Our Terms & Conditions | Our Privacy Policy

A Significant Move In India’s Automotive Market

Hyundai Motor IPO: A Significant Move In India’s Automotive Market | File Photo

The Indian stock market is about to witness a groundbreaking event as Hyundai Motor India Limited (HMIL) gears up for its much-anticipated Initial Public Offering (IPO). Known for its impressive lineup of sedans, SUVs, and electric vehicles, Hyundai is India’s second-largest car manufacturer, exporting passenger vehicles to multiple countries.

This IPO offers a significant opportunity for investors looking to invest in a strong, reliable brand with a history of innovation. With this in mind, it’s crucial to understand how to make the most of the opportunity, whether through a web trading platform or another medium.

Get the full details on the Hyundai IPO and HDFC Sky’s ‘One-Click IPO’ solution to simplify investments.

A Closer Look at Hyundai Motor India

Established in 1996, Hyundai Motor India is a subsidiary of Hyundai Motor Company, headquartered in South Korea. The company has become a leader in the Indian automotive market, thanks to its wide range of feature-packed, reliable vehicles.

Whether it’s their popular hatchbacks like the Grand i10 NIOS, stylish sedans like the Verna, or their rapidly growing electric vehicle (EV) segment, Hyundai has something for every customer. Additionally, the brand has made a significant mark in the SUV category with models like the Creta and Tucson, both of which enjoy substantial market shares.

Hyundai India has a robust sales network with over 1,366 sales points and 1,550 service centers across the country. It also enjoys strong export numbers, solidifying its global presence. As of March 2024, Hyundai has sold nearly 12 million passenger vehicles, both in India and internationally.

Key Details of the Hyundai Motor IPO

Details of the Hyundai Motor India IPO

The Hyundai Motor IPO is set to open on October 15, 2024, and will close on October 17, 2024. Here are the key details you need to know about this much-anticipated IPO:

One of the easiest ways to get started is by opening an online Demat account. Numerous platforms allow users to open free Demat account without hassle.

Market Valuation and Financial Overview

The Hyundai Motor India IPO is expected to raise substantial funds, making it potentially one of the largest IPOs in India. Here’s a breakdown of the financial aspects and market valuation of the IPO:

With such a robust financial foundation, Hyundai Motor IPO offers investors a promising opportunity for growth. The company’s diverse product lineup, ranging from hatchbacks to electric vehicles (EVs), ensures continued dominance in the Indian automotive market.

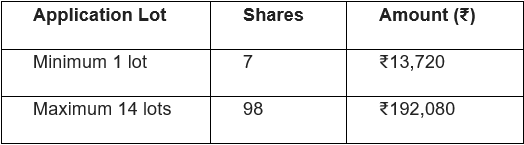

IPO Market Lot and Share Offer Breakdown

The market lot determines the minimum number of shares you can apply for during the IPO. For Hyundai Motor India, the minimum lot size is 7 shares. Investors can apply for a maximum of 14 lots, equating to 98 shares. Here’s a detailed table:

The shares will be allocated across three main categories:

Investors will receive their allotted shares after the final allocation, and those who are unsuccessful will be refunded.

Investing in the IPO has been simplified with the advent of digital solutions. Once the Demat account is set up, you can begin applying for the IPO through the platform of your choice. Be sure to use an efficient share trading app that provides real-time updates, easy application processes, and smooth fund transfers.

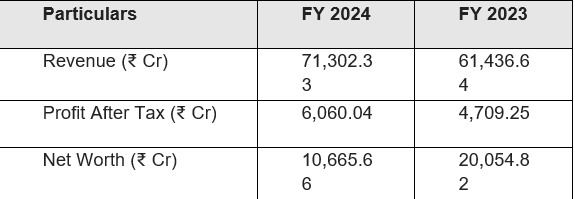

Financial Snapshot of Hyundai Motor India

Hyundai Motor India’s financial performance has been nothing short of impressive. Between March 2023 and March 2024, the company’s revenue grew by 16%, while the profit after tax (PAT) surged by 29%. This reflects the company’s operational efficiency, effective cost management, and ability to adapt to market trends, especially in the fast-evolving EV space. Below is a financial breakdown of Hyundai Motor India:

These numbers show Hyundai’s strong financial health and potential for growth, making it a favourable investment option for both institutional and individual investors.

Hyundai’s Potential in the Electric Vehicle Segment

One of Hyundai Motor India’s standout achievements has been its early adoption of electric vehicles (EVs) in the Indian market. The company’s flagship electric SUV, the Ioniq 5, has received rave reviews for its futuristic design, performance, and eco-friendly technology. As the Indian government pushes for more stringent emissions norms and incentivizes electric vehicles, Hyundai’s position as a leader in this segment could be a major advantage.

EVs are expected to account for a significant share of the company’s future revenue, and the IPO proceeds could help fund more innovations in this space. With a global shift toward greener technologies, Hyundai’s EV offerings could not only enhance its brand image but also provide substantial returns for its investors.

Why Invest in Hyundai Motor India’s IPO?

Several factors make the Hyundai Motor India IPO an appealing investment opportunity:

1. Strong Brand Recognition: Hyundai is synonymous with reliability, innovation, and customer satisfaction. The company has consistently delivered quality vehicles across multiple segments, building a loyal customer base in India and abroad.

2. Diverse Product Lineup: Hyundai’s extensive vehicle range, including sedans, SUVs, and EVs, ensures that the company caters to a broad spectrum of consumers. Their ongoing commitment to electric vehicles also positions them well for the future as demand for green technologies grows.

3. Consistent Financial Performance: Hyundai Motor India has seen steady growth in both revenue and profits. This reflects the company’s strong foothold in the market and its ability to capitalize on opportunities in the automotive sector.

4. Global Backing: As part of the Hyundai Motor Group, Hyundai Motor India benefits from global research and development (R&D), advanced manufacturing practices, and cutting-edge technology, further strengthening its market position.

How to apply for IPO using HDFC Sky’s One-Click feature

The One-Click IPO feature on HDFC Sky streamlines the application process for IPOs, making it easy and efficient. To apply for the Hyundai IPO, follow these steps:

Login to HDFC Sky: Start by logging into your HDFC Sky account with your credentials.

Go to the IPO section: Navigate to “Indian Stocks” in your profile and click on “IPO.”

Choose the Hyundai IPO: Locate the Hyundai IPO and click “Apply Now.”

Enter your bid: Provide your bid details and make any necessary customisations.

Proceed with payment: Select UPI as your payment option.

Approve the mandate: Open your UPI or banking app to approve the payment mandate.

Confirm your order: Finalise your application by confirming and placing your order.

Key features of HDFC Sky’s One-Click IPO include:

● Simple application process: Apply for the IPO with a single click, minimising paperwork and errors.

● Real-time updates: Get instant notifications regarding your application status, allotment results, and refunds.

● Unified management: Manage all IPO investments seamlessly from one platform.

● Accessible anywhere: Apply using the HDFC Sky mobile app or online portal for convenience.

The Hyundai IPO represents a significant investment opportunity, combining growth and stability. Thanks to HDFC Sky’s One-Click IPO feature, the application process is more accessible and efficient. Don’t miss this chance to participate in this major market event.

Disclaimer: This is a syndicated feed. The article is not edited by the FPJ editorial team.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.