Our Terms & Conditions | Our Privacy Policy

How can Europe back its tech champions?

While the US is producing global tech giants such as Google, Amazon, or Facebook, Europe is falling back, with only a handful of companies reaching similar scale. According to Atomico’s State of European Tech 2023, despite Europe’s strong startup ecosystem, only 1 in 10 European unicorns have achieved global success, compared to 1 in 3 in the US.

Interestingly, the EU has created more high-tech startups than the US, which raises the question: why is Europe still falling back? A study by the European Investment Bank highlights the barriers preventing European startups from scaling. Building on this, experts from Zubr Capital have further explored the challenges faced by late-stage and tech startups, offering insights on how to overcome these obstacles and drive Europe into the next era of innovation.

What is a scale-up and why is it important for startups?

A scaleup is an entrepreneurial venture that has achieved product-market fit and is now focused on achieving exponential growth through a mass market release and an intensified growth strategy. Only about 0.4% of all startups scale, reaching more than $10m in revenues within five years.

Many organisations concentrate solely on revenue growth without considering cost management, which can lead to failure. Wework and SoundCloud are two notable examples of companies that pursued this strategy and faltered. In contrast, King Digital Entertainment, the company behind Candy Crush, saw a 12-fold increase in revenue with only a sixfold increase in costs, demonstrating effective scaling. According to Harvard Business Review, for a scale-up to be successful, companies need to enter the extrapolation stage. It entails pursuing profitable growth while leveraging economies of scale. To achieve a successful scale-up, companies must be agile, maintain small teams, allocate human capital to the highest potential opportunities, and focus on sustainable growth.

Scale-ups are crucial for startups because they unlock numerous advantages, some of which are as follows:

Entering the big leagues

Once a startup achieves product-market fit, it can begin its journey to becoming a market or industry leader. Successful scale-ups not only generate significant revenue but also demonstrate high growth potential and a loyal customer base. This success leads to greater recognition in the venture capital landscape, resulting in premium valuations and easier access to funding.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

View profiles in store

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Country *

UK

USA

Afghanistan

Åland Islands

Albania

Algeria

American Samoa

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Armenia

Aruba

Australia

Austria

Azerbaijan

Bahamas

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Belize

Benin

Bermuda

Bhutan

Bolivia

Bonaire, Sint

Eustatius

and

Saba

Bosnia and Herzegovina

Botswana

Bouvet Island

Brazil

British Indian Ocean

Territory

Brunei Darussalam

Bulgaria

Burkina Faso

Burundi

Cambodia

Cameroon

Canada

Cape Verde

Cayman Islands

Central African Republic

Chad

Chile

China

Christmas Island

Cocos Islands

Colombia

Comoros

Congo

Democratic Republic

of

the Congo

Cook Islands

Costa Rica

Côte d”Ivoire

Croatia

Cuba

Curaçao

Cyprus

Czech Republic

Denmark

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Estonia

Ethiopia

Falkland Islands

Faroe Islands

Fiji

Finland

France

French Guiana

French Polynesia

French Southern

Territories

Gabon

Gambia

Georgia

Germany

Ghana

Gibraltar

Greece

Greenland

Grenada

Guadeloupe

Guam

Guatemala

Guernsey

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and

McDonald

Islands

Holy See

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Iraq

Ireland

Isle of Man

Israel

Italy

Jamaica

Japan

Jersey

Jordan

Kazakhstan

Kenya

Kiribati

North Korea

South Korea

Kuwait

Kyrgyzstan

Lao

Latvia

Lebanon

Lesotho

Liberia

Libyan Arab Jamahiriya

Liechtenstein

Lithuania

Luxembourg

Macao

Macedonia,

The

Former

Yugoslav Republic of

Madagascar

Malawi

Malaysia

Maldives

Mali

Malta

Marshall Islands

Martinique

Mauritania

Mauritius

Mayotte

Mexico

Micronesia

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Myanmar

Namibia

Nauru

Nepal

Netherlands

New Caledonia

New Zealand

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Northern Mariana Islands

Norway

Oman

Pakistan

Palau

Palestinian Territory

Panama

Papua New Guinea

Paraguay

Peru

Philippines

Pitcairn

Poland

Portugal

Puerto Rico

Qatar

Réunion

Romania

Russian Federation

Rwanda

Saint

Helena,

Ascension and Tristan da Cunha

Saint Kitts and Nevis

Saint Lucia

Saint Pierre and Miquelon

Saint Vincent and

The

Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

Solomon Islands

Somalia

South Africa

South

Georgia

and The South

Sandwich Islands

Spain

Sri Lanka

Sudan

Suriname

Svalbard and Jan Mayen

Swaziland

Sweden

Switzerland

Syrian Arab Republic

Taiwan

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Turkey

Turkmenistan

Turks and Caicos Islands

Tuvalu

Uganda

Ukraine

United Arab Emirates

US Minor Outlying Islands

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

British Virgin Islands

US Virgin Islands

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Kosovo

Industry *

Academia & Education

Aerospace, Defense &

Security

Agriculture

Asset Management

Automotive

Banking & Payments

Chemicals

Construction

Consumer

Foodservice

Government, trade bodies

and NGOs

Health & Fitness

Hospitals & Healthcare

HR, Staffing &

Recruitment

Insurance

Investment Banking

Legal Services

Management Consulting

Marketing & Advertising

Media & Publishing

Medical Devices

Mining

Oil & Gas

Packaging

Pharmaceuticals

Power & Utilities

Private Equity

Real Estate

Retail

Sport

Technology

Telecom

Transportation &

Logistics

Travel, Tourism &

Hospitality

Venture Capital

Tick here to opt out of curated industry news, reports, and event updates from Retail Banker International.

Submit and

download

Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

Access to top talent

Scaling brings increased financial resources and enhanced industry reputation. This allows companies to attract top-tier talent by offering competitive compensation packages. Additionally, employees are more likely to join organisations that have a strong brand presence and proven success.

Exploring new opportunities

As scale-ups generate consistent revenue and growth in their core business, they gain the flexibility to explore new avenues. With more financial backing and a track record of success, these companies can invest in new areas and take calculated risks. Investors are often more supportive, as the firm has already proven itself in its primary market.

The existing venture capital and startup scenario in Europe

Venture capital plays a crucial role in funding innovative companies and fostering the creation of tech giants. Many industry leaders, including Apple, Facebook, Google, Spotify, Airbnb, and Uber, relied on venture capital in their early stages to fuel their growth. According to Mollica and Zingales (2007), a $64m increase in venture capital investment can lead to a 4-15% rise in patents and a 2.5% increase in new businesses. Venture-backed companies are typically highly innovative with significant growth potential, making venture capital essential for their expansion and success.

The venture capital and startup landscape in Europe has faced significant challenges in 2023. Atomico’s 2023 report projects a 45% decline in venture capital investment in the tech sector, with total funding expected to reach $45bn. This marks a sharp drop from $82bn in 2022 and $100bn in 2021. Notably, there have been virtually no major IPOs in Europe this year, and mergers and acquisitions (M&A) activity remains subdued. The reported deal transaction value in 2023 stands at $36bn, with most exits taking place at lower valuations, typically under $100m.

The scale-up gap: Why is it more relevant for Europe?

European tech start-ups are struggling to scale compared to their US counterparts due to a variety of factors. These include limited access to capital, fewer venture capital funds investing in European companies (both domestically and globally), and a preference among investors for safer assets such as banks and government bonds. Additionally, Europe’s relatively lower R&D spending further hampers the growth potential of start-ups, reducing their ability to innovate and compete on a global scale.

Here are some statistics that underscore Europe’s struggles with scaling up, and now is a crucial time to focus on these issues:

- The European Union has fewer than half the number of startups in the United States, and only one-fifth the number of scale-ups.

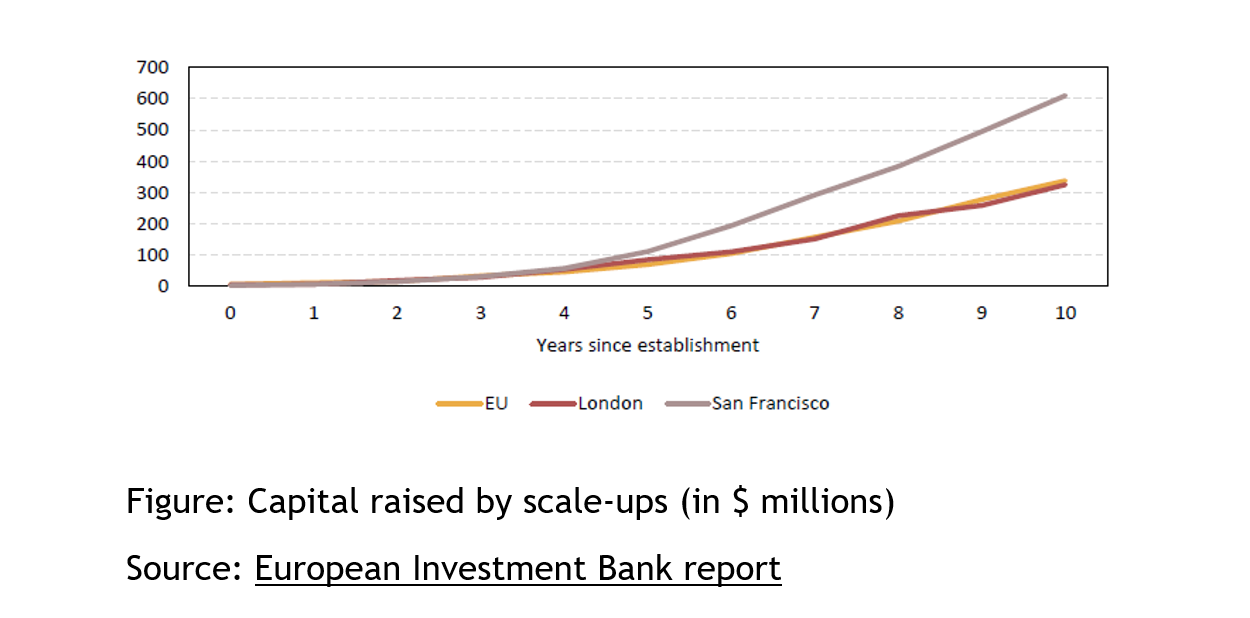

- By the time European scale-ups reach ten years of operation, they raise 50% less capital compared to their counterparts in San Francisco.

- In the European Union, more than 80% of scale-up deals involve a foreign lead or sole investor, compared to only 14% in San Francisco.

- 66% of the venture capital fund managers interviewed said there were insufficient financing opportunities for companies to scale up in Europe

- Venture capital investment in the EU has been only 0.03% of its annual gross domestic product (GDP), compared with about 0.19% in the United States

- Ten years after its establishment, EU scale-ups have raised, on average, 50% less capital than their US counterparts.

Tackling the scale-up gap: strategies to drive Europe in an era of innovation

While the challenge of building successful tech scale-ups and global giants in Europe may seem daunting, heavy investment in innovation is the path forward. Europe can learn from the success of venture capital and technology scale-ups in the United States and implement the following strategies to revive its tech ecosystem and usher in an era of innovation:

Active Participation of Pension Funds

The United States transformed Silicon Valley after enacting ERISA in 1974, which recognised that a “prudent person” would include a mix of riskier instruments in their portfolio. This shift allowed pension funds to invest in venture capital, fueling the growth of Silicon Valley. Without this reform, the tech hub might not exist today. In contrast, Europe is still operating with a pre-ERISA mindset. In 2022, European venture capital invested only 0.024% of EU pension fund assets. To unlock similar innovation, European governments must consider relaxing investment regulations, giving citizens the option to invest in riskier assets with informed consent.

Bolstering innovation hubs and incubators

The European government needs to bolster innovation hubs and incubators, as these firms act as intermediaries between startups and investors, supporting companies in their early stages of development. The European Union has seen some success in this area, particularly when incubators establish strong connections with the innovation activities of universities and research centers (such as PoliHub or KU Leuven Kick). However, these initiatives remain small and too fragmented.

Cross border integration

Currently, the 27 countries in the EU face fragmented venture capital funding, with each country having its own financial norms, tax regulations, corporate governance rules, and stock exchanges. This creates regulatory, legal, and linguistic differences across countries. The European Investment Fund is already prioritising cross-border venture capital firms. To further support startups, the EU should focus on reducing these barriers, enabling easier access to capital throughout the region, and facilitating successful scaling of startups.

Conclusion

The outlook for scaling up in Europe appears challenging, and it may be some time before a global tech giant emerges from the region. Europe can benefit by studying the success of Silicon Valley in the US and implementing similar strategies to address the funding gap. Governments should consider becoming active investors in startups, providing both capital and support to help these companies grow. Innovation should be at the heart of government initiatives and tech startups. The success of US-based startups in scaling up and dominating the global market is a key factor behind the US becoming the world’s leading economy.

Nikolay Shestak is a partner at Zubr Capital

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.