Alexander Baldvin, Analyst and Consultant

For most of the people in Central Asia, forex trading is a niche area; heard of but not understood clearly.

Forex trading is a scalable economic activity. The potential ranges from an attractive side income to full-scale, lucrative and steady source of income.

All you need is internet access and a willingness to learn. Today, you can start trading on global financial markets using just a phone or laptop—from anywhere in the country, without being tied to a specific location.

Forex trading is permitted in all of the countries of Central Asia – Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. However, before entering the field of forex trading, the citizens of each country must familiarize themselves with the rules and regulations governing the entire spectrum of this activity.

In general, citizens of Central Asia can engage in forex trading and crypto currency activities to varying degrees, often subject to licensing, registration, or using authorized platforms.

However, regulations evolve, and individuals should consult local authorities or legal experts for personalized advice. Note that forex trading typically falls under broader foreign exchange and financial market rules, while cryptocurrency has seen more recent developments in regulation across the region.

What is trading and why do you need it?

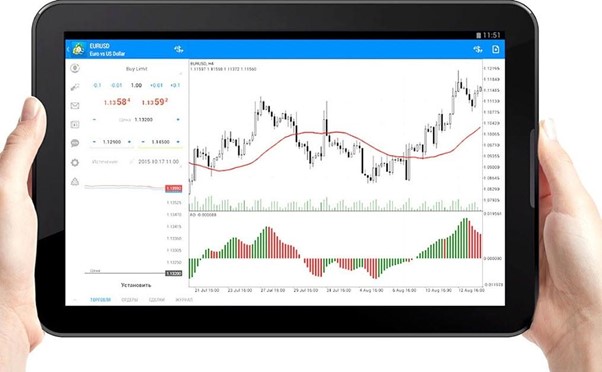

Simply put, trading is speculation on financial markets. You buy and sell various assets: currencies (dollars, euros), precious metals (gold, silver), oil, shares of global giants (Apple, Google), or cryptocurrencies, profiting from their price fluctuations. CFDs (contracts for difference) are especially popular among beginners, allowing you to trade without directly owning the asset.

The advantage of CFDs is that you can start with a very small amount and manage your trades with leverage. Leverage is a tool that allows a trader to open a position with an amount many times greater than their own capital. Furthermore, you can even trade on a downward price (so-called “short selling”).

For example, with $100 in your account and a leverage of 1:50, you can open a trade equivalent to $5,000. This sounds tempting, but it also poses a major risk for beginners. It’s important to remember that leverage is a financial accelerator that works in both directions. The key is not to overuse it, as trading leverage increases both potential profit and potential loss equally.

How does it work?

Depending on the access to foreign financial platforms, there are many international CFD brokers providing services to the people. The key is to choose a broker with a proven track record and, most importantly, convenient and effective methods for depositing and withdrawing profits (e.g., via cryptocurrency or e-wallets) that are not subject to restrictions imposed by local banks.

On the Brokers.best portal , you can view ratings of forex brokers working with clients from Turkmenistan. This reliable source of information features licensed companies with clear terms and conditions and Russian-language support.

For example, go to Brokers.best’s rating of brokers for Turkmenistan

Why Just2Trade is worth considering

One of the recommended brokers for traders in Central Asia including Turkmenistan is Just2Trade.

This international platform offers access to a wide range of instruments: currency pairs, metals and oil, US, European, and Asian stock markets, and cryptocurrencies.

- At Just2Trade you can open an account starting from 100 USD .

- MetaTrader 5 platform is convenient and popular among traders worldwide, with a huge number of indicators and expert advisors.

- High-quality analytics and support , and you can also subscribe to market reviews delivered directly to your email.

- Importantly, there’s a full-fledged demo account where you can practice risk-free, creating your own trading strategy or testing a ready-made one found online.

Even with a deposit of just 100 USD, you’ll gain access to global markets and begin developing the most important skill—trading.

Check out the detailed review Just2Trade broker

Why start with a demo account or a small deposit?

Trading requires practice, like driving a car or playing a musical instrument. You can’t just read a book and become a master. A demo account allows you to, as they say, “get a feel” for the market, try out different strategies, and learn how to place orders without losing a penny. It’s the perfect way to understand the basic mechanics.

But the main task at this stage is to learn discipline. Here’s a simple plan for doing this in practice:

- Write clear rules for your strategy: when to enter a trade, where to place a stop-loss, and when to take profits.

- Keep a trading journal: meticulously record the reasons for each trade, your emotions at the time (fear, greed, hope), and note any violations of your own rules.

- Trading with a plan means not trading without a plan. If your strategy doesn’t provide an entry signal, you’re not trading. Patience is just as important as chart analysis.

- Set goals for the process, not for profit. Your goal in the first stage isn’t to earn $50, but to complete 10 trades strictly according to the rules, without a single violation.

Start with a demo account or a minimal amount to develop the habit of following the rules without fear of losing significant funds. Once you feel more confident, move on to a live account. With just $100, you’ll have more than enough to experience real trading and gain the first, most important results.

For the countries of Central Asia, including Turkmenistan, trading can be a window into the world of global finance and an opportunity to expand beyond the confines of the traditional economic space. However, it’s important to understand that this is a serious endeavor that requires study and discipline. If you’re not from Turkmenistan, check out the ranking of reliable brokers for traders from your country on the website. Brokers.best .

Author Bio: Alexander Baldvin, an experienced analyst and consultant at a trading school with 15 years of experience. Having previously worked as a broker, I have a strong understanding of banking and capital management. I trade on crypto exchanges using my own methodology. In my free time, I enjoy collecting NFT digital paintings. I am particularly drawn to the work of contemporary artists who create unique art objects.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.