Mt. Gox’s prolonged repayment saga extends into 2026, keeping 34,000 BTC off the market and easing near-term sell pressure.

The move delays what would have been a supply shock to the Bitcoin market for the third time. It was initially set for October 31, 2023, and October 2025 after that.

Sponsored

Sponsored

Bitcoin rose nearly 4% in the past 24 hours to trade at $115,559 as of press time. The move follows defunct exchange Mt. Gox again, delaying its long-awaited creditor repayments by another year, now set for October 31, 2026.

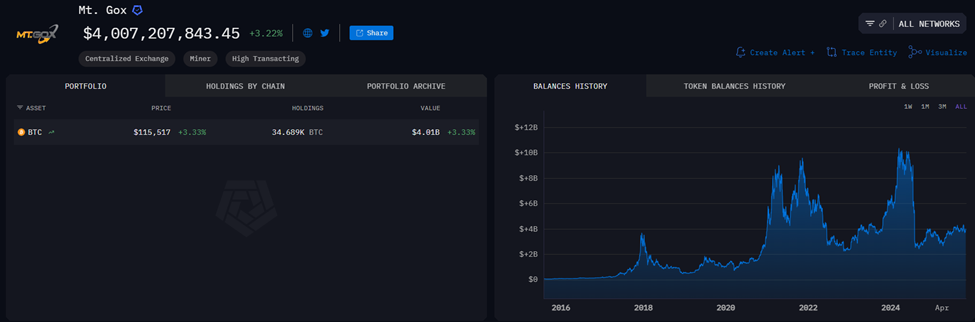

INTEL: Mt. Gox has delayed creditor repayments by another year, now due Oct 2026. The exchange still holds 34,689 BTC awaiting distribution.

— Solid Intel (@solidintel_x) October 27, 2025

A Japanese court authorized the decision, meaning roughly 34,689 BTC will remain locked away for at least another twelve months. This limits the immediate risk of a large-scale selloff.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

The new notice, dated October 27, 2025, from rehabilitation trustee Nobuaki Kobayashi, explains that while “repayments to eligible creditors are largely completed,” many cases remain unresolved due to incomplete procedures and administrative issues.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” Kobayashi stated in the letter, citing court approval for the one-year extension.

Sponsored

Sponsored

Legal Delays and Lingering Fallout

The extension highlights the lingering technicalities of the 2014 Mt. Gox collapse. Hackers stole around 850,000 BTC worth $450 million from what was once the world’s largest Bitcoin exchange.

Over 127,000 users have awaited compensation for over a decade, as legal proceedings and asset recovery efforts dragged on. Blockchain data still shows the exchange’s wallets holding 34,689 untouched BTC, valued at over $4 billion at current prices.

Mt. Gox BTC. Source: Arkham

Mt. Gox BTC. Source: Arkham

According to BeInCrypto’s earlier reporting, Mt. Gox wallets recently showed movement for the first time in seven months, fueling speculation about test transfers ahead of distributions.

Analysts noted that similar activity in the past preceded repayment events. However, the latest development regarding a one-year delay assuages the market and serves as a stabilizing event for Bitcoin.

CryptoQuant analyst Mignolet previously warned that if the trustee fails to secure further extensions, the eventual release of 34,000 BTC could “become a catalyst for creating FUD once again.” This has now been avoided.

The fears abounded as weakening liquidity in OTC (over-the-counter) markets raised concerns. Unlike last year, that volume is now weakening, raising uncertainty about whether the market could absorb 34,000 Bitcoins at once as it did before.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.