Our Terms & Conditions | Our Privacy Policy

CMA Sri Lanka presents budget proposals for promotion and development of SME sector – Business News

The CMA Sri Lanka SME Development Committee comprises members from professional bodies, commercial banks, chambers of commerce and industry and industry experts, who have been meeting since April 2020 to find solutions and support the small and medium enterprise (SME) sector.

The committee has organised conferences, workshops and UN Micro, Small and Medium Enterprise (MSME) Days annually since 2021. The chief guest at the last UN MSME Summit was Asian Development Bank (ADB) Country Director Takafumi Kadano.

The United Nations states, “Let’s not forget that MSME enterprises, which generally employ fewer than 250 persons, are the backbone of most economies worldwide and play a key role in developing countries.”

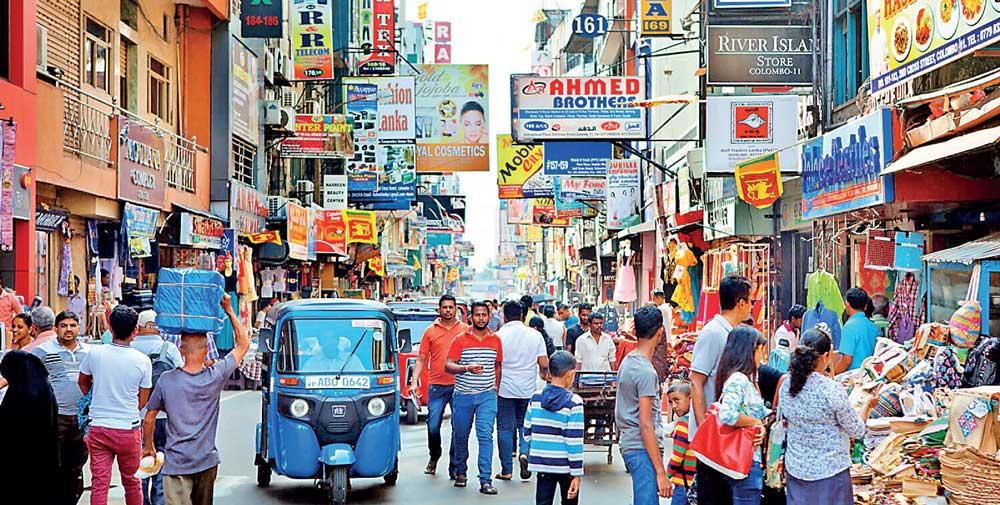

In Sri Lanka, MSMEs comprise more than 75 percent of enterprises and account for 52 percent of GDP, 45 percent of employment and a meagre 5 percent in exports. The UN General Assembly has declared June 27 as the Micro, Small and Medium-Sized Enterprises Day, to raise public awareness of their contribution to sustainable development and the global economy. CMA Sri Lanka SME Development Committee has been celebrating this event annually by organising very successful conferences along with the banking sector and their SME customers.

Some of the budget proposals, which the committee wishes to make for the development of the SME sector, are as follows:

1. Expedite SME Credit Guarantee Institution to commence operations immediately to benefit entrepreneurs and start-up projects

One of the significant achievements of the committee was the recommendation made to the Industries Ministry in 2020 to submit a Cabinet Paper to reactivate the SME Credit Guarantee Institution, which was initiated with a loan of US $ 100 million from the ADB and included in the budget proposals in 2017 to provide guarantees to entrepreneurs and start-ups to obtain loans without providing collateral. This project, which was put in cold storage, was still listed in the pending loan portfolio of the ADB. The committee found this out and made representations to the Industries Minister. He submitted a Cabinet Paper, which was approved by the Cabinet on April 27, 2021 and handed over to the Finance Ministry External Resources Department. The committee has been informed it is now ready to be launched, fulfilling a great need to support those who are unable to provide collateral or security to banks. This will benefit and promote start-up young entrepreneurs and women-led SMEs and many others who are unable to provide collateral to the banks and lending institutions.

The committee wishes to suggest that action be taken to expedite the commencement of the Credit Guarantee Institution at an early date.

2. Setting up of export houses to promote and develop MSME exports

The committee also wishes to recommend the setting up of export houses to promote exports of MSMEs approved by the Export Development Board (EDB). They will market the products and services of MSMEs and SMEs in overseas markets and will mainly support local farming and fishery communities, local suppliers – producers – manufacturers, export villages, service providers such as IT and suppliers of technical skills with international buyers in the global market to increase the MSME contribution towards national exports from the present 5 percent to 15 percent within three to five years. The registration with the EDB will give official recognition to the export houses and it is requested that the EDB supports them when organising international exhibitions and will also assist them in obtaining bank facilities for undertaking exports.

3. Definition for MSMEs

(a) It is suggested to revise the present definitions to fall in line with the depreciation of the currency, which has resulted in the price of most goods increasing substantially, including capital goods, raw materials, wages, etc. It is suggested to increase the upper limit of turnover of the medium sized enterprises to Rs.1,000 million, which is similar to the Central Bank classification.

4. Suggest that an MSME Development Act be enacted with the object of promotion and development and enhancing competitiveness of MSMEs, similar to other countries, to give necessary support to this most important sector.

The act should be a single legal framework for the MSMEs’ registration, governing and providing protection to the small industries and their employees throughout Sri Lanka. The national board established under the act shall have power to implement various schemes and policies for upliftment of the MSME sector and as a result, the MSME sector to be made a major contributor of industrial production and exports. The act should, as a necessity, make the MSME sector a vibrant and dynamic sector of the Sri Lankan economy and it will provide protection to the SME sector.

5. Support in accounting, financial and cost management, digitisation and e-commerce

The maintenance of proper books, accounts and cost records is recommended, as this will enable the business organisations to run profitably and to gradually advance to SMEs. Digitisation will support accounting while marketing aspects could be expanded using e-commerce. Maintenance of financial and cost records will also assist the banking sector when lending to the SME sector to provide loans with no additional security.

6. Building entrepreneurship

Turning unemployment into entrepreneurship was an address made at the 2024 CMA Sri Lanka UN MSME Summit in Colombo by the speaker from Grameen Trust of Bangladesh, which the committee is now working on.

He stated that to address this global problem and achieve zero unemployment through turning unemployment into entrepreneurship, Professor Muhammad Yunus, the Nobel Laureate, launched the programme ‘New Entrepreneurship Programme’, which is commonly known as ‘Nobin Programme’ on the ground, on September 4, 2013.

The above reforms will enable the resurgence of the MSME sector to continue playing their crucial role in creating decent jobs and improving livelihoods. Small businesses also depend more than ever on an enabling business environment, including support for access to finance, information and markets.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.