Our Terms & Conditions | Our Privacy Policy

From underwater dinners to Vogue internships: Top experiences ultra HNIs are spending on today

For India’s ultra-rich, luxury isn’t about the brand tag—it is about access. Access to moments suspended in time, to rooms where legacy is shaped, and to experiences that can’t be found just anywhere on the internet.

Kotak Private Bank’s (a division of Kotak Mahindra Bank) report ‘Top of The Pyramid 2025’ gives us a behind-the-scenes look at how India’s 2.83 lakh Ultra-High Net-Worth Individuals (UHNIs) — with a collective wealth of around Rs 232 trillion—spend their money not just on investments or houses, but on curated travel, legacy-building experiences, alternative wellness, and collectables that whisper cultural pride.

Several luxury lifestyle management firms, such as RedBeryl, Pinch, Quintessentially, and CribLife, work around the clock to bring a wide range of fantasies and dreams to life. From securing an internship at Vogue through discreet fashionworld connections to delivering 30 Lego City boxes from the United Kingdom (UK) to light up a child’s birthday, India’s concierge industry is quietly powering the dreams and demands of its most affluent. Luxury has evolved beyond ownership to experience.

From ownership to experience

Kotak’s report highlights that 18% of India’s ultra-rich prefer to reinvest their wealth in their businesses, 13% prefer to allocate their wealth to household expenses, 10% prioritise health and wellness, 8% spend on their children’s education, and 7% utilise their wealth for exotic foreign travel. “UHNIs are no longer buying luxury to belong; they are spending it to experience and evolve,” says Vodhi Chakravartty, Head of Strategy, Kotak Private Banking.

A Lamborghini or a Louis Vuitton trunk won’t do. “At this level, it’s all about opening doors to the kinds of opportunities that quietly shape a legacy,” says Vijaya Eastwood, founder of CribLife, a homegrown concierge and private family office firm. RedBeryl, a concierge firm, recounts organising a private dinner by the pyramids, complete with curated lighting under the stars. Another client proposed via a surprise flash mob at Times Square, ending in a custom light display. “Our members don’t just want luxury, they want to live the story,” says Manoj Adlakha, founder and CEO, RedBeryl.

If you have the money, surely a Hermes Birkin bag would be easy to get? Not quite, actually. “No vendor had it in stock,” Adlakha recalls. “Our team visited highend boutiques and private collectors across countries, inspected each piece for authenticity, and finally handed over what was a collector’s dream come true.” Elsewhere, Quintessentially, another concierge firm, arranged a limited-edition Audemars Piguet watch as part of a Tuscan birthday celebration— packaged alongside a private wine tasting inside a preserved castle.

There are three primary areas where the ultra-rich tend to allocate their wealth, as per Kotak Bank’s report: wellness, education and experiential travel.

Note:“Today’s UHNIs want depth, meaning, and access that can’t be googled.”

VIJAYA EASTWOOD, FOUNDER OF CRIBLIFE

The pillars

Wellness: Health & wellness have become an essential expense for over 90% of UHNIs, according to Kotak Bank’s report. And concierge services echo that. RedBeryl observes a surge in retreats across Vizag and Bali, where clients seek “spaces to realign and feel truly alive.” CribLife adds that demand for

hyper-personalised longevity therapies and spiritual sabbaticals is soaring.

Pinch, a concierge firm, reports that patrons are now blending luxury with restoration: “From drum circles in Bengaluru to silent walks with monks, wellness today isn’t performative, it’s personal,” says Nitin Mohan Srivastava, founder and CEO, Pinch. “True luxury today is the ability to live without micro-stress. To be present without planning,” Srivastava says. For one client with phototoxicity, Pinch coordinated a complex relocation from Bangkok to the Netherlands, managing lighting logistics at airports, express immigration, cold packs, and even a last-minute hotel switch—all to ensure the client remained safe and calm.

Education for legacy-building: The report states that 83% of UHNIs are now spending more on education. However, it’s not just about the university the child attends. It’s about legacy-building. CribLife recounts helping a client land their daughter an internship at Vogue’s New York office through insider connections. Another client’s son was placed in a shadow mentorship at Meta in Silicon Valley, arranged via ex-founders and tech investors. UHNIs are looking to their lifestyle advisers for not just bookings, but for strategic guidance and outcomes that shape their personal and professional legacy, Eastwood highlights.

Travel as transformation: Nearly 60% of entrepreneurs surveyed by Kotak say that travel is essential to them. But they seek something more immersive. “The ask now is for a moment that cannot be Googled,” says Mishti Bose, Group CEO of Quintessentially. How about an underwater dinner with sharks? Or put together a flash mob to dance to your girlfriend’s favourite number in the middle of Times Square, where you can get down on your knees and surprise her with a ring. “Young wealth creators are more global in mindset,” adds Chakravartty. “They are spending on life coaches, spa getaways, and personal development services,” he adds.

Where the money flows

According to Chakravartty, allocation to alternative assets has nearly doubled over the past decade, from 5% to 10% to 18% of UHNI portfolios today. These include direct investments in startups, private equity, venture capital, NFTs, and passion purchases such as art, watches, and vintage cars. “UHNIs are merging investment logic with personal passions,” notes the Kotak report.

Nearly 94% of UHNIs spend on jewellery and 73% on art, according to Kotak Bank’s report. From heirloom pieces to blue-chip Indian masters, these emotionally driven buys are rare, valuable assets often passed down generations. In 2023, Amrita Sher-Gil’s painting The Storyteller sold for a record. Rs.61.8 crore, among the most expensive Indian artworks ever.

According to the report, 29% of UHNIs invest abroad, and a majority plan to increase their global exposure over the next 3-5 years. Popular destinations include the US, UK, Switzerland, and Portugal— not just for wealth growth, but also for lifestyle, education, and future migration options.

The Reserve Bank of India’s Liberalised Remittance Scheme (LRS) allows up to US$250,000 per person annually for foreign spending, translating to approximately US$1 million for a family of four. This gives Indian UHNIs considerable muscle to invest or spend globally without regulatory friction. “The Indian UHNI wants the freedom of choice, where to live, learn, heal, and grow,” says Eastwood.

Global outlook

The rich aren’t just globe-trotting; they are also passport-shopping. More than one in five UHNIs is actively pursuing foreign residency or citizenship, often tied to real estate investments. Concierge services say they are being asked to source heritage homes in the South of France, ranches in New Zealand, or help with golden visa processes in Portugal. “There is an increased global diversification into luxury real estate abroad, exclusive investment opportunities, and even AI-driven ventures,” says Chakravartty. CribLife recently helped a client relocate their base to Dubai and secure admission for their children in a London boarding school, all while facilitating property viewings in Knightsbridge, within the same week.

Philanthropy reimagined

According to the India Philanthropy Report 2025 by Bain and Company and Dasra, private spending by Indian philanthropists rose by 7% in FY24, reaching Rs.1.31 lakh crore, and is projected to grow by 10-12% annually in the coming years—primarily driven by family philanthropy.

“We are seeing families hire philanthropy professionals to manage their charitable giving, evaluate impact, and plan long-term initiatives,” Chakravartty says. Wealthy families—especially the next generation—are backing niche causes, such as gender equity and LGBTQ+ inclusion, climate action and conservation, and reviving Indian arts, heritage, and textiles. “Today’s UHNIs want to feel like catalysts—not just donors,” notes Eastwood.

The new definition of wealth

“The question is no longer how much can I spend, but how unforgettable can I make it?” says Adlakha . This shift from accumulation to experience, and access, signals a fundamental change in how India’s wealthiest view their fortunes. As they invest in wellness, craft legacies through education, and seek transformation through travel, they are not just spending money—they are redefining what it means to live a rich life.

Residing beyond Indian borders

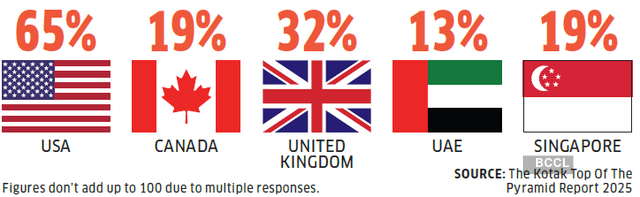

Indian UHNIs are looking for alternatives to India. 69% consider ‘smoothening of business operations’ as a key driver. Where do they migrate?

Alternative assets on UHNI radar

Indian UHNIs are keen to increase their exposure to alternative assets. Among them, following are the preferences, as surveyed.

Wildest UHNI requests

- Private catch-up with Lionel Messi in Mumbai

- Flash mob proposal in Times Square

- Sourcing a 1965 Ford Mustang from a royal collection

- Met Gala invitations and VIP Wimbledon seats

- Getting a star named after a loved one

- Securing Patek Philippe Grand Complications ref. 6300G

SOURCE: CONCIERGE SERVICES

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.