Our Terms & Conditions | Our Privacy Policy

FMCG TV, print ad volumes dip by 6% in H1’24: TAM AdEx report | Advertising

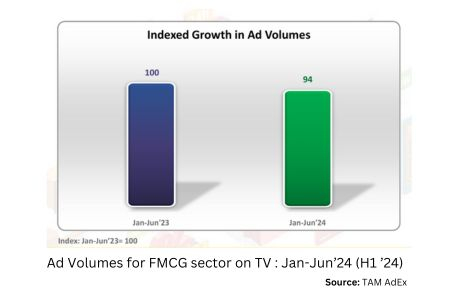

Between January to June 2024, FMCG ad volumes for television witnessed a decline of 6% over the corresponding period last year, while digital medium showed a positive, 7% growth. This was revealed in the Advertising Report on the sector (January to June, 2024) by TAM AdEx. The latest half yearly report (H1’24) for the sector demonstrates varied advertising performance across media platforms.

Television trends

Comparing the month-on-month performance, May 2024 had the highest, 18% share of the FMCG TV ad volumes. Among product categories, toilet soaps (10%) retained its No 1 position even this year.

Among the top FMCG advertisers, Hindustan Unilever stood first with 18% share of TV ad volumes. Among the top 10 FMCG brands, six belonged to Reckitt Benckiser (India), with ‘Harpic Power Plus 10x Advanced’ securing the topmost rank.

Prime time attracted the highest FMCG advertising on TV followed by the afternoon and morning time-bands. Prime time, afternoon, and morning time bands together accounted for 72% share of ad volumes.

Among genres, GEC emerged as the most preferred one by FMCG advertisers in H1’24. The top two channel genres combined, GEC and movies, accounted for 63% of the total ad volumes for the sector during this period.

The paper crumbles?

Much like television, the print advertising witnessed a decline of 6% in FMCG ad space during January to June, 2024 period compared to Jan-Jun’23. Among months, January 2024 recorded the highest share of FMCG ad space I.e. 20%, followed by March 2024 with 18% share in H1’24. Whereas, May 2024 had the lowest share of ad space (14%) in H1’24.

Digestives maintained their No 1 rank among categories in H1’24 and in H1’23. Among advertisers, Munimjee & Sons, Mankind Pharma, Vicco Laboratories, Shree Baidyanath Ayur Bhawan, and Hamdard were the new entrants in the top 10 list of advertisers in H1’24 over H1’23.

Analysing the geographic distribution of FMCG print ad volumes, north zone emerged as the top territory with 38% share of ad space during H1’24. On pan-India basis, Mumbai and New Delhi were the top two cities for this period.

Demand for digital

The ad impressions in digital medium showed an increase of 7% in H1’24 over H1’23. Among months, March 2024 demonstrated the highest ad impressions (22%), whereas February 2024 had the lowest share of impressions (13%).

While hearing aids (8%) emerged as the top-ranked FMCG category in terms of digital ad impressions in H1’24, L’Oreal India topped among FMCG advertisers with 9% share of ad impressions. Among top 10 brands, Hear.com retained the 1st position with 8% share of ad impressions in H1’24 over H1’23.

Incidentally, No 1 positions in all these three groups, product category, organisation, and brand, were captured by the health and wellness sector.

Programmatic advertising (84%) was the top transaction method for digital FMCG advertising based on impressions during H1’24. Programmatic and Programmatic/Ad Network transaction methods together captured 91% share of FMCG ad impressions on digital media platforms.

Radio: Marginal growth

The FMCG ad volumes on radio showed no resounding growth, rather a marginal increase of 1% during H1’24. Among months, January 2024 recorded the highest, 20% share of FMCG ad volumes on radio.

While Pan Masala with 7% share topped the radio ad volumes for FMCG, sugar was a new entrant in the top 10 list of categories this year. Among states, Gujarat won the No 1 position, followed by Uttar Pradesh during H1’24 in terms of ad volumes by FMCG.

Of time-bands, FMCG advertisers gave preference to the Evening band followed by the Morning time-band on radio. Evening and Morning time-bands combined controlled 68% share of the FMCG ad volumes during H1’24.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.