Our Terms & Conditions | Our Privacy Policy

Michael Saylor’s Strategy Halts Bitcoin Buys, MSTR Stock Up 2%

Strategy, previously known as MicroStrategy, has revealed that it didn’t buy any Bitcoin last week. This development comes ahead of the company’s earnings report later this week. Meanwhile, the MSTR stock is up from its closing price last week.

Strategy Didn’t Buy Bitcoin Last Week

A Form 8-K filing with the SEC indicates that the company didn’t purchase Bitcoin last week, following two consecutive weekly purchases. As a result, it still holds 607,770 BTC, which it acquired for $43.61 billion at an average price of $71,756 per bitcoin.

This development comes just a day after Michael Saylor had hinted at another Bitcoin purchase. In his usual fashion, the company’s Executive Chairman had posted their BTC portfolio tracker, with the caption, “It all began with a quarter billion in bitcoin.”

It all began with a quarter billion in bitcoin. pic.twitter.com/Ssbef084YQ

— Michael Saylor (@saylor) July 27, 2025

However, this has turned out not to be a hint at a purchase, but simply a reference to Strategy’s first purchase of 21,454 BTC for $250 million, at an average price of around $11,654. Since then, Saylor and his company have continued to actively accumulate more BTC for their treasury, even during the bear markets.

The company is still expected to purchase more Bitcoin in the coming weeks, having announced plans to raise almost $2.5 billion through its Stretch preferred stock offering. According to the announcement, it will issue and complete the sale of these shares by July 29, just before the earnings report on July 31.

As CoinGape earlier reported, the company already announced a $14 billion unrealized gain on its Bitcoin investment in the second quarter. This occurred thanks to the Bitcoin price rally in May, when it hit a previous all-time high (ATH) of $111,900.

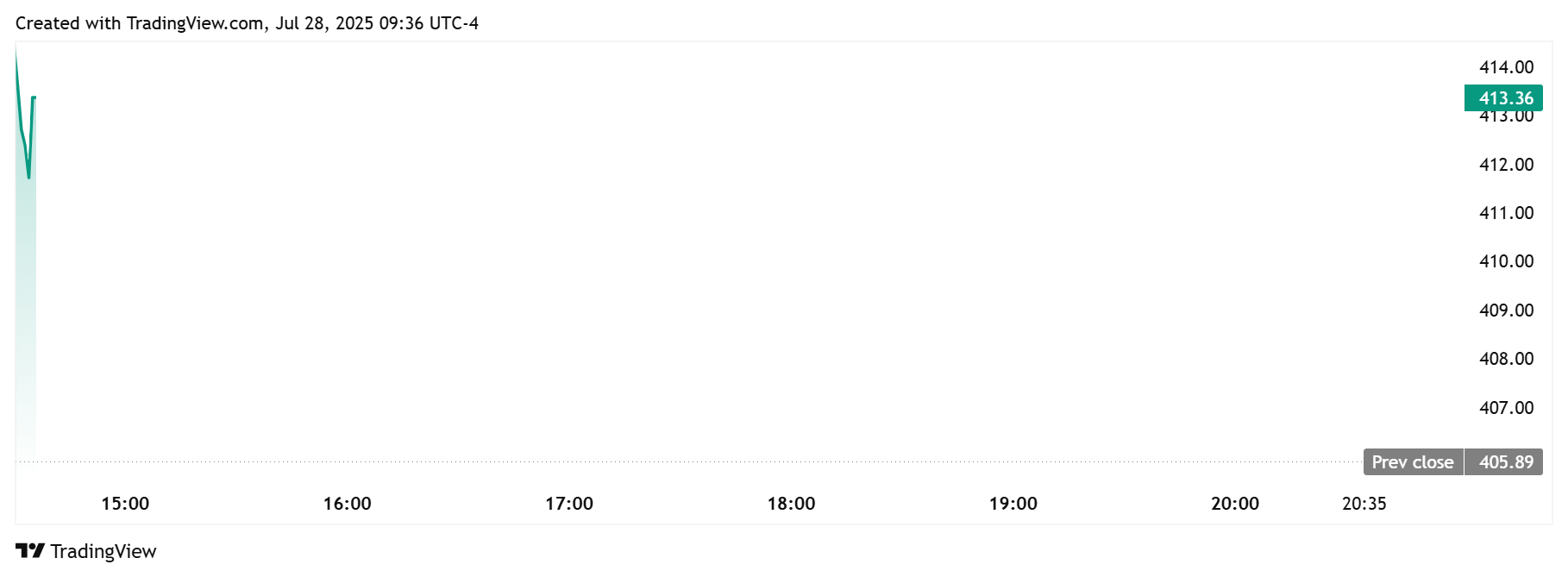

Meanwhile, despite not announcing any Bitcoin purchases, MicroStrategy stock has rebounded from its closing price of $405 last week. TradingView data shows that the MSTR stock is up almost 2%, trading at around $413.

Source: TradingView

Source: TradingView

How The Company Is Changing The IPO Game With BTC

In an X post, Strategy highlighted how it is driving the “digital transformation of IPOs” with Bitcoin. The company revealed that it has raised $4.8 billion through BTC-backed IPOs in 2025.

Source: Strategy’s X

Source: Strategy’s X

Specifically, the company raised $584 million through its first Bitcoin-backed security, STRK, back in January this year. It then raised $723 million through the STRF offering in March.

Furthermore, Strategy raised $1 billion through its STRD offering in June. Now, the company is about to raise $2.5 billion through its Stretch (STRC) preferred stock offering.

✓ Share:

![]()

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several niches. His speed and alacrity in covering breaking updates are second to none. He has a knack for simplifying the most technical concepts and making them easy for crypto newbies to understand.

Boluwatife is also a lawyer, who holds a law degree from the University of Ibadan. He also holds a certification in Digital Marketing.

Away from writing, he is an avid basketball lover, a traveler, and a part-time degen.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our Editorial Policy, our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes and media correctly. We also follow a rigorous Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.