Our Terms & Conditions | Our Privacy Policy

Metaplanet Bitcoin Buying Frenzy Continues as BTC Price Eyes New ATH in October

Japanese public-listed firm Metaplanet, popularly known as Asia’s MicroStrategy has continued with its Bitcoin buying streak. Earlier today, the company announced the purchase of another 108 Bitcoins worth 1 billion Japanese yen, thereby taking its total holdings to more than 639 BTC. The purchase comes at a time when the BTC price has given strong bounce back from its $60,000 bottom last week with analysts eyeing from new all-time highs this month.

MetaPlanet Bitcoin Buying Spree Continues

Japan’s public-listed firm Metaplanet, also popular as Asia’s MicroStrategy has continued with its Bitcoin buying spree. Earlier on Monday, October 7, the firm announced buying an additional 108.78 BTC to its kitty. With the company’s consistent purchasing of BTC since May 2024, its total investment in the asset class has surged to 6 billion Japanese Yen.

Last week, Metaplanet added Bitcoins worth $1.4 through options trading for the asset class. The company successfully sold 223 fully USD-collateralized contracts of $62,000 put options set to expire on December 27, 2024. Through this transaction, it generated 23.97 BTC in option premiums, which will be recognized as revenue.

As of press time, the Metaplanet stock price is up 14% trading around 1045 levels. The stock has been trading at the same levels over the past month with its year-to-date gains at 544%. However, it’s still trading at a 66% discount from its all-time high in May.

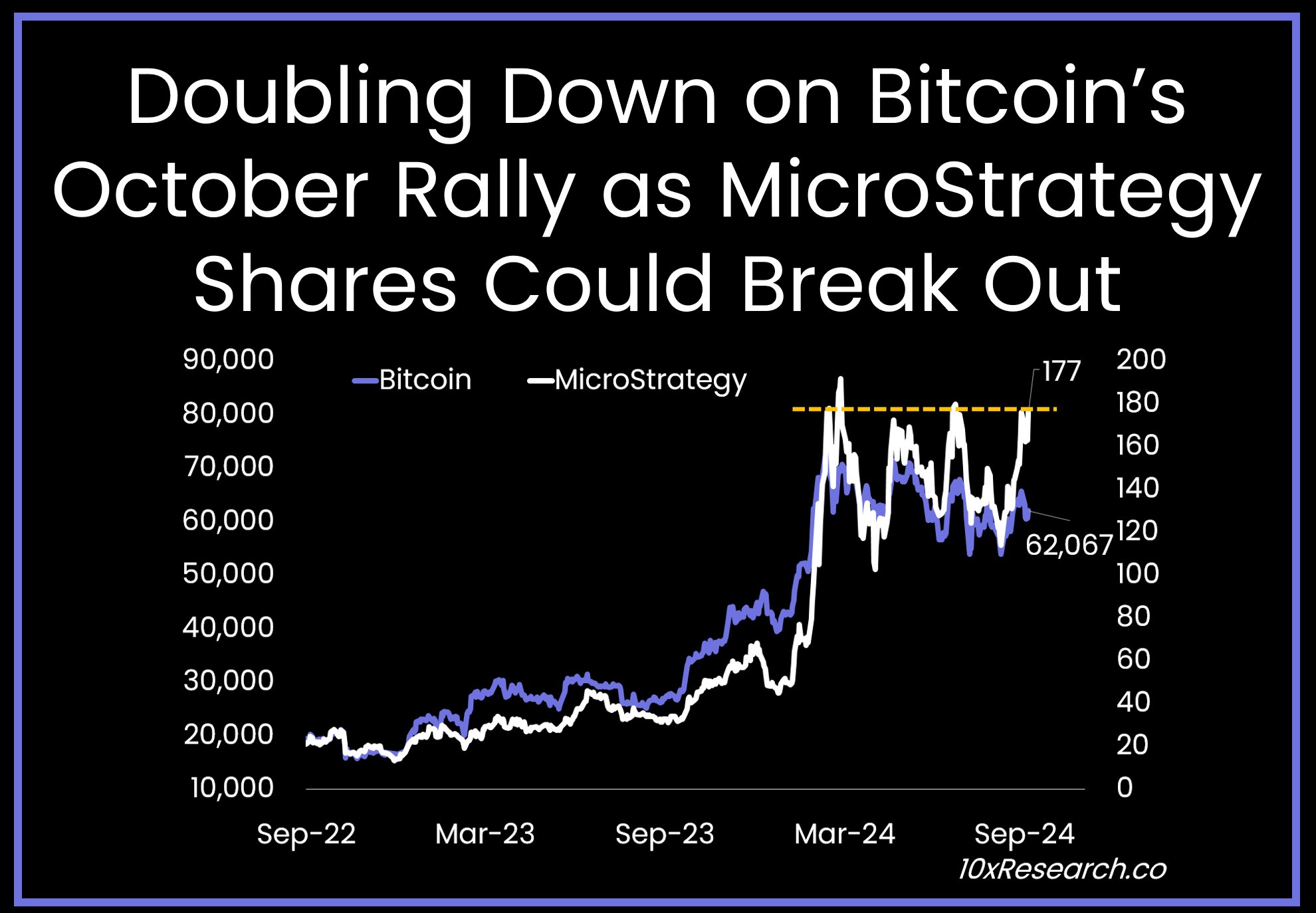

On the other hand, MicroStrategy (NASDAQ: MSTR) shares have been on a staggering rally this year shooting up 8% last Friday, following strong US jobs data. The MSTR stock is already up 41% over the last month, and 157% since the beginning of the year. As per the latest charts, the MSTR share price is on the cusp of a major breakout which could lead to a strong surge in the Bitcoin price in the rest of the month.

Courtesy: 10x Research

Courtesy: 10x Research

BTC Eyes New All-time High in October

In the early Asian market trading session on Monday, the Bitcoin price surged over 3% all the way past $63,600 levels. After a weak opening to the month of October with a dip under $60,000, analysts are predicting a strong rally ahead. Apart from Metaplanet, there are other factors to trigger the BTC rally in October.

Historical data shows that following the bottom in October, Bitcoin usually surged 31.72% in the same month. Last week on October 3, the BTC price hit a bottom of $59,800 before recovering from there. Thus, if we consider 32% gains from here, the BTC price can rally all the way to $77.7K by the end of the month. In its latest research report, 10x Research noted:

“October is filled with critical catalysts that could sustain the upward momentum. Geopolitical factors are unlikely to disrupt this bullish trend; they may present intriguing opportunities for savvy traders looking to capitalize on the market’s volatility”.

BTC typically bottoms 3-4 days into October

From the bottom to the end of October, BTC is up 32% (36% if you exclude Octobers that have a negative return)

We tagged 59.8K on Oct 3 after a sell off

If we return 30% on 59.8K, we will end the month at 77.7K pic.twitter.com/9Wirjz9zuG

— jay (@0xjaypeg) October 6, 2024

✓ Share:

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.