We’re thinking about the $250,000 Bitcoin scenario once more. Before the year ends, Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, remains steadfast in his audacious forecast that Bitcoin will reach a new all-time high.

Lee believes that the world’s largest cryptocurrency will make a late-year breakout despite market volatility due to strong macroeconomic and cyclical dynamics.

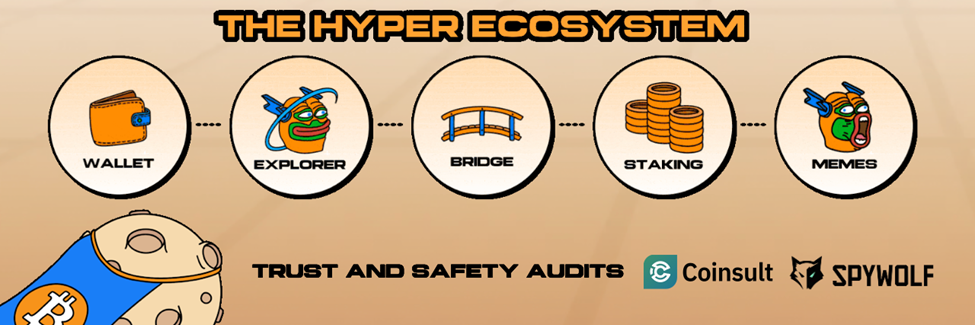

A second-layer network called Bitcoin Hyper (HYPER), which was created to increase the scalability of Bitcoin, recently achieved a significant milestone by raising over $25 million during its presale. This achievement not only shows investor confidence but also a more general change in market sentiment.

Investors are starting to make connections. For Bitcoin to sustain levels above $200,000, it needs more than speculation, it needs new utility and on-chain demand. That’s exactly where Bitcoin Hyper steps in. By adding real functionality to Bitcoin’s reputation as a store of value, HYPER aims to bridge the gap between value and velocity.

Built on the Solana Virtual Machine (SVM), known for its unmatched transaction speed and scalability, the project blends Bitcoin’s security with Solana’s performance, creating an infrastructure capable of supporting high-speed applications and real-world use cases.

Momentum is building fast. Crypto whales have been increasing their holdings as the presale progresses. With HYPER currently priced at $0.013125 and the next price jump approaching, anticipation is mounting, and the buying window is closing rapidly.

Bitcoin Bulls Return: Lee, Newton, and Hayes Eye a Massive Year-End Rally

Tom Lee is not alone in defending such a projection. Arthur Hayes, co-founder of BitMEX, and Mark Newton, head of technical strategy at Fundstrat, both hold a resolutely positive outlook.

Lee reiterated his prediction that Bitcoin might trade between $200,000 and $250,000 before December at Korea Blockchain Week in Seoul.

One important macroeconomic aspect that supports this prediction is the US Federal Reserve’s easing of its restrictive policies. This monetary shift acts as a breath of fresh air for risk markets.

Indeed, Fundstrat’s charts confirm the trend. Newton suggests a solid cyclical structure, capable of supporting a recovery in the last two months of the year.

In early October, during his appearance on Bankless, Lee reiterated his scenario. He estimated that Ethereum could climb to between $10,000 and $12,000, while Arthur Hayes set his own target at $10,000. According to him, the Bitcoin bull cycle has not yet had its last word.

The market remains volatile, of course. BTC fell to $107,000 on Thursday after a fragile recovery. But historical data remains favorable. October and November were among the best-performing months since the asset’s inception. Additionally, cryptocurrency flows may increase if the Fed lowers interest rates much more.

A larger structural tendency is beginning to emerge behind this short-term conjecture. Projects with significant technological value are attracting capital. Therefore, Bitcoin Hyper seems to be a driving force behind the upcoming growth cycle. Without compromising security, it aims to close a gap that Bitcoin has never really been able to: speed and flexibility.

Bitcoin’s Built-In Bottleneck: Why Speed Is the Next Frontier

Bitcoin was designed with a purposeful ideology in mind when it was first launched. A decentralized, censorship-resistant digital money that could function without the intervention of a central authority was Satoshi Nakamoto’s concept. Flexibility and speed were subordinated to security and dependability in order to accomplish this.

This foundational choice became the cornerstone of Bitcoin’s identity. It turned BTC into a symbol of monetary sovereignty and financial independence, trusted by millions as “digital gold.” However, this strength also serves as its biggest drawback.

Compared to international payment systems like Visa, which can process hundreds of transactions per second, the Bitcoin network can only process three or four. In contrast to the original white paper’s goal of a peer-to-peer cash system, this bottleneck renders Bitcoin unsuitable for regular payments or high-volume on-chain activity.

Moreover, Bitcoin’s architecture offers limited programmability, restricting developers from building complex decentralized applications directly on its base layer. Consequently, whole ecosystems have thrived elsewhere, mostly on Ethereum, Solana, and other more flexible networks, ranging from DeFi protocols and NFT marketplaces to blockchain gaming platforms.

Over time, numerous attempts have been made to get around these restrictions. While RSK provided Ethereum-compatible DeFi capability to the network, Stacks introduced smart contracts for Bitcoin.

However, both have not yet gained significant use due to scaling concerns. These efforts exposed an important fact: although Bitcoin’s fundamental security is unparalleled, it lacks the speed and flexibility needed for widespread use.

Bitcoin Hyper (HYPER) seeks to bridge this particular divide. By integrating the Solana Virtual Machine (SVM), Bitcoin Hyper hopes to bring together the blazing-fast performance of Solana with the unquestionable security of Bitcoin.

The end product is a system that can handle hundreds of transactions every second while preserving the trust and decentralization that characterize Bitcoin.

Essentially, Bitcoin Hyper is a logical development rather than a substitute for Satoshi’s concept. It moves Bitcoin one step closer to becoming a fully functional digital currency that can power large-scale real-world applications as well as a store of value.

Bitcoin Hyper and the Rebirth of a Functional Bitcoin

Bitcoin Hyper (HYPER) positions itself not as a competitor to Bitcoin, but as its natural evolution, a second-layer extension designed to give the world’s most secure network a new level of usability and speed.

The project enables developers to build high-performance decentralized applications (dApps) that harness Solana’s efficiency while maintaining Bitcoin’s unmatched security foundation.

At the heart of this system lies a bridge mechanism that connects the Bitcoin main chain to the Hyper network. Users can lock their BTC on the original chain and receive a wrapped version, called the BTC, on Hyper. This wrapped asset mirrors the value of Bitcoin 1:1, ensuring full transparency and reliability.

What makes it powerful is flexibility. The wrapped BTC isn’t static, it’s fully tradable and redeemable. To reclaim their original Bitcoin, holders can burn the wrapped tokens whenever they want. Their assets, such as DeFi platforms, blockchain games, staking protocols, and digital finance tools, are still usable within the Hyper ecosystem in the interim.

This effectively transforms Bitcoin from a passive store of value into an active economic instrument. It preserves Bitcoin’s integrity and scarcity, yet gives it a new utilitarian layer, one capable of moving, interacting, and generating yield without compromising security.

In other words, Bitcoin Hyper doesn’t aim to replace Satoshi Nakamoto’s creation, it aims to complete it. By merging security with scalability, it allows Bitcoin to function as both sound money and a global medium of exchange.

The implications are massive. In a market filled with short-lived narratives and fleeting trends, Bitcoin Hyper stands out through technical depth and long-term vision. It’s not just another project promising high returns, it’s a structural upgrade to Bitcoin’s ecosystem, giving it the performance edge it has long lacked.

With this fusion of value and velocity, Bitcoin Hyper may well mark the beginning of Bitcoin’s next chapter, one where BTC isn’t just held, but used.

Powering the Future: How HYPER Fuels Bitcoin’s Next Evolution

The numbers rarely lie, and in this case, they paint a story of growing conviction. Investors are obviously confident in the project’s long-term prospects and ambition, as evidenced by the approximately $24 million raised during the Bitcoin Hyper (HYPER) presale.

At the heart of this growing ecosystem is the HYPER token, which drives all network interactions, transactions, and governance decisions. Every transaction on the Hyper chain requires the payment of gas expenses in HYPER, ensuring consistent token demand and reinforcing its role as the network’s energy source.

But HYPER’s utility extends far beyond transactions, it’s also a governance token, giving holders a direct voice in shaping the future of the ecosystem. From network upgrades to community initiatives, users can participate in defining the next milestones of Bitcoin Hyper’s development.

For early adopters, the opportunity is even more attractive. Participants can stake their tokens before the network’s full deployment and earn an annual yield of up to 49% through the native staking protocol. This early participation not only amplifies potential returns but also strengthens the network’s liquidity base ahead of its official launch.

Access is designed to be simple and inclusive. Subscriptions remain open on the official Bitcoin Hyper website, with multiple accepted cryptocurrencies including SOL, BNB, ETH, and USDT. To streamline the process, the team recommends Best Wallet, a platform recognized for its reliability and smooth token management experience.

Notably, investors can easily purchase, monitor, and redeem the HYPER token upon its introduction because it is already featured in the “Upcoming Tokens” section.

With frequent updates on technological developments, roadmap milestones, and presale details, the project’s development team keeps a robust community presence on Telegram and X (Twitter). Their steadfast openness has contributed to the development of trust, which is typically lacking in new cryptocurrency efforts.

In the end, Bitcoin Hyper is more than just another speculative token since it serves as a philosophical and technological link between the past of Bitcoin and its possible future. By enabling a faster, more usable layer on top of Bitcoin, HYPER may play a big part in the next big crypto cycle, when the cryptocurrency not only maintains its value but actually moves with it.

For more details, visit the official Bitcoin Hyper website and explore how the project plans to redefine Bitcoin’s role in the global digital economy.

DISCLAIMER: This content is for informational and entertainment purposes only and does not constitute financial advice or investment solicitation. Cryptocurrencies, especially meme coins, are highly volatile and speculative. Always do your own research and consult with a licensed financial advisor before participating in any crypto project.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.