Our Terms & Conditions | Our Privacy Policy

India’s No. 1 Hotel Company: Can the Leader’s bold 2030 vision drive Its stock higher? – Stock Insights News

By Madhvendra

Indian Hotels (IHCL) has emerged as a trailblazer in the Indian hospitality sector. Over the past five years, its stock has surged by an impressive 450%, reflecting a journey driven by robust demand amid limited hotel room supply, rising average room rates (ARR), and improving revenue per available room (RevPAR).

Once known primarily for its flagship Taj hotels, IHCL has evolved into a multi-brand powerhouse with a presence across luxury, premium, and budget segments. However, IHCL doesn’t want to remain just a hotel player; it is strategically diversifying to become a comprehensive hospitality ecosystem.

The company’s forward-looking initiatives, including expanding new-age offerings like Ama Stays & Trails and Qmin and its asset-light model, have redefined its growth trajectory. To keep its growth on track and capitalise on new opportunities, it has set an ambitious goal for 2030.

With India’s tourism sector witnessing strong growth, premiumisation, rising per-capita income, and a shift toward personalised hospitality experiences, IHCL is well-positioned to capitalise on these opportunities through its diversified offerings and strategic initiatives.

This article will examine its visionary 2030 goals and how it plans to achieve them. We’ll also explore its financials and current stock valuation. The goal is to understand how Indian Hotels is positioning itself for the future and whether its strong performance so far can continue.

IHCL’s 2030 ambitions focused on expanding and strengthening presence

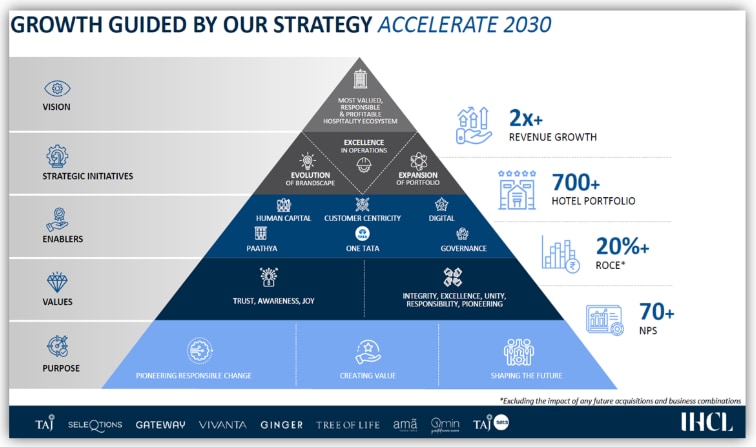

IHCL has set forth an ambitious plan to tap into India’s tourism potential via its “Accelerate 2030” initiative. Over the next five years, the company intends to invest up to ₹50 billion for this purpose.

Their vision encompasses expansion, revenue growth, an asset-light approach, and a commitment to shareholders through a dividend strategy.

Under this plan, IHCL aims to increase its hotel portfolio from 311 to over 700 (operational and under development). Additionally, it seeks to double its consolidated revenue to ₹150 billion.

IHCL 2030 vision aims at diversification to sustain its growth

Source: IHCL Q3FY25 Investor Presentation

Source: IHCL Q3FY25 Investor Presentation

IHCL has also considered shareholders in its 2030 vision. To increase shareholder value further, it has announced a dividend policy that allocates 20-40% of profit after tax (PAT) to shareholders.

Now that we understand its long-term plan, let’s dig deeper and find out how it plans to achieve it.

IHCL manages a diversified portfolio of five hotel brands: Taj, Vivanta, Seleqtions and Ginger. Its portfolio comprises 310 hotels: 110 under the Taj brand, 39 under Seleqtions, 57 under Vivanta, and 90 under Ginger. Recently, it launched another brand, Gateway, which has a portfolio of 17 hotels.

Additionally, the portfolio features the newly introduced brand “Tree of Life,” which consists of 14 hotels. Besides, IHCL also owns Ama Stays & Trails, a heritage bungalow and luxury homestay chain.

The Taj brand and Ama Stays focus on the luxury segment, whereas Seleqtions and Vivanta fall under the upper-upscale category. Ginger, on the other hand, serves the mid-scale and economy segments.

IHCL aims to more than double the number of hotels by 2030

The company plans to reach its target of 700 hotels by 2030 by scaling new brands and expanding into new regions.

Growth will stem from emerging brands—including Ginger, Gateway, and Tree of Life—projected to increase from 141 hotels in 2024 to 400 by 2030. Of this, Gateway alone has a target of reaching 100 hotels by 2030.

Also, premium brands like Taj, Seleqtions, and Vivanta will grow from 209 hotels in 2024 to 300. The company also aims to expand “Taj” internationally, especially in the Middle East and South Asia.

IHCL follows two business strategies: capital-light and capital-heavy

The company employs two primary business strategies: capital-light (managed properties) and capital-heavy (owned).

In the capital-heavy approach, IHCL directly oversees them, resulting in a capital-intensive balance sheet that demands substantial investment.

In the capital-light approach, IHCL concentrates on property management rather than ownership, generating management fees (a fixed share of gross income) for handling these assets.

Moreover, it also earns an incentive fee based on the hotel’s operating profit. Since management contracts generate revenue without operational costs, increasing the number of these contracts enhances the company’s EBITDA margin.

IHCL’s focus on managed properties have boosted business and return ratios

In the past, the IHCL hotel portfolio was primarily composed of owned properties, with a ratio of 70:30 for owned to managed hotels in FY18. A predominantly owned property portfolio in an industry with excessive supply is a recipe for poor returns.

As a result, this led to lower profitability, weak Return on Equity (RoE), and Return on Capital Employed (RoCE). Its shares have also stagnated, resulting in disappointing shareholder returns.

Therefore, the company revised its strategy to focus on capital-light managed properties. The focus on owned properties has now been limited to projects with a high return potential only. This transition changed the owned-to-managed hotels ratio from 70:30 to an even 50:50 in FY25E.

This marked a turning point for IHCL as it entered a period of profitable growth, enhancing its RoE and RoCE. Post-pandemic revenge travel, increasing RevPAR, and ARR proved a boon for IHCL as operating leverage kicked in.

Focus on management of properties amplified its profitability and return ratios

Source: IHCL Q4FY24 Investor Presentation

Source: IHCL Q4FY24 Investor Presentation

Furthermore, management fees increased significantly by 151%, reaching ₹4.7 billion in FY24. The company is on track to reach the target of ₹5.5 billion by FY26.

Management fees grew 151% during FY18-24

Source: IHCL Q4FY24 Investor Presentation

Source: IHCL Q4FY24 Investor Presentation

IHCL aims to sustain growth by increasing managed properties by 2030

Looking ahead, IHCL is also focusing on keeping this growth lever intact. It aims to increase the ratio of managed properties by 57% by FY29, according to Axis Capital.

IHCL has set a target of ₹10 billion in management fees by 2030. However, Axis Capital projects that IHCL will surpass this milestone earlier, reaching ₹11 billion by FY27 at a CAGR of 33% over the next three years. As a result, these fees will represent 12% of its hotel revenue by FY27, up from about 7% today.

Managed hotel will add 12% to its total hotel revenue.

Source: Axis Capital Indian Hospitality (December 2024)

Source: Axis Capital Indian Hospitality (December 2024)

Premium properties to drive managed portfolio growth

IHCL plans to achieve this by increasing the share of managed properties under its Taj, Seleqtions, and Vivanta brands. This is because high-end properties require significant capex and have a longer payback period.

Axis Capital expects managed Taj properties to grow from 41% to 57%, while Seleqtions and Vivanta are projected to reach 79% by FY29. This will further help the company boost its profitability, EBITDA margin, RoE and RoCE.

Share of owned Taj rooms to fall by FY29

Source: Axis Capital Indian Hospitality (December 2024)

Source: Axis Capital Indian Hospitality (December 2024)

In contrast, Ginger focuses on the mid-scale market and requires reduced construction costs. Therefore, IHCL intends to expand this segment through its ownership model. Additionally, IHCL is transforming Ginger into a “lean-luxe” brand, necessitating its control.

Qminisation to fuel ginger’s growth, expected to be IHCL’s key growth lever

Ginger’s revenue has grown steadily at a 15% CAGR, reaching ₹486 crore from FY19 to FY24. This growth was driven by increased ARR and food and beverage (F&B) revenue. The brand boasts a robust EBITDA margin of 41%.

Source: IHCL Q4FY24 Investor Presentation

Source: IHCL Q4FY24 Investor Presentation

IHCL has transformed the Ginger brand into a ‘lean-lux’ concept, introducing various upgrades to products and services.

Part of this change includes launching Qmin restaurants (termed Qminisation) within Ginger Hotels, which is expected to help Ginger sustain its growth.

Axis Capital projects that Ginger’s revenue will grow at 23% CAGR from FY24- 27. This growth is expected to be driven by a 7% CAGR in owned rooms and a 10% CAGR in ARR, thanks to enhanced offerings.

Moreover, improved profitability arising from rising food revenues and ARR will further boost IHCL’s management revenue from the brand.

With the “Qminisation” process in place, Ginger is expected to become IHCL’s key growth engine in the coming years. As the Ginger Hotels portfolio expands, the anticipated increase in revenue and EBITDA will bolster IHCL’s overall financials.

IHCL transforming into a ‘House of Brands’

IHCL is transforming into a diversified ‘House of Brands.’ This shift is designed to target different market segments, increase revenue streams, and further strengthen its leadership in the hospitality industry. Here’s a closer look at its other brands:-

- TajSATS:- It is India’s leading airline catering service provider with a 60% market share. It partners with over 40 domestic and international airlines, serving over 150,000 meals on over 1,000 flights daily. The brand is growing strongly, with its revenue increasing 40% YoY to ₹9 billion in FY24.

TajSATS Revenue Grew 40% in FY24, with Strong Growth in EBITDA & Margin

Source: IHCL Q4FY24 Investor Presentation

Source: IHCL Q4FY24 Investor Presentation

TajSATS has eight kitchens, which it plans to increase to nine in FY25. Moreover, It is also diversifying into providing institutional catering services to corporate houses, sports events, healthcare institutions and QSR chains to fuel growth plans.

- Qmin:- This multi-format F&B brand provides food delivery services across 27 cities. Qmin caters to bulk orders for corporate and social clients, among others, and is also available at Ginger Hotels. In FY24,

Qmin recorded a 73% increase in Gross Merchandise Value (GMV) to ₹1.1 billion. 53% of the revenue was generated from Ginger Hotels, and the remainder from food delivery. As mentioned earlier, this section is expected to be essential for Ginger’s growth.

- Ama Stays: It has Ama Stays, which has been on accelerated growth with 200 portfolios, of which 100 are operational. It has recorded a 42% increase in GMV in FY24. As operations of the rest 100 open, it will also support its growth.

- The tree of life resorts: IHCL entered a strategic alliance last year with The Tree of Life Resorts & Hotels. It has 14 boutique luxury resorts in serene locations. The company aims to grow this to 100 by 2030.

- Gateway: Gateway is looking to capture growth opportunities in the micro market of metros, Tier 2, and Tier 3 cities. The brand roll-out began with the opening of Gateway Bekal and the rebranding of four hotels in Nashik, Coonoor, Madurai, and Chikmagalur. It has a portfolio of 17 hotels and is estimated to reach 100 by 2030.

IHCL is looking to scale new Businesses, comprising of Ginger, Qmin, amã Stays & Trails, and Tree of Life, and has guided for revenue CAGR of over 30% in the coming years., while the re-imagined businesses of The Chambers and TajSATS will continue their growth momentum.

What about IHCL’s financials?

On a consolidated basis, the company generates 50% of its revenue from room rentals, 35% from F&B revenue, 7% from management fees, and others.

Over the past three years, sales have grown robustly at a 63% CAGR, reaching ₹6.7 billion, while profits have increased by 34% to ₹1.7 billion. EBITDA has grown at a CAGR of 61%, and margins surged from 17.4% to 33.7% in FY24.

Its return ratios have significantly improved, with RoE rising from 3% in FY18 to 15% in FY24 and RoCE increasing from 7% to 14% during the same period. This reflects the company’s efficient use of shareholder funds and the ability of new investments to generate strong returns.

IHCL wants to double this revenue 2x by 2030

As part of its 2030 vision, IHCL aims to double its revenue to ₹150 billion, which translates to a 12% CAGR. The company anticipates 25% of this revenue will originate from newly launched businesses, including Ginger.

The remaining 75% is expected to come from traditional sectors, notably upscale hotels, supported by leadership in RevPAR, asset management strategies, and the expansion of current inventory.

What about IHCL’s valuations?

We used the EV/EBITDA metric for valuations as it emphasises operational performance without considering depreciation and varying capital structures, which tend to be higher in the capital-intensive hotel industry.

We find that IHCL is currently trading with an EV/EBITDA multiple of 40, which reflects a 42% premium over its 10-year median of 28.6x.

Relatively, it trades at a 90% premium against EIH’s multiple of 21x, a competitor in the premium segment, and a 74% premium over Lemon Tree’s valuation of 23x, which operates in the mid-income segment.

The valuation is undeniably high. It still seems excessive even when accounting for premium valuation because of its dominant position and industry-leading performance.

The sustainability of these valuations hinges on the successful execution of its plan.

Is the management of IHCL capable? Recently, it demonstrated this when it launched “AHVAAN 2025” in 2022 with a three-year roadmap, which it has effectively carried out.

Successful execution of AHVAAN 2025 leads to stock rerating

Source: IHCL Q4FY24 Investor Presentation

Source: IHCL Q4FY24 Investor Presentation

The hotel industry remains on an upward trajectory. As per capita income rises, demand in the premium segment is anticipated to continue.

Additionally, the hotel sector has a demand-supply imbalance in favour of demand, which is expected to support continued growth in ARR and RevPAR. As IHCL adopts a capital-light approach, reduced depreciation expenses will enhance profitability, EBITDA, and margins.

The company has eliminated its debt and now enjoys positive cash flow, suggesting that IHCL is set for profitability growth in the coming years. Additionally, advancing its brand portfolio will help sustain this progress.

According to Axis Capital, a low debt-to-equity ratio indicates that key profitability metrics, RoE and RoCE, will likely rise to 13% and 17%, respectively.

Furthermore, Axis anticipates that momentum driven by ARR will persist as foreign tourist arrivals, still below pre-COVID levels, improve. As a result, they have raised the target price (TP) for IHCL from ₹800 to ₹940 per share, representing a 21% upside from the current market price (CMP) of ₹779.

On similar lines, Motilal Oswal also predicts strong momentum, fueled by growth in the core business and accelerated expansion in newly launched ventures. They maintain a buy rating with a TP of ₹960, reflecting a 23% upside from the CMP of ₹779.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends. A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.You can connect with Madhvendra on LinkedIn to explore more of his insights and engage in meaningful discussions.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.