Our Terms & Conditions | Our Privacy Policy

Strategic consolidation to drive re/insurance M&A activity in 2025, poll suggests

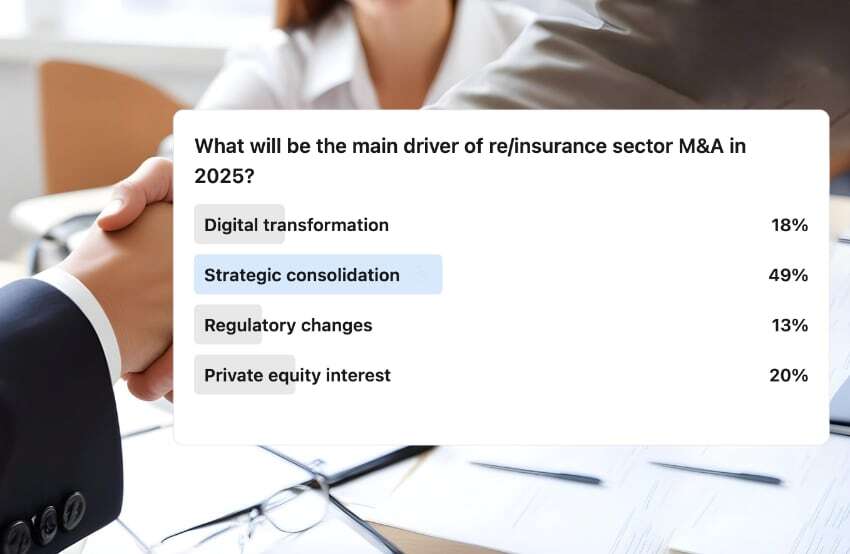

After a challenging period for mergers and acquisitions (M&A) in the global re/insurance sector, industry analysts have suggested that 2025 could be the year the market turns, fuelled primarily by strategic consolidation, according to a recent Reinsurance News poll.

The poll revealed that 49% of the hundreds of respondents believe strategic consolidation will be the primary driver of reinsurance M&A activity in 2025, followed by private equity interest (20%).

The poll revealed that 49% of the hundreds of respondents believe strategic consolidation will be the primary driver of reinsurance M&A activity in 2025, followed by private equity interest (20%).

Digital transformation was cited by 18% of participants, while regulatory changes took last place, at just 13%.

This prediction aligns with forecasts from Fitch analysts late last year, who suggested that a softening market and dwindling organic growth opportunities would spur reinsurance M&A activity, as companies with accumulated capital may seek to acquire struggling re/insurers.

M&A activity had slowed down in 2024 due to the ongoing hard market, which allowed reinsurers to focus on organic growth thanks to favourable pricing and terms.

Challenges such as integration risks, concerns over casualty reserve adequacy, and regulatory uncertainties also contributed to this.

Despite the overall slowdown, a WTW report noted a 15% increase in global M&A deals valued over $100 million in the second half of 2024, driven largely by a surge in large transactions (between $1 billion and $10 billion), with 99 such deals completed.

Jana Mercereau, Head of Europe M&A Consulting at WTW, stated: “Financing conditions have improved, with interest rates stabilizing and a new US administration signalling looser regulatory scrutiny. However, navigating complex M&A transactions in 2025 will remain challenging.

“Dealmakers face ‘known unknowns,’ including the risk of new tariffs and policies reigniting inflation, affecting supply chain stability and consumer prices. The growing influence of private equity on M&A will also have a significant impact. With trillions in dry powder to deploy, PE firms will leverage their expertise in complex deals to drive aggressive timelines, forcing corporate buyers to compete with greater efficiency and agility.”

The UK financial services sector, encompassing banks, insurers, and asset managers, also saw increased M&A activity in 2024, reaching its highest annual volume since 2012.

Damian Hourquebie, UK Financial Services Strategy and Transactions Leader at EY, commented: “UK financial services M&A activity reached a decade high in 2024, as signs of economic recovery boosted market confidence, valuations rose, and inbound deals increased.

“While optimism is warranted, macroeconomic uncertainty and geopolitical tensions could create headwinds in 2025.”

He concluded: “However, if the UK’s economic outlook continues to improve as expected, we anticipate sustained M&A activity throughout 2025 as confidence grows and firms accelerate transformation plans.”

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.