Our Terms & Conditions | Our Privacy Policy

Can BigEndian Challenge China’s Supremacy In CCTVs With India-Made Chipsets?

SUMMARY

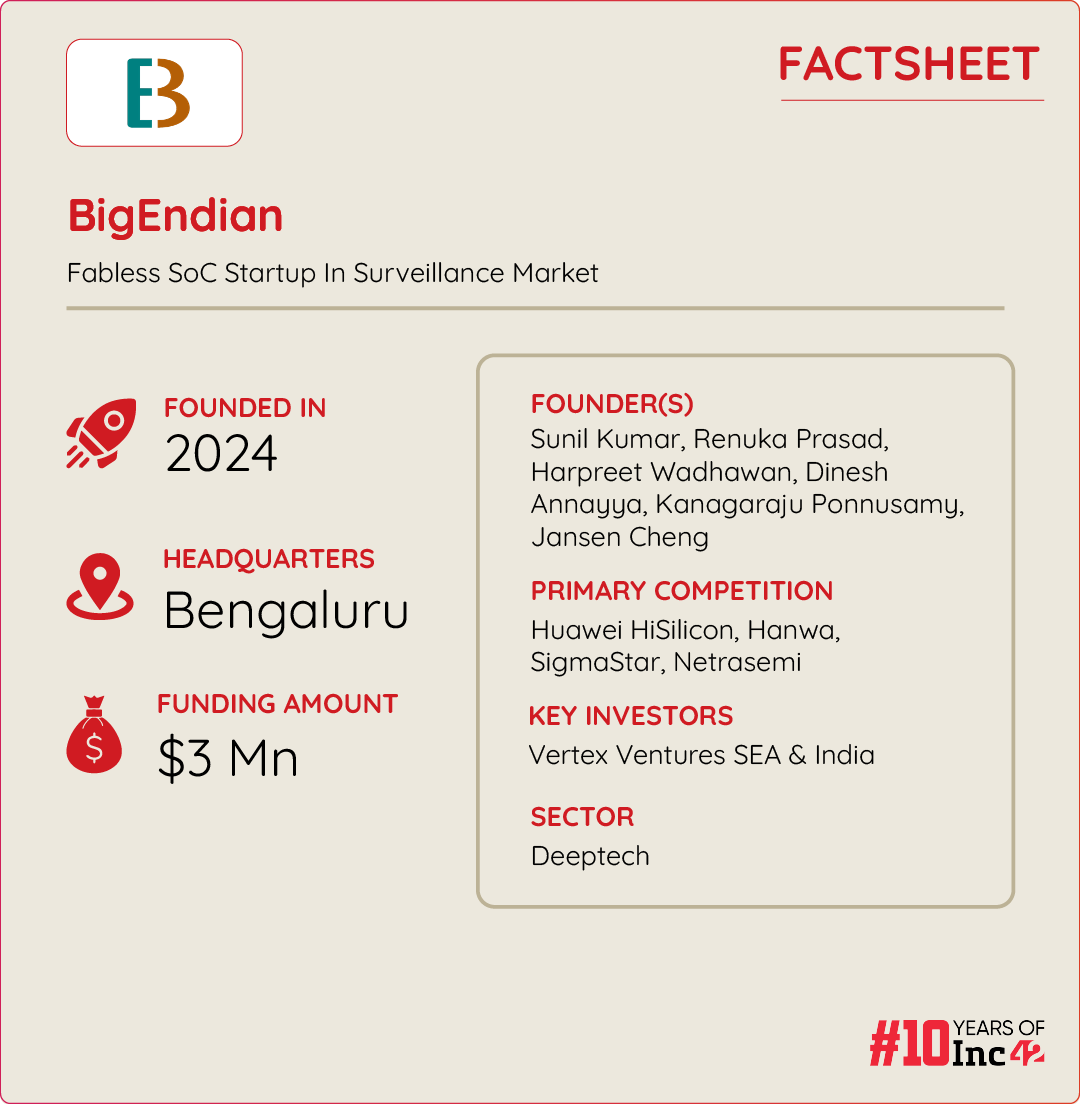

BigEndian is building chipsets that can replace Chinese components in CCTV cameras. With this, the startup addresses the growing concern about Chinese surveillance cameras becoming a threat to national security

Recently, the startup raised $3 Mn from Vertex Ventures SEA & India and a few other investors. BigEndian will use the funds to find the right design and EMS partners across the value chain for its upcoming products

Starting with the surveillance market, it will gradually venture into the automotive space and infrastructure and electronics segments

The influx of imported Chinese components in the Indian consumer electronics market for the last more than two decades has impacted the country’s ability to innovate. According to semiconductor industry veteran Sunil Kumar, the impact is visible from the fact that today a majority of original equipment manufacturers (OEMs) in the Indian electronics space are mere assembling units.

This is precisely why he incorporated BigEndian Semiconductors earlier this year, along with Renuka Prasad, Harpreet Wadhawan, Dinesh Annayya, Kanagaraju Ponnusamy, and Jansen Cheng.

Having helmed executive positions at companies like ARM, Intel, and Beceem (which taped out the world’s first 4G chipset from Bengaluru and got acquired by Broadcom in 2010), Kumar sees a massive opportunity to bring in breakthrough technology in the surveillance camera value chain – a sector he feels has seen minimal innovation over the years.

To achieve this, BigEndian is building chipsets that can replace Chinese components in CCTV cameras. If this happens, it would not only ensure domestic value addition but also heighten security, solving the growing concern about Chinese surveillance cameras being a threat to national security.

Notably, the company has been incorporated at a time when the Indian semiconductor and electronics manufacturing industry is trying to attract the attention of the nations that are serious about their “China-plus-one” strategy amid rising geopolitical tension.

In addition to this, the US has already banned Chinese telecommunications and video surveillance equipment and the UK has called for an official ban on these cameras in certain “sensitive areas” in the country. India, too, has recently limited the use of Chinese-manufactured surveillance equipment.

Meanwhile, although it sounds easy to ban Chinese CCTV OEMs, eliminating them from the Indian electronics ecosystem could prove to be tough unless India’s system-on-chip (SoC) players and semiconductor design and manufacturing industry step up their game.

Having raised $3 Mn recently, BigEndian has set its sail in this direction, with tailwinds of growth expected from the Indian semiconductor ecosystem projected to become a $150 Bn opportunity by 2030.

The BigEndian Inception Story

The founders have spent the last two years meeting industry stakeholders – from electronics manufacturing services (EMS) companies, government officials and regulatory bodies to Taiwanese original design manufacturers (ODMs) – to identify and bridge the gap created due to the absence of Indian chipsets makers.

By November 2023, the founders began their quest to find the investors who could back this idea. Besides the higher scope for innovation that the founders were looking for, a few other factors that drove them to foray into the surveillance market with BigEndian were more opportunities for B2G collaborations and an increasing demand for such electronic devices in the country.

As per a report, the India CCTV market is estimated to breach the $10.17 Bn mark by 2029, growing from $3.98 Bn in 2024. Out of the total consumption of these devices, there is an increasing demand for surveillance devices across government departments, including police, railways, defence, hospitals, and roads and highways.

For instance, Indian Railways has installed internet protocol-based video surveillance systems (VSS) at various stations for safety purposes.

“The government itself consumes about 40-45% of the total volume of surveillance cameras. Besides, we saw it would be a business where there is a interest from the government,” Kumar said.

He added that all founders were clear from day one that they wouldn’t foray into a market that is already highly saturated, like automobile.

“Surveillance fitted into all our buckets and the rest is history,” Kumar said.

After months of R&D, BigEndian is currently doing a shuttle run with its fabrication plant that would produce its chipsets. The startup is aiming to launch its first chipset by May 2025.

Recently, it raised $3 Mn from Vertex Ventures SEA & India and a few other investors. BigEndian will use the funds to find the right design and EMS partners across the value chain for its upcoming products.

A Sneak Peak Into BigEndian’s Potential Market

As an SoC player focussed on the CCTV camera industry, BigEndian’s chips are expected to be used by major brands such as Philips, Godrej, Honeywell, Bosch, and other Indian and global surveillance device manufacturers.

However, despite this potential market scope, the startup is unlikely to sell its chipsets directly to these companies. Instead, BigEndian’s primary customer base will be original design manufacturers (ODMs).

“We understood that the first piece of the puzzle we needed to solve was not the end brand that buys the product from the ODM but the ODMs themselves. We wanted to plug the ODM piece first because they are the people who will engage with the semiconductor companies, understand reference design, and build the printed circuit board assemblies (PCBAs),” explained Kumar.

For this, BigEndian tied up with a Taiwanese ODM, which will be the lead partner for the startup once its test chip is out in May.

“The Taiwanese ODM will use the test chip to build the actual device, what we call as form factor reference design, which will then be then be optimised for the price point, the exact discrete components like lens, sensor casing, power supply, etc.,” he added.

Currently, BigEndian is witnessing significant traction for its surveillance SoCs from the Global South, which includes Africa, Southeast Asia, and Latin America. However, per the CEO, India continues to remain the key focus for the company, which it would continue prioritising.

“Before stepping up the value chain to supply to other markets, we need to be successful in our home market first. While there is solid traction from other places, we have told our investors that India will be our starting place,” Kumar said.

Where Do BigEndian’s Aspirations Lead To?

Limiting its potential to the surveillance market alone would not be beneficial for BigEndian in the long run, and hence, the company has bigger plans in place.

Starting with the surveillance market, it will gradually venture into the automotive space and infrastructure and electronics segments.

“We are eyeing the industrial segment next, as India consumes a lot of microcontrollers, digital chipsets and analogue chipsets for the power sector, industrial automation and basic consumer electronics,” Kumar said, adding that it is a long journey ahead.

Further, stating that he is overly cautious about building value over valuation, the CEO said that the company’s expansion would only depend on its success in the surveillance market. As of now, the startup is planning for a roadshow to raise additional funds in December this year.

Meanwhile, the dominance of Chinese SoC companies like Huawei HiSilicon, Hanwa, and SigmaStar remains a major challenge for BigEndian. Apart from that Indian players such as Netrasemi and Mindgrove, too, pose significant threats to the company forging ahead with six semiconductor veterans to dominate the surveillance market with its chipsets.

Overall, according to an Inc42 report, the Indian semiconductor market is set to breach the $150 Bn opportunity mark by 2030, growing from a mere $33 Bn in 2023.

[Edited By Shishir Parasher]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.