Our Terms & Conditions | Our Privacy Policy

Just 4 out of 38 private insurance cos have 74% FDI: Govt to LS

Finance Minister Nirmala Sitharaman during a debate in the Lok Sabha in New Delhi, on Monday

| Photo Credit:

–

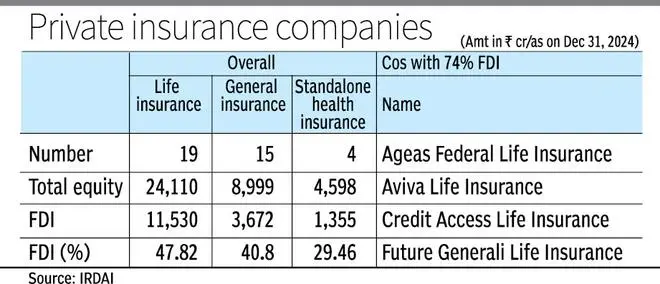

While Bill to increase foreign direct investment (FDI) limit in insurance sector is due in the ongoing Parliament session, the government informed the Lok Sabha on Monday that just four private sector insurance companies have achieved the current limit of 74 per cent.

A written response from Finance Minister Nirmala Sitharaman showed only four insurance companies — Ageas Federal Life Insurance, Aviva Life Insurance, Credit Access Life Insurance and Future Generali Life Insurance — have 74 per cent of FDI. Not a single general insurance or standalone health insurance company has exhausted the entire FDI limit

“Section 2(7A) (b) of Insurance Act, 1938, prescribes the upper limit of FDI in an insurance company. The decision to increase FDI component in a particular insurance company is made by its promoters, depending upon various factors such as capital requirement of the company, solvency requirement, future business plans etc,” Sitharaman said.

Key reason

Giving the rationale behind proposal to raise the FDI limit, she said that with the hike in FDI limit, the government aims to unlock the full potential of the Indian insurance sector, which is projected to grow at 7.1 per cent annually over the next five years, outpacing global and emerging market growth. This is an enabling provision which will help the interested insurers to explore hiking the FDI percentage.

“This will eliminate the need for foreign investors to find Indian partners for the remaining 26 per cent, easing the process of setting up their operations in India, effectively increasing the number of insurers in the country, she said. Removing the FDI cap will attract stable and sustained foreign investment, increase competition, facilitate technology transfer, and improve insurance penetration in the country, she added.

Published on July 28, 2025

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.