Our Terms & Conditions | Our Privacy Policy

Coal India: Why this boring PSU stock deserves more attention

I recently stumbled upon something while examining India’s most efficient profit-makers. Names such as Tata Consultancy Services, Hindustan Unilever Ltd, Nestle India and Colgate-Palmolive (India) Ltd were on this list. But one unexpected entry caught my attention, especially because it operates in a sunset sector.

Coal, once the backbone of India’s energy sector, has seen a rapid decline in demand over the decades due to a mix of environmental, economic and technological factors.

The global push for cleaner energy sources to control climate change has put significant pressure on coal consumption. India, which is a signatory to international climate agreements, started pursuing renewable-energy alternatives such as solar and wind power.

These green technologies rapidly became more cost-effective and efficient, and began eating into coal’s economic advantage.

Stricter environmental regulations and health hazards associated with coal pollution accelerated the shift away from this fossil fuel.

With investors and policymakers pushing for green energy initiatives, financial support for coal projects took a hit. Though coal still played a big role in India’s energy space, its long-term prospects didn’t seem bright.

Going green is isn’t easy

However, the years-long global push for cleaner energy sources has made one thing clear.

The transition to green energy, while crucial for fighting climate change, is proving to be complex and costly. Renewable energy sources such as solar and wind come with big challenges such as intermittency, and require substantial investments in energy storage and grid upgrades.

These reasons, and the need for rare earth minerals, make the shift to renewable energy even more challenging, especially for developing countries such as India.

Many governments, including India’s, are thus going back to coal for their energy needs. After all, it is a reliable, readily available, and relatively cost-effective energy source that can meet immediate power needs. Recent energy crises and supply-chain disruptions highlight the need to turn back to coal.

One public sector unit (PSU) is making the most of this opportunity, markets-wise. For decades, the narrative has been clear: the private sector is far more efficient than the public sector. But this PSU has made its way into the list of India’s most efficient profit-makers, rubbing shoulders with some vaunted private-sector giants.

Let’s dig deeper into this PSU and find out what’s really happening.

Coal India Ltd

Coal India Ltd’s core business is mining and producing coal, as well as operating coal washeries. Its major clients are in the power and steel sectors, followed by companies that make cement, fertilisers, brick kilns and so on.

It is a Maharatna company, which gives it more authority and autonomy. A PSU with Maharatna status can invest 15% of its net worth in a private project without the need of prior approval from the Indian government.

Coal India is the world’s single largest coal producing company and one of the largest corporate employers. It operates in eight Indian states and owns a mining company in Mozambique, Coal India Africana Limitada,which is set to begin operations soon.

The magic monopoly

Coal India Ltd undoubtedly leads the country’s coal production, contributing more than 80% of the nation’s entire output. Its supplies to the power sector exceed 80% of its entire dispatch.

Coal India’s offerings comprise coking coal, semi-coking coal, non-coking Coal, washed and beneficiated coal, middlings, rejects, CIL coke, tar, heavy oil, light oil, soft pitch, and other value-added products.

The company has aggressively expanded its capacity of late, according to its annual report for FY24. With more than 313 mines across subsidiaries, overall coal production was more than 770 million tonnes.

The company also runs 13 coal washing facilities that can handle nearly 25 million tonnes of coal a year. Eleven of these focus on coking coal, while two handle non-coking coal.

These numbers show Coal India is investing big to meet India’s growing demand and to reduce imports.

The company’s capital expenditure (capex) was ₹7,311 crore in FY19 and ₹23,475 crore as of FY24 – an increase of more than 220%.

The goal is to increase the total output of coal to a billion tonnes by FY26, which would mark a 67% increase from 600 million tonnes in FY19.

Crashing the profit party

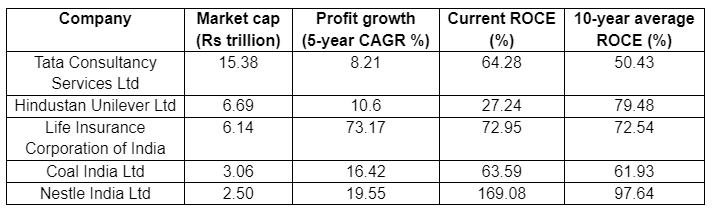

I recently crunched the numbers of companies that have a proven record of high profitability. Here’s what I found.

View Full Image

Source: Screener.in

The data above is from a filter I ran on Screener.in to find companies with the highest return on capital employed (ROCE) over the past 10 years. These are the top five, ranked by market cap.

The surprise entry is Coal India Ltd at number 4.

ROCE measures how many rupees of profit a company generates for every rupee of capital it invests in the business. It gives you a concrete view of the company’s operational efficiency and long-term sustainability. A high ROCE means the company is good at turning capital into profits.

Proof in the pudding

Let’s look at Coal India’s financials to get a better understanding of how it landed a spot on this list.

Its current ROCE is almost 64%, which means that for every ₹100 it invests in the business, it generates a profit of ₹64.

The industry’s median ROCE is about 19%, which Coal India beats by a wide margin. Its closest competitor is Vedanta Ltd, with a current ROCE of 21%.

Coal India’s 10-year average ROCE is also impressive at 62%, which shows the current performance is no flash in the pan – the company is indeed an efficient user of capital.

With a market cap of ₹3.06 trillion, Coal India has clocked compound annual sales growth of 16% over the past three years and 7% over the past five.

Earnings before interest, taxes, depreciation, and amortisation (Ebitda) was ₹25,007 crore in March 2019 and ₹47,971 crore in March 2024, meaning it grew at a compound annual rate of 14% over five years. Profit after tax was 37,369 crore in FY24, with a compound annual growth rate of 8% over the past five years.

Coal India’s stock currently trades at ₹497, up 169% over the past five years.

View Full Image

Source: TradingView

The dividend yield is an impressive 5.13% given the industry median is 0.15%. Coal India also maintains a healthy dividend payout ratio of 50%.

Valuation and opportunity

The company currently trades at a price-to-earnings (PE) multiple of 8x. The median PE multiple for the past 10 years is also around 8x, which suggests the stock is fairly valued relative to its own historical standards.

However, the company appears to be significantly undervalued compared to its peers. It’s trading at just over one-third of the industry’s average PE multiple of around 22x.

The low PE multiple relative to the industry suggests that the market has much lower expectations for the company’s future performance compared to its peers.

This could be because coal is a sunset sector, and at some point in the future, demand should cool off. Another reason could be that some funds and investors have rules that prevent them from investing in industries that contribute to global warming.

In the company’s annual report for 2023-24, chairman P M Prasad said, “Coal India concluded the fiscal year 2023-24 on a thumping note with impressive all-round performance, and is poised to enter the [new] fiscal year to achieve even higher goals set for our company.”

According to the report, the capex target for Coal India and its subsidiary in FY24 was ₹16,500 crore. However, actual capex amounted to ₹23,475 crore, 42% higher than what was planned, and 26% higher than in the preceding year.

But as we have seen, the company is very efficient in generating profits from the money it spends.

No wonder institutional investors such as Life Insurance Corporation of India, HDFC Balanced Advantage Fund, and Parag Parikh Flexi Cap Fund have bought into the company.

Green initiatives

Coal India also aims to lead the way in green energy initiatives to hedge the potential decline in demand for coal in the future.

The company plans to have 3GW of solar power capacity by FY26 and 5GW by FY29.

Coal India has also invested almost ₹16,000 crore in a thermal power plant at Sundargarh, Odisha, in what amounts to forward integration.

Under the coal to chemical business vertical, the company has taken up three coal gasification projects. It has a joint-venture agreement with BHEL for the project in Odisha. A joint venture agreement with GAIL for a project in West Bengal is in the advanced stages.

Conclusion

A PSU operating in a sunset sector is competing with the best on the all-important ROCE parameter. It’s no wonder then, that despite all the challenges brought on by global warming, Coal India’s stock is near its all-time highs.

It also offers one of the best dividend yields among large companies.

Given its financial discipline, and the strong demand scenario in the medium term, it may be worth tracking how the company performs going forward. The investments it makes to prepare for a post-coal future are equally important.

Note: We have relied on data from Screener.in and Trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. He was an integral part of a leading equity research organisation in Mumbai as head of sales & marketing. Presently, he spends most of his time dissecting the investments and strategies of India’s super investors.

Disclosure: The writer and his dependants do not hold the stocks discussed in this article.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.