Our Terms & Conditions | Our Privacy Policy

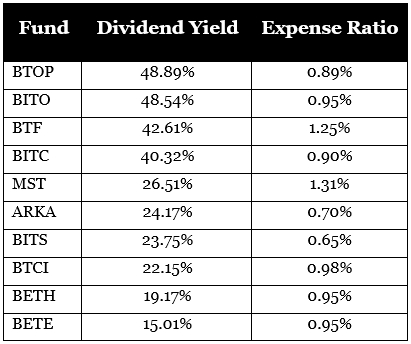

Top 10 Bitcoin Dividend ETFs: Earn Income Without Owning BTC

Looking to earn income from without the hassle of wallets, keys, or direct ownership? Dividend-paying Bitcoin ETFs offer a unique solution.

These funds combine crypto-linked exposure with the potential for regular cash distributions, thanks to futures strategies, Treasury collateral, and options overlays.

Whether you’re chasing yield, diversifying your portfolio, or simply seeking passive crypto income, there’s likely an ETF that fits your goals.

In this article, we’ll explore the top 10 Bitcoin dividend ETFs available today, highlighting their income potential, strategies, and what makes each one stand out in a rapidly evolving crypto income landscape.

Let’s dive in.

1. Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF (BTOP)

- Inception Date: September 29, 2023

- Price as of Aug. 20, 2025: $37.11

- Dividend Yield as of Aug. 20, 2025: 48.89%

- Expense Ratio as of Aug. 20, 2025: 0.89%

- Net Assets as of Aug. 20, 2025: $4.82 million

- 52‑Week Range as of Aug. 20, 2025: $23.40 – $66.82

- YTD Return as of Aug. 20, 2025: 5.97%

The Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF (NYSE:) gives you balanced exposure to Bitcoin and while managing risk with a rules-based rotation.

In strong uptrends, the fund invests equally in Bitcoin and Ether futures; when momentum turns negative, it shifts fully into U.S. Treasuries, providing stability and income potential.

This unique approach allows you to capture crypto upside while benefiting from Treasury yields during downturns.

With a striking 48.89% dividend yield, a competitive 0.89% expense ratio, and exposure to both crypto and bonds, BTOP appeals to dividend-focused investors seeking exposure to income-generating crypto.

2. ProShares Bitcoin ETF (BITO)

- Inception Date: October 18, 2021

- Price as of Aug. 20, 2025: $20.46

- Dividend Yield as of Aug. 20, 2025: 48.54%

- Expense Ratio as of Aug. 20, 2025: 0.95%

- Net Assets as of Aug. 20, 2025: $2.73 billion

- 52‑Week Range as of Aug. 20, 2025: $16.11 – $27.88

- YTD Return as of Aug. 20, 2025: 16.81%

If you want dividend exposure to Bitcoin, the ProShares Bitcoin ETF (NYSE:) offers a compelling option.

Unlike many other crypto-focused vehicles, it provides a remarkable 48.54% dividend yield, paired with a transparent 0.95% expense ratio.

Since its launch in 2021, BITO has grown into the most liquid U.S. Bitcoin futures ETF, consistently delivering monthly distributions when available.

For investors seeking both Bitcoin exposure and dividend income, the fund strikes a rare and attractive balance.

3. CoinShares Bitcoin and Ether ETF (BTF)

- Inception Date: October 21, 2021

- Price as of Aug. 20, 2025: $17.22

- Dividend Yield as of Aug. 20, 2025: 42.61%

- Expense Ratio as of Aug. 20, 2025: 1.25%

- Net Assets as of Aug. 20, 2025: $39.11 million

- 52‑Week Range as of Aug. 20, 2025: $8.53 – $26.25

- YTD Return as of Aug. 20, 2025: 18.54%

Want dividend income alongside diversified crypto exposure? The CoinShares Bitcoin and Ether ETF (NASDAQ:) is worth considering.

This actively managed fund invests in CME-traded Bitcoin and Ether futures, with collateral held in cash and Treasury bills, providing exposure to the two largest digital assets without requiring direct ownership.

With a dividend yield of 42.61% and monthly distributions when available, BTF is especially appealing for income-focused investors.

Although its 1.25% expense ratio is higher than that of some of its peers, you benefit from professional management, diversification, and straightforward 1099 tax reporting.

4. Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC)

- Inception Date: March 20, 2023

- Price as of Aug. 20, 2025: $46.68

- Dividend Yield as of Aug. 20, 2025: 40.32%

- Expense Ratio as of Aug. 20, 2025: 0.90%

- Net Assets as of Aug. 20, 2025: $22.09 million

- 52‑Week Range as of Aug. 20, 2025: $38.57 – $79.48

- YTD Return as of Aug. 20, 2025: -1.46%

The Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (NYSE:) offers a smart way to earn income while managing crypto risk.

You get 100% exposure to Bitcoin futures during uptrends, and a full rotation into U.S. Treasuries during downtrends, enabling you to capture growth when it’s there and income when it’s not.

This rules-based strategy helps sidestep major drawdowns while unlocking the yield potential of Treasuries.

With a dividend yield of 40.32%, a competitive 0.90% expense ratio, and no direct crypto custody risks, BITC is an appealing choice if you’re looking for income and Bitcoin exposure in one ETF.

5. Defiance Leveraged Long Income MSTR ETF (MST)

- Inception Date: May 01, 2025

- Price as of Aug. 20, 2025: $11.01

- Dividend Yield as of Aug. 20, 2025: 26.51%

- Expense Ratio as of Aug. 20, 2025: 1.31%

- Net Assets as of Aug. 20, 2025: $126.81 million

- 52‑Week Range as of Aug. 20, 2025: $10.78 – $24.23

- YTD Return as of Aug. 20, 2025: -47.89%

The Defiance Leveraged Long + Income MSTR ETF (NASDAQ:) offers you an aggressive yet income-generating way to tap into Bitcoin’s upside without holding crypto.

The fund provides 150–200% leveraged exposure to MicroStrategy (a major BTC-proxy stock) while layering on a credit-call-spread strategy to generate income.

The result? Weekly distributions and a 26.51% dividend yield. While the call spreads cap some upside, they help offset volatility and provide regular cash flow.

Despite higher volatility and a 1.31% expense ratio, MST’s blend of amplified exposure and regular income appeals to experienced, yield-focused crypto investors.

6. ARK 21Shares Active Bitcoin Futures Strategy ETF (ARKA)

- Inception Date: November 13, 2023

- Price as of Aug. 20, 2025: $69.63

- Dividend Yield as of Aug. 20, 2025: 24.17%

- Expense Ratio as of Aug. 20, 2025: 0.70%

- Net Assets as of Aug. 20, 2025: $12.61 million

- 52‑Week Range as of Aug. 20, 2025: $40.61 – $75.83

- YTD Return as of Aug. 20, 2025: 15.80%

The ARK 21Shares Active Bitcoin Futures Strategy ETF (NYSE:) invests in 100% CME Bitcoin futures while collateral is held in interest-earning T-bills. This setup allows ARKA to generate income distributions alongside capital appreciation.

With a competitive 0.70% expense ratio, ARKA stands out as one of the lowest-cost actively managed crypto futures ETFs.

Its 24.17% dividend yield makes it especially appealing if you’re seeking regular income alongside BTC-linked performance.

7. Global X Blockchain & Bitcoin Strategy ETF (BITS)

- Inception Date: November 15, 2021

- Price as of Aug. 20, 2025: $77.78

- Dividend Yield as of Aug. 20, 2025: 23.75%

- Expense Ratio as of Aug. 20, 2025: 0.65%

- Net Assets as of Aug. 20, 2025: $35.61 million

- 52‑Week Range as of Aug. 20, 2025: $45.63 – $106.93

- YTD Return as of Aug. 20, 2025: 16.75%

The Global X Blockchain & Bitcoin Strategy ETF (NASDAQ:) offers you a diversified, income-friendly way to participate in the crypto market.

By combining long positions in U.S.-listed Bitcoin futures with global blockchain-related equities, BITS provides exposure to both crypto price movements and equity-based growth.

This hybrid structure enhances income potential through equity dividends and interest from futures collateral, contributing to a solid 23.75% dividend yield.

With a low 0.65% expense ratio and a semi-annual distribution schedule, the fund’s balance of equity dividends and futures income provides diversification that pure Bitcoin futures funds can’t match.

8. NEOS Bitcoin High Income ETF (BTCI)

- Inception Date: October 17, 2024

- Price as of Aug. 20, 2025: $61.47

- Dividend Yield as of Aug. 20, 2025: 22.15%

- Expense Ratio as of Aug. 20, 2025: 0.98%

- Net Assets as of Aug. 20, 2025: $ 556.5 million

- 52‑Week Range as of Aug. 20, 2025: $38.20 – $65.87

- YTD Return as of Aug. 20, 2025: 26.41%

The NEOS Bitcoin High Income ETF (NYSE:) is designed for income-focused investors who want exposure to Bitcoin with reliable monthly payouts.

The fund holds Bitcoin-linked ETPs and enhances income through a systematic covered-call strategy, allowing you to capture option premiums without the complexity of trading options yourself.

With a dividend yield of 22.15%, BTCI offers one of the most attractive income streams in the crypto ETF space.

While its expense ratio is 0.98%, the potential for strong distributions and price appreciation makes it a compelling dividend play.

9. ProShares Bitcoin & Ether Market Cap Weight ETF (BETH)

- Inception Date: October 2, 2023

- Price as of Aug. 20, 2025: $84.42

- Dividend Yield as of Aug. 20, 2025: 19.17%

- Expense Ratio as of Aug. 20, 2025: 0.95%

- Net Assets as of Aug. 20, 2025: 17.87 million

- 52‑Week Range as of Aug. 20, 2025: $53.00 – $101.33

- YTD Return as of Aug. 20, 2025: 18.78%

The ProShares Bitcoin & Ether Market Cap Weight ETF (NYSE:) invests in Bitcoin and Ether futures and automatically adjusts allocations based on each asset’s market capitalization.

Its futures-backed setup also creates the potential for monthly distributions, supported by income from cash and Treasury collateral.

While the expense ratio comes in at 0.95%, the fund’s strong yields, convenient access, and long-term growth potential make it an attractive option if you’re looking for dividend-focused crypto exposure.

10. ProShares Bitcoin & Ether Equal Weight ETF (BETE)

- Inception Date: October 2, 2023

- Price as of Aug. 20, 2025: $83.83

- Dividend Yield as of Aug. 20, 2025: 15.01%

- Expense Ratio as of Aug. 20, 2025: 0.95%

- Net Assets as of Aug. 20, 2025: $11.01 million

- 52‑Week Range as of Aug. 20, 2025: $44.83 – $95.56

- YTD Return as of Aug. 20, 2025: 24.95%

The Proshares Bitcoin & Ether Equal Weight ETF (NYSE:) gives you simple, balanced exposure to both Bitcoin and Ether by investing in regulated, cash-settled futures.

It keeps a 50/50 split that’s rebalanced each month, so you’re not overly reliant on just one asset and can benefit from the growth potential of both.

With a dividend yield of 15.01%, the fund offers attractive income potential, and even with its 0.95% expense ratio, it stands out as a way to capture crypto performance while also enjoying steady payouts.

What You Need to Know Before Buying a Dividend BTC ETF

Before you invest in any of these high-yield Bitcoin ETFs, it’s important to understand what’s behind the numbers.

While each fund offers unique exposure and income potential, not all dividends are created equal, and some come with trade-offs that may not fit every investor’s goals.

Here are a few key things to keep in mind before adding a dividend-paying BTC ETF to your portfolio:

High Yields Aren’t Always What They Seem

At first glance, a sky-high dividend yield might seem like a no-brainer. After all, who wouldn’t want a fund paying out 20%, 30%, or even more?

But here’s the catch: those headline yields often reflect past payouts, not guaranteed, recurring income.

That’s why it’s crucial to dig deeper.

Don’t just look at the yield; check the fund’s distribution history, read the prospectus, and understand whether those payouts were qualified dividends, short-term gains, or simply a return of your own investment.

Knowing where the income comes from will help you set realistic expectations and avoid tax surprises down the line.

Futures-Based ETFs Don’t Track Spot Prices

Many crypto dividend ETFs, especially those linked to Bitcoin and Ether, don’t actually hold the coins. Instead, they use CME-traded futures contracts to gain price exposure.

This setup comes with a few key trade-offs. First, performance can drift from spot BTC or ETH prices, especially during big rallies or sharp drops. You’re tracking futures, not the real-time market.

On the flip side, these ETFs often hold collateral in short-term Treasuries, which earn interest. That interest can be passed along to you as income.

Bottom line? You might get solid distributions, but you’re not getting direct exposure to the coins themselves.

Options Strategies Trade Growth for Income

Some dividend ETFs use options strategies, like covered calls or call spreads, to generate income. These approaches can produce steady cash flow, which is great if you’re focused on income.

But there’s a trade-off. By selling options, the fund gives up some of its upside potential. That means your gains may be capped, especially if the underlying asset soars.

If you’re okay with slower growth in exchange for regular income, these funds might suit you. Just make sure the strategy fits your personal goals and risk tolerance.

Leverage Magnifies Both Gains and Losses

Leveraged ETFs, like MST, can amplify your returns when the market is moving in your favor. In a strong upswing, they shine. But that extra power comes with a cost.

These funds can be extremely volatile in sideways or falling markets. And because they typically rebalance daily, small fluctuations can compound and erode returns over time.

That’s why leveraged ETFs are best suited for active, experienced traders who can manage the risks.

If you’re focused on steady income and portfolio stability, these may be too aggressive for your needs. Make sure the potential reward is worth the extra risk you’re taking on.

Final Thoughts

Bitcoin dividend ETFs offer a compelling way to participate in crypto upside while collecting income, but they’re not all built the same.

Some rely on futures-backed interest, others on options premiums, and some rotate into Treasuries when volatility spikes.

High yields can be tempting, but it’s essential to understand the source, strategy, and risks behind the numbers.

Whether you value consistency, growth, or diversification, choosing the right fund comes down to aligning the ETF’s income profile with your financial goals.

Do your due diligence, stay informed, and let your dividends work as hard as your capital.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.