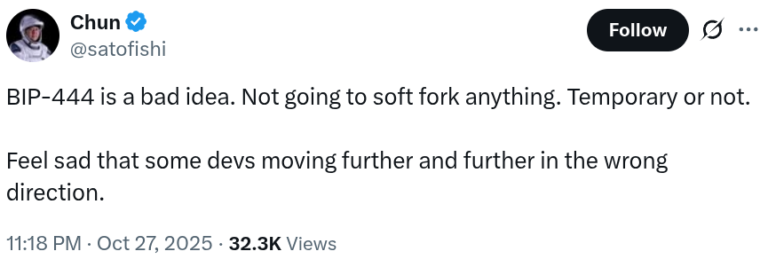

Chun Wang, co-founder of major Bitcoin mining pool F2Pool, pushed back against a proposed temporary soft fork aimed at limiting data spam on the Bitcoin network.

Wang wrote in a Monday X post that “BIP-444 is a bad idea.” He added that he, and presumably F2Pool, are “not going to soft fork anything,” whether it is “temporary or not.”

He said, “Feel sad that some devs [are] moving further and further in the wrong direction.”

Bitcoin Improvement Proposal (BIP)-444 is a temporary soft-fork proposal for the Bitcoin network aimed at restricting the inclusion of arbitrary data, which its proponents view mainly as spam. The soft fork would limit non-transaction data — which enables alternative uses for the Bitcoin blockchain — to 83 bytes, among other limitations.

Source: Chun Wang

Related: Bitcoin upgrade is splitting developers and purists

BIP-444 and its raison d’être

BIP-444 appears to be a response to a late September update from leading Bitcoin node software Bitcoin Core. The update in question removed the 80-byte cap on OP_RETURN, a part of a transaction script that allows users to embed arbitrary data.

Many have viewed the change as corporate capture of the Bitcoin blockchain, since it allows companies to build layer 2s and other infrastructure on Bitcoin. Furthermore, some argue that allowing more arbitrary data onchain results in faster increases in blockchain size, higher node requirements and greater centralization.

Others pointed out that this is part of a debate that dates back to the very early days of Bitcoin (BTC). Additionally, proponents of the change highlight that it is hard to ensure miners enforce a rule that goes against their own incentives. A January 2024 review revealed that miners, such as F2Pool, were already including non-standard transactions that exceeded OP_RETURN limits.

The BIP, submitted by pseudonymous developer Dathon Ohm, is called a “Reduced Data Temporary Softfork” and suggests to “temporarily limit the size of data fields at the consensus level.” The limit would last until Bitcoin block 987,424, or about 1.27 years from now.

In a dedicated mailing list, the creator explained that “the idea is to strongly reaffirm in consensus that bitcoin is money, not data storage.” “After a year, the soft fork expires, giving us time to come up with a more permanent solution,“ they said.

Related: Ordinals dev floats forking Bitcoin Core amid censorship concerns

What does BIP-444 do?

BIP-444 is a temporary soft fork that would close most data-embedding paths on Bitcoin, including stricter size caps on outputs and pushes, bans on annex, unknown witness versions, deep Taproot trees, OP_SUCCESS* and conditional branches. This limits Ordinal-based non-fungible token (NFT) creation, large data payloads and complex scripts while keeping simple monetary unaffected.

The BIP text argues that with modern data compression, it is possible to embed “objectionable images (often illegal to even possess) in as few as 300–400 bytes.” This would allow “a malicious actor to mine a single transaction with illegal or universally abhorrent content and credibly claim that Bitcoin itself is a system for distributing it.”

Bitcoin developer and cypherpunk Peter Todd, on the other hand, stated that the approach is also ineffective in achieving its intended goal. Todd demonstrated this by embedding the entire BIP-444 text in a Bitcoin transaction that would be compliant with the soft fork.

Still, the proponent of the change highlighted that sending it costs over $100 in fees and argued that if embedding illegal data is made harder, “it would not make sense to hold node operators legally responsible.” They explained:

“If Bitcoin provides an officially supported method of storing arbitrary data […] node operators could conceivably be held responsible for possession and distribution.“

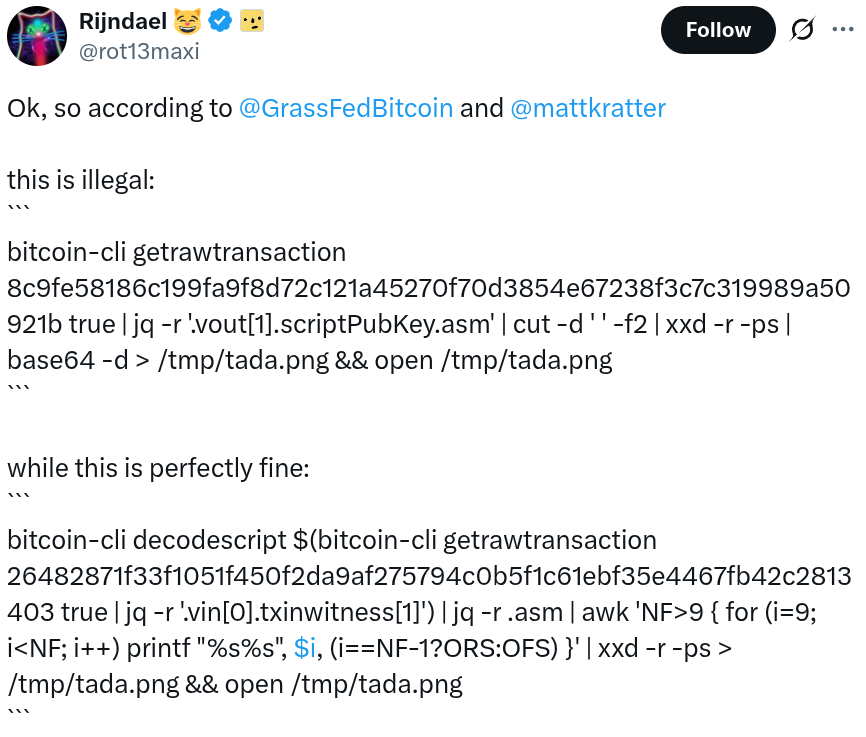

Still, some view the distinction as arbitrary and unrealistic. One X user demonstrated the idea by sharing two commands that would gather data from an image stored on the Bitcoin network, highlighting how scarce the differences are in practice.

Source: Rijndael

Source: Rijndael

Magazine: ZK-proofs are bringing smart contracts to Bitcoin

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.