Our Terms & Conditions | Our Privacy Policy

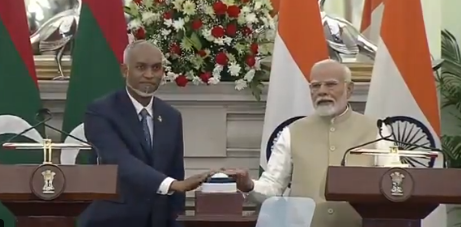

India ‘satisfied’ with $400 million currency swap that boosted Maldives’ Forex reserves

Male: India Saturday noted with satisfaction that the $400 million currency swap between Male and New Delhi helped boost Maldives’ foreign exchange (FX) reserves.

The comments by the Indian High Commission in Maldives came after global credit rating agency Fitch on Thursday affirmed the archipelagic country’s sovereign rating at ‘CC’, among other reasons due to increased Forex reserve.

The Indian High Commission in Maldives, in a post on X, said it noted with satisfaction that the FX reserves increase in the island nation was driven by the $400 million drawdown under a currency swap between the Reserve Bank of India (RBI) and the Maldives Monetary Authority (MMA) in October 2024.

“The currency swap alleviated imminent external liquidity strains as noted by Fitch credit rating for Maldives, it added.

Credit rating agency Fitch noted that the country’s FX reserves have increased due to solid tourism-related receipts, the newly-implemented Foreign Currency Act, which mandates tourism-related businesses to exchange either 20 per cent of monthly foreign-currency receipts, and the support from the RBI, alleviating imminent external liquidity strains, Sun Online news portal reported.

The rating agency said that while the tourism sector continues to expand and gross FX reserves have increased following support from the RBI, persistent external and fiscal vulnerabilities will complicate refinancing of Maldives’ impending large external debt-servicing obligations in the year ahead.

The agency projects the Maldives’ fiscal deficit will widen to 14.5 per cent of GDP in 2025, up from 14 per cent in 2024 on high recurrent spending, mainly due to expectations of rising public wages and continued delays in the planned fiscal reforms of subsidies and healthcare spending largely due to political considerations the report said.

PTI

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.