Our Terms & Conditions | Our Privacy Policy

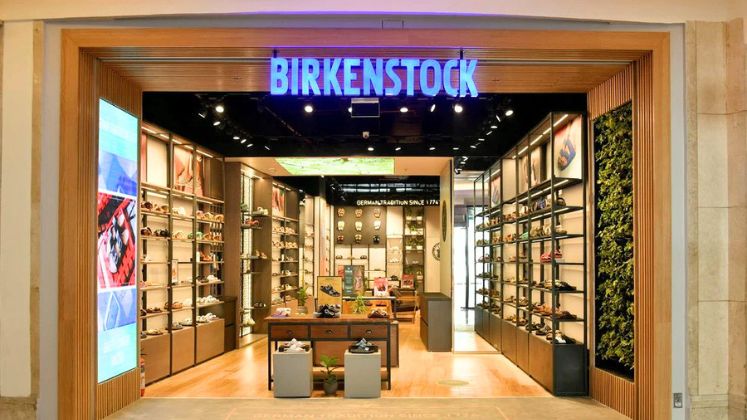

Birkenstock sees India sales growth slow down

Image Courtesy: Birkenstock

Image Courtesy: Birkenstock

German shoe firm Birkenstock, which has quadrupled its income annually since opening in India around five years ago, saw a halving of its sales growth in 2023–24 to US $ 20 million, while surpassing the majority of sports and footwear brands, albeit on a lower basis.

The company’s revenue growth rate dropped to 46 per cent in 2023–2024 from over 110 per cent in the previous two fiscal years, per regulatory filings. With its distinctive cork and latex-molded footbeds, the company that makes orthopaedic-looking footwear gained prominence during the COVID-19 epidemic as workplaces became more informal and comfort became a top concern. Nevertheless, the demand for the majority of lifestyle and discretionary goods has decreased over the last six to eight quarters, putting a stop to their run after the pandemic’s end, when stores almost doubled their sales in two years.

The rise in demand for casual footwear is one example of how experts claim that the current trend of casualisation has greatly impacted consumer choices, leading people towards a “comfort over fashion” approach. The evolving dynamics of the workplace, where a more lenient dress code has developed and permits employees to choose semi-formal or informal wear, highlight this change.

In 2019, the company made its e-commerce debut in India, and a year later, it set its shop at the Delhi airport. It has increased its door count to over 40 shops and seen its revenue more than double annually for the last four years.

When the footwear brand went public in October 2023, it raised over US $ 1.48 billion, which put Birkenstock’s valuation at nearly US $ 8.64 billion. To reduce debt, the retailer got a third of the proceeds; the remainder went to its largest stakeholder, the private equity firm L Catterton, which is supported by the French luxury fashion brand LVMH.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.