencing a post-pandemic revival, driven by gaming culture and online marketplaces, trading cards have emerged as a bright spot in the specialty print sector. Mittera cited Rex3’s capabilities in this high-value category as an important factor in its decision to complete the acquisition. The acquisition underscores a consistent theme in today’s market: differentiation and specialization are key drivers of value in commercial print mergers and acquisitions.

The Franchise-Driven Print & Copy Segment

This upward trend in transaction volume deserves closer inspection. Not all commercial print deals are created equal. When we filter out a separate subset of transactions, those classified as being in the print & copy segment, i.e., those typically involving small storefront operations, a more nuanced picture emerges. The deals involving these smaller companies represent 12 of the 30 transactions we identified as being in the commercial segment.

These print & copy companies are smaller shops, often located in retail corridors or downtown shopping districts, and usually maintain a street-level presence designed to attract local walk-in business. A notable share of these transactions involves franchise conversions, often facilitated with the support or involvement of the master franchisor. In two of the past twelve months, June ’24 and April ’25, the only commercial printing companies that traded were those with franchise operations as buyers.

In some cases, the buyer is a first-time entrant into the printing business, seeking the training, brand recognition, and operating systems of an established franchise network. In other cases, the buyer is an existing franchisee looking to expand within their designated territory. These franchise buyers may fold the acquired location into an existing franchise location, or alternatively, retain the operation in the acquired location, thereby increasing the number of storefronts under their control.

Beneath the Surface: Stability or Stagnation?

At face value, these numbers, while increasing, still suggest relative calm in the general commercial market. However, conversations with owners tell a more cautious tale. We are seeing an increase in exploratory outreach from commercial printing company owners who are neither thriving nor in financial distress. Many are simply treading water, breaking even, and have begun to consider succession plans, or are actively looking for a way to exit the business gracefully.

In many cases, these companies were already under pressure before the pandemic and were kept afloat thanks to government stimulus programs. The Paycheck Protection Program (PPP) and Employee Retention Credit (ERC) injected life-saving liquidity into otherwise marginal operations. However, for many, the money has now been spent, with some of it covering losses and some used for equipment refurbishment. Without substantive structural change, the pre-pandemic financial pressures have re-emerged.

The steady secular decline in general commercial printing, marked by shrinking demand, rising input costs, and the persistent pricing pressure, has resumed its long-term trajectory. The brief surge in demand that followed the pandemic is fading, and competitive pressure has returned to the market. Print buyers are once again exerting downward pricing pressure. The optimism of 2022–2023 is giving way to a more sober view of the road ahead. For many, 2019 was the benchmark year considered to be the normal economic condition that would return as the impact of the pandemic receded into history. Instead, demand has swung wildly in response to the lockdown and its aftermath, supply constraints supported price increases, excessive inventory was laid on and subsequently had to be worked off. And now, in 2025, owners face the oscillating threat of extreme tariffs. Company owners appear to be adjusting to the reality that constant change is the new normal, and there may not be a better time to plan an exit.

Looking Forward: A Steady Stream of M&A to Come?

Although it may be too soon to draw firm conclusions, the current trend in M&A transactions within the commercial printing segment appears to be upward. When viewed alongside an increase in confidential owner inquiries, the data suggests that further consolidation is on deck for the commercial printing segment. While May’s activity may not represent a breakout moment, it may very well be a bellwether.

Click to enlarge.

Click to enlarge.

Click to enlarge.

View The Target Report online, complete with deal logs and source links for May 2025

For more information on Graphic Arts Advisors, visit graphicartsadvisors.com

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.