Our Terms & Conditions | Our Privacy Policy

Down 40%: Why is this top investor sticking with these 2 troubled stocks? – Stock Insights News

The news channels, YouTube and other outlets are full of super investors giving away knowledge and insights. Kedia, Agarwal, Kela are names all over the spectrum. But while the waves are full of these names, a few Indian women Warren Buffetts are quietly raking in the monies, picking future multibaggers.

Vanaja Sunder Iyer, an ace investor worthy of being called one of the women Warren Buffetts of India, is a very respected and highly followed investor, known for her community service and mentoring initiatives. Investors know her for her strategic picks from varied sectors like automobiles, industrial manufacturing, and real estate.

Currently she holds 12 stocks in her portfolio, with a worth of Rs 1,038 cr. And two these favourite 12 stocks are currently trading at a discount of over 40% from their all-time high prices. Are these golden cheap buying opportunities or holes in the ground?

Bajaj Healthcare Ltd – Improving Financial Health Post Losses

Incorporated in 1993, Bajaj Healthcare Ltd has a market cap of Rs 1,421 cr.

he company is focused on development, supply, manufacturing of Amino Acids, Nutritional Supplements and Active Pharma Ingredients for Pharmaceutical, Nutraceuticals and Food industries. It manufactures active pharmaceutical ingredients and formulations in the form of tablets, capsules, powder, etc.

Vanaja Iyer holds a 2.2% stake in the Bajaj Healthcare worth Rs 31.5 cr. HDFC Pharma and Healthcare Fund also holds another 1.7% stake in the company.

The company’s sales grew between FY20 and FY23, but FY24 saw a drop. FY25 however saw a jump again.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 410 | 657 | 680 | 646 | 473 | 543 |

The EBITDA (earnings before interest, taxes, depreciation, and amortization) also saw similar trajectory.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 48 | 136 | 119 | 112 | 76 | 82 |

The net profits saw a bumpy road in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | 25 | 83 | 71 | 43 | -84 | 40 |

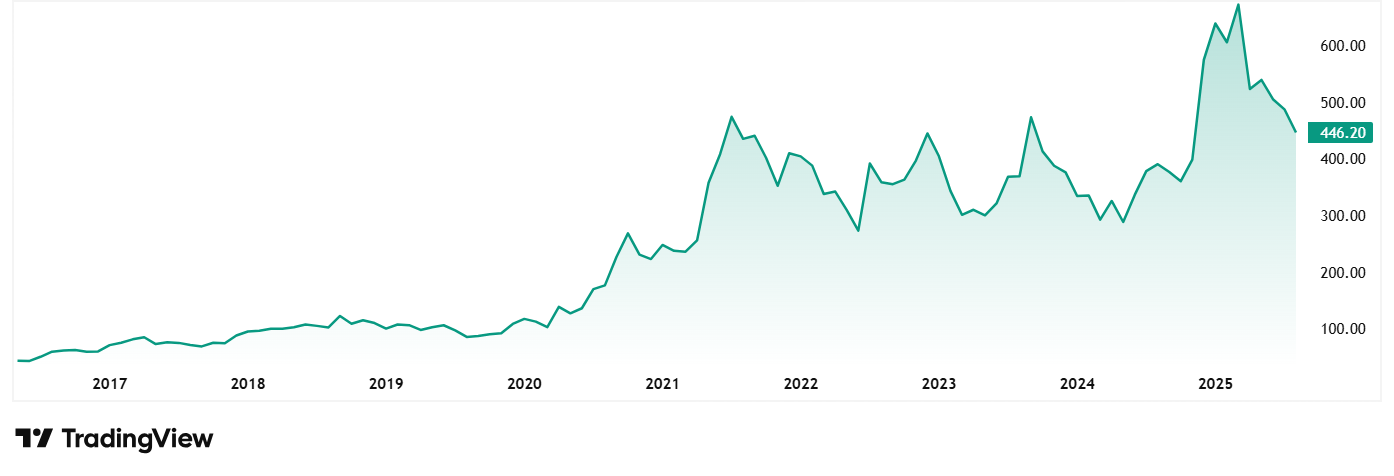

The share price of Bajaj Healthcare Ltd was around Rs 180 in August 2020, which has climbed to its current price of Rs 445 as on 22nd August 2025, which is a jump of about 150% in 5 years.

At the current price of Rs 445, the stock is trading at a discount of 41% from its all-time high price of Rs 745.

The company’s share is trading at a PE of 30x while the current industry median is 34x.

The current, ROCE (Return on Capital Employed) of the company is 11%, while the industry median is 15%. Which means for every Rs 100 the company spends as capital, it makes a profit of Rs 11 on it while the industry is around Rs 15.

In the company’s last investor presentation, Managing Director Anil Jain said, “Backward integration continues to be a cornerstone of our strategy, especially in supporting scale-up across CDMO and formulation segment. Export contribution rose to 35% of total revenue, up from 23% last year, reflecting stronger API demand and deeper access to global markets. We remain firmly on course to build a value-driven, innovation-led growth engine across APIs, formulations, and CDMO.”

Hariom Pipe Industries Ltd – Big Growth in The Pipeline?

Incorporated in 2008, Hariom Pipe Industries Ltd is a manufacturer of high-quality steel products.

With a market cap of Rs 1,556 cr, the company is a vertically integrated steel manufacturer with 800+ SKUs of Iron & Steel products. It is one of the few players to have an end-to-end Backward Integration process for Hot Charging, from producing raw materials like sponge iron and billets to final products.

Vanaja Iyer holds a 1.3% stake in the company as of the quarter ending June 2025, which is worth Rs 20 cr. Apart from her, Malabar India Fund Limited, a Foreign Institutional Investor also holds another 9.2% stake.

The company’s sales grew from Rs 161 cr in FY20 to Rs 1,357 cr in FY25, logging in a compound growth of 53%.

The EBITDA grew at a compound rate of 50% from Rs 23 cr in FY20 to Rs 175 cr in FY25.

The net profits were Rs 8 cr in FY20 which grew at a compounded rate of 51% to Rs 62 cr in FY25.

The share price of Hariom Pipe Industries Ltd jumped from around Rs 231 at listing in April 2022, which has gone to Rs 491 as on 22nd August. That is a jump of about 116%.

At the current price of Rs 491, the company’s share is trading at a discount of about 44% from its all-time high price of Rs 889.

The company’s share is trading at a PE of 23x while the industry median is 24x.

The current, ROCE of the company is 14%, which is same as the industry median.

According to the latest investor presentation from August 2025, Hariom Pipe Industries is executing strongly on its integrated, value-added product strategy, driving robust growth and margin stability. The company is leveraging its backward integration, expanding OEM/B2B business, and making significant inroads into solar structures and renewable energy.

The management is highly confident about future growth, supported by operational discipline, innovation, and a focus on high-margin segments, with no major headwinds articulated. The green steel initiative and solar project are key future growth and margin levers.

Will She, Won’t She – A Strategic Hold or Blind Blunder?

The two stocks that we saw today are Vanaja Iyer’s favourites and she has held them despite the 40% decline in prices. This gives birth to a lot of questions, about whether she sees something in these stocks which is missing the average investors eyes?

Financials of both, Bajaj Healthcare and Hariom Pipes show a lot of promise. Bajaj healthcare did see a slump, but is showing signs of recovery, while Hariom Pipes has been consistently logging in growth. Overall, as of now, both the stocks seem to be on the way to good times.

What the stocks will do in the coming time and whether Iyer keeps, sells it, or adds more of it will be interesting to dig into. For now, adding these stocks to your watchlist is a clever idea. Keep an eye on them!

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.