Our Terms & Conditions | Our Privacy Policy

Bitcoin Corporate Treasury Trend Grows As Robin Energy Commits $5 Million

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Cyprus-based international ship-owning firm Robin Energy today announced the successful conclusion of its initial $5 million Bitcoin (BTC) allocation through Anchorage Digital Bank N.A., as part of its newly adopted treasury framework.

Robin Energy Buys $5 Million Worth Of Bitcoin

According to an announcement made earlier today, Robin Energy has completed its initial $5 million worth of BTC purchase. With this, the Cyprus-based company, which also provides energy transportation services has become the latest firm to leverage digital assets to diversify its portfolio.

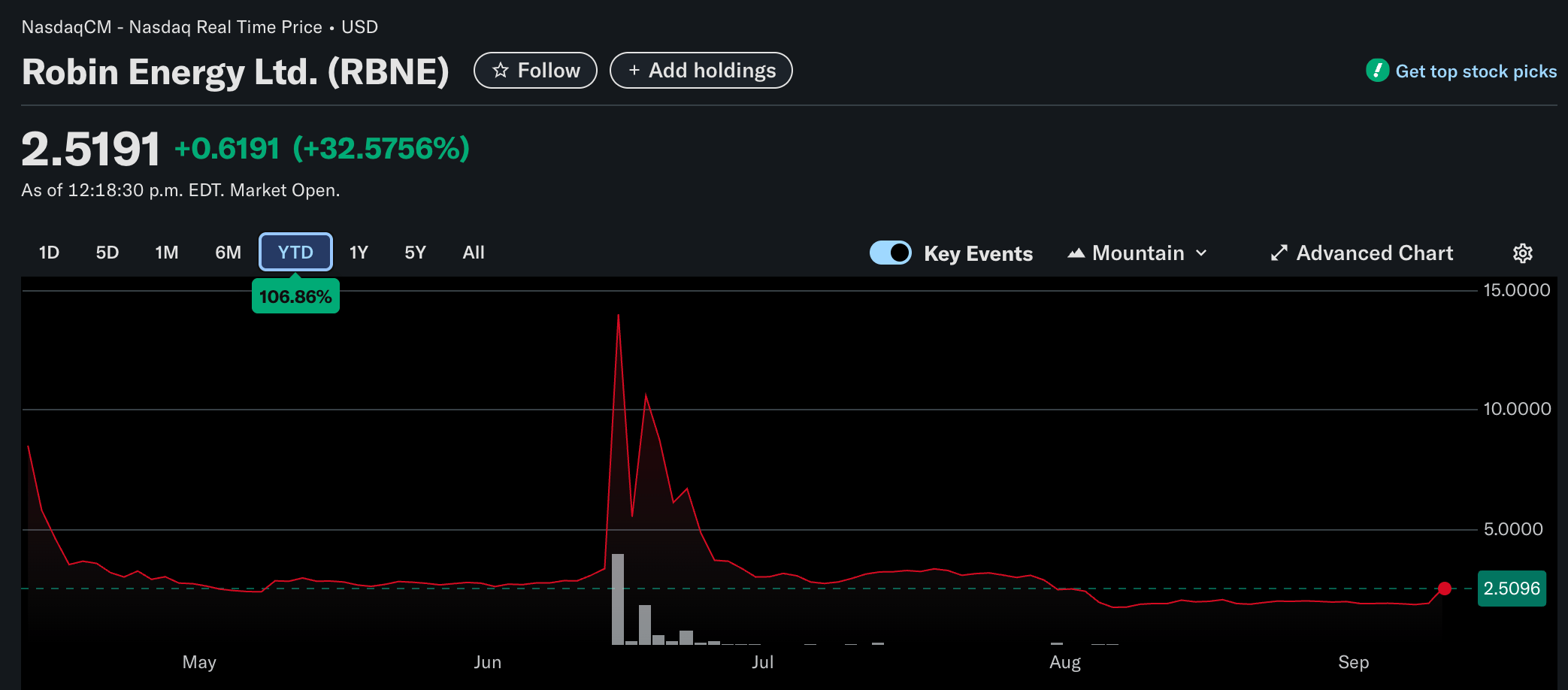

Following the development, the firm’s Nasdaq-listed stock RBNE spiked 90%, hitting an intraday high of $4.27 before losing some of its gains. On a year-to-date (YTD) basis, the stock has increased by 106.8%.

Source: Yahoo! Finance

Source: Yahoo! Finance

It is worth noting that RBNE hit its all-time high (ATH) earlier this year on June 13. However, no specific reason can be found for the same. Commenting on today’s Bitcoin purchase, Petros Panagiotidis, CEO, Robin Energy, said:

We are pleased to have completed the allocation of $5 million to Bitcoin in accordance with our board-approved strategy. We believe in Bitcoin’s unique characteristics as a scarce digital asset and see it as an integral component of our long-term strategy to grow our Company further and drive shareholder value.

Robin Energy’s foray into the cryptocurrency realm is not surprising, as an increasing number of firms are choosing to add leading digital assets like BTC and Ethereum (ETH) to their balance sheets in 2025.

For example, Taiwanese investment firm Sora Ventures recently unveiled a massive $1 billion Bitcoin treasury fund, a first in Asia. At the time, the firm stated that it would use the proceeds from the fund to buy BTC over the next six months.

Similarly, Japanese investment firm Metaplanet also shared plans to double down on BTC recently. Specifically, the firm stated that it will spend as much as $835 million to buy more Bitcoin.

Unsurprisingly, the total amount of BTC held by publicly-listed companies recently crossed one million. Among these companies, US-based Strategy ranks at the top as it alone holds close to 638,000 BTC on its balance sheet.

Source: Coingecko

Source: Coingecko

ETH, A Worthy Challenger To BTC?

Although Bitcoin’s dominance and adoption rate are unquestionable, it appears to be getting serious competition from the second-largest cryptocurrency by market cap, Ethereum. In 2025 specifically, ETH adoption has surged at an unprecedented pace.

Asset manager VanEck CEO, Jan van Eck, recently dubbed ETH the “Wall Street token,” thanks to its incredible range of use-cases, including facilitating stablecoin transactions on the Ethereum blockchain.

Similarly, August 2024 saw ETH-based exchange-traded funds (ETFs) attract $4 billion worth of net inflows, while Bitcoin ETFs witnessed net outflows to the tune of $628 million. At press time, BTC trades at $113,930, up 2.7% in the past 24 hours.

Bitcoin trades at $113,930 on the daily chart | Source: BTCUSDT on TradingView.com

Bitcoin trades at $113,930 on the daily chart | Source: BTCUSDT on TradingView.com

Featured image from Unsplash.com, charts from Yahoo! Finance, Coingecko, and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.