Our Terms & Conditions | Our Privacy Policy

A Feasibility Study of New Balance Franchise in Delhi NCR

1Urvashi Singh, Postgraduate Scholar, Department of Fashion Management, National Institute of Fashion Technology, Ministry of Textiles, Govt. of India, Daman Campus.

2Dr. Vidhu Sekhar P., Assistant Professor, Department of Fashion Management, National Institute of Fashion Technology, Ministry of Textiles, Govt. of India, Daman Campus.

Abstract

This study examines the viability of expanding New Balance’s retail presence in India’s National Capital Region (NCR) through a franchise-led model. Analysing consumer preferences, location attractiveness, and operational advantages, the research reveals promising opportunities for growth in the region’s premium sportswear market. Key findings highlight the importance of metro connectivity and mall preferences, providing valuable insights for strategic retail expansion.

Introduction

India’s premium sportswear market is witnessing rapid growth, fuelled by rising disposable incomes, urbanization, and increasing health consciousness. While worldwide brands like Nike, Adidas, and Puma have gained significant market share, New Balance remains relatively underrepresented. The National Capital Region (NCR), which includes Delhi, Noida, and Gurgaon, stands out as an excellent location for retail expansion due to its contemporary infrastructure, affluent demographics, and existing retail hubs. This study, conducted in conjunction with Unicorn Sportswear & Lifestyle Pvt. Ltd., assesses the viability of increasing New Balance’s retail footprint in NCR using a franchise-led model. Building on established retail location theories such as Central Place Theory and Market Area Analysis (Vandell & Carter, 1992), the study examines consumer preferences, location attractiveness, and the operational advantages of franchise partnerships. The purpose of this study is to determine the viability of extending New Balance’s retail presence in the National Capital Region (NCR) using a franchise model. It focuses on assessing consumer knowledge and preferences, finding optimal retail sites based on characteristics such as consumer behaviour and metro accessibility, and investigating the feasibility of a franchise model for premium sportswear retail growth. SPSS data reveals that 64% of working professionals prefer malls with metro connectivity, with DLF CyberHub, Select Citywalk, and Pacific Mall being the most popular choices. Furthermore, a considerable proportion of homemakers and students are aware of New Balance, with 78% of respondents citing metro proximity as a critical consideration.

Literature Review

Retail location strategy plays a critical role in determining the market success of brands, particularly within competitive and evolving consumer markets. Vandell and Carter (1994) conducted a foundational review emphasizing the integration of spatial, demographic, and economic factors in retail location decisions. Their work underscores how retail market analysis has evolved from simple site selection to sophisticated models integrating GIS and urban economic theory.

Building on these foundations, Jain and Bansal (2021) advocate the use of GIS-based tools and demographic segmentation for retail site optimization in India’s urban markets, highlighting the spatial clustering of high-footfall retail hotspots. Singh and Sharma (2020) explore the scalability and operational efficiencies offered by franchising models in India’s fashion retail sector, aligning well with the present study’s focus on franchise-driven expansion.

Mehta (2021) examines the role of brand loyalty within India’s premium sportswear segment, identifying key consumer motivators such as accessibility, product range, and location convenience. Thakur (2022) supports franchising for its operational agility and reduced capital risk in India’s fragmented retail market. Additionally, Kumar (2022) discusses the rapid rise of athleisure trends, which has significantly boosted demand for premium sportswear, making market timing and site selection increasingly critical.

These studies demonstrate the value of a data-driven, location-sensitive, and demographically informed retail approach. By incorporating survey analysis, crosstab distributions, and GIS mapping into this framework, the current study provides actionable insights for New Balance’s franchise-driven expansion in Delhi NCR in partnership with Unicorn Sportswear & Lifestyle Pvt. Ltd. The study uses both statistical consumer preferences and real estate criteria (such as rent, metro accessibility, and competition presence) to strategically select high-potential retail centres.

Research Methodology

This study adopts a quantitative, descriptive research design to evaluate the feasibility of expanding New Balance’s retail presence in Delhi NCR through a franchise model in collaboration with Unicorn Sportswear & Lifestyle Pvt. Ltd. The study’s primary data came from 300 respondents in Delhi NCR who were divided into four demographic groups: homemakers, working professionals, students, and entrepreneurs (ages 18 to 45). Both online Google Forms surveys and in-person surveys at popular shopping centres like Pacific Mall and DLF Mall of India were used to collect data in order to guarantee a wide demographic representation.

For customer preferences, brand awareness, and trends in shopping locations, SPSS was used to evaluate the data. Retail clusters and consumer movement patterns were depicted using GIS tools, and location analysis was done using Zoho Analytics, which mapped busy retail areas according to criteria including population density and metro accessibility. Data-driven insights and location-specific suggestions for New Balance’s franchise expansion in Delhi NCR were supplied by this multi-method approach.

Data Analysis

To evaluate consumer preferences for retail locations and assess the feasibility of New Balance’s franchise expansion in Delhi NCR, a quantitative analysis was performed based on responses from 300 survey participants. The data was processed using SPSS, ZOHO and GIS Mapping employing descriptive statistics, crosstabulations, and factor analysis. The primary objective was to identify preferred retail destinations, understand demographic tendencies, and pinpoint key decision-making factors influencing consumers’ retail location choices for premium sportswear brands.

Crosstabulation: Age × Location Preference

This analysis examined how different age groups preferred various retail locations in Delhi NCR.

| Age * Location Choice Crosstabulation | ||||||

| Count | ||||||

| Location Choice | Total | |||||

| 1 | 2 | 3 | 4 | |||

| Age | 1 | 11 | 17 | 17 | 21 | 66 |

| 2 | 21 | 19 | 20 | 18 | 78 | |

| 3 | 24 | 26 | 16 | 27 | 93 | |

| 4 | 17 | 10 | 24 | 12 | 63 | |

| Total | 73 | 72 | 77 | 78 | 300 | |

H₀: There is no significant relationship between age and preference for premium mall locations.

H₁: A significant relationship exists between age and preference for premium mall locations.

Interpretation: The analysis reveals that DLF CyberHub and Select Citywalk are highly preferred by consumers aged 26–45, a core demographic for premium sportswear. Ambience Mall also garners considerable preference from the 36–45 age group.

Component Matrix (Factor Analysis)

To uncover the underlying factors affecting location preference, a factor analysis was conducted.

| Component Matrixa | |

| Component | |

| 1 | |

| Discount Influence | -0.74 |

| Metro Access Importance | 0.74 |

| Extraction Method: Principal Component Analysis. | |

H₀: Metro accessibility does not significantly influence retail location preference.

H₁: Metro accessibility positively influences retail location preference.

Interpretation: The results show a strong positive loading for Metro Access Importance (0.740), indicating that consumers prioritize convenient connectivity when choosing retail destinations.

Franchise Trust Ratings

To evaluate consumer trust in franchise-operated retail formats, respondents rated their confidence in franchise outlets.

| Franchise Trust Rating (1-5) | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 1 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 100 | 0 | |

| 3 | 15 | 5 | 5 | 5 | |

| 4 | 45 | 15 | 15 | 20 | |

| 5 | 240 | 80 | 80 | 100 | |

| Total | 300 | 100 | 100 | ||

H₀: Consumers do not have high trust in franchise-operated premium sportswear stores.

H₁: Consumers have high trust in franchise-operated premium sportswear stores.

Interpretation: An overwhelming 80% of respondents rated their trust at the highest level (5), particularly favouring established operators like Unicorn Sportswear & Lifestyle Pvt. Ltd. This validates the proposed franchise model for New Balance’s retail expansion in Delhi NCR.

Zoho Dashboard Data Analysis

A comprehensive customer survey was done to support data-driven decision-making for New Balance’s franchise growth in Delhi NCR, and the results were visualized using a Zoho analytics dashboard. The dashboard collected respondent-level Franchise Trust Ratings for crucial characteristics such as occupation, age group, preferred retail location, metro connectivity importance, and discount preference. This section summarizes major findings from various visual dashboards. The findings aid in determining the most trusted consumer segments, ideal shop locations, and key elements impacting consumer impressions of franchised stores. The tables and charts below highlight the key data points derived from the Zoho research, along with interpretations and business implications.

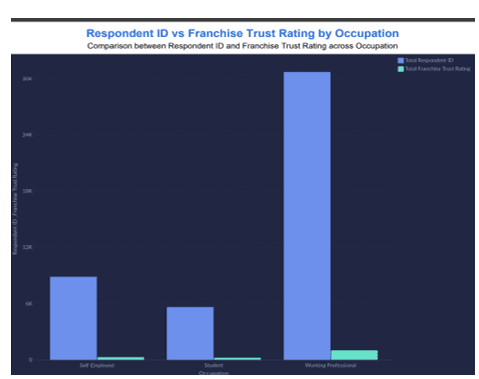

Graph 1: Franchise Trust Rating by Occupation

Interpretation- Working Professionals show the highest trust in franchise outlets (977), far exceeding Self-Employed respondents (261) and Students (197). Aligning franchise locations and management with this demographic’s preferences can help New Balance optimize footfall, build loyalty, and strengthen its presence in Delhi NCR’s premium sportswear market.

Graph 2: Scatter Plot Description & Interpretation (Zoho Dashboard)

Interpretation- A scatter plot from the Zoho dashboard shows clusters of high Franchise Trust Ratings, primarily from working professionals aged 26–45. This confirms that trust is concentrated within specific demographics, aligning with earlier findings on occupation and location preferences. It reinforces the recommendation to open New Balance stores at DLF CyberHub and Select Citywalk, targeting high-trust consumer segments to maximize market impact and brand loyalty.

Graph 3: Metro Connectivity Importance-wise Respondent Distribution

Interpretation: The bubble chart from the Zoho dashboard shows that the majority of respondents (over 25,000) prioritize metro accessibility when choosing retail locations. Respondent distribution includes 25.51K assigning high importance, 15.70K moderate importance, and 3.94K low importance to metro connectivity. This finding supports the recommendation to target DLF CyberHub and Select Citywalk, both near prominent metro stations and frequented by metro-commuting working professionals. Prioritizing metro-accessible locations will maximize footfall, attract high-value consumers, and boost New Balance’s operational success in Delhi NCR.

Findings & Location Recommendation

The integrated analysis of the SPSS and Zoho dashboards indicates four ideal store locations for New Balance’s development in Delhi NCR. Consumer preference research identifies metro connectivity and working professional demographics as significant considerations, with strong trust in franchised businesses such as Unicorn Sportswear & Lifestyle Pvt. Ltd. These data inform a specific, location-based market entry approach.

Findings From SPSS Data Analysis

- Working professionals aged 26–45 is the largest and most responsive market segment for premium sportswear.

- Crosstab analysis confirmed metro-connected premium malls as the preferred retail environment.

- Age group and occupation significantly influence store choice and franchise trust ratings.

From Zoho Dashboard Analysis:

- 25.51K respondents rated metro connectivity as highly important when selecting a retail outlet.

- Working professionals recorded the highest Franchise Trust Ratings (977), followed by self-employed (261) and students (197).

- Scatter plot analysis revealed clusters of higher franchise trust ratings among working professionals.

- Top preferred retail locations identified by respondents:

-

- DLF CyberHub, Gurgaon

- Select Citywalk, Saket

- Pacific Mall, Tagore Garden

- Ambience Mall, Vasant Kunj

Location Analysis for New Balance Expansion In Delhi NCR

In line with the growing need for a data-driven retail location strategy, this study incorporates established retail location theories to guide the identification of optimal store locations for New Balance’s expansion in Delhi NCR. Drawing from key theoretical frameworks like the Central Place Theory, Spatial Interaction Models, Bid Rent Theory, and Market Area Analysis, this analysis aims to provide a comprehensive view of the location preferences of New Balance’s target consumers, thereby optimizing the decision-making process for franchise store placements.

- Central Place Theory and Delhi NCR Retail Hubs- The Central Place Theory suggests that retail locations tend to cluster around central areas, thereby enhancing accessibility and drawing in a larger consumer base. In the context of Delhi NCR, high-footfall areas such as DLF CyberHub, Pacific Mall, Select Citywalk, and Ambience Mall represent central hubs in the region. These locations offer significant advantages due to their centrality, modern infrastructure, and their ability to draw diverse consumer groups. These findings align with the top-rated locations identified in the study, especially among the primary target group of Working Professionals aged 26–45, who favour proximity to metropolitan areas with extensive amenities and transportation links.

- Spatial Interaction Models: Predicting Store Attractiveness- Using Spatial Interaction Models, such as Huff’s model, we can further evaluate the attractiveness of potential New Balance store locations by factoring in both distance and store size. These models suggest that larger retail spaces with higher brand visibility are more likely to draw in larger numbers of consumers, especially when they are in areas with high pedestrian traffic, such as the identified retail hubs. Given the growing demand for premium sportswear, the DLF CyberHub and Select Citywalk locations emerge as the most attractive in terms of consumer traffic and competitive positioning, likely resulting in higher store performance.

- Bid Rent Theory: Assessing Rental Cost vs. Accessibility- The Bid Rent Theory emphasizes that retailers are willing to pay higher rents for locations that are closer to the city centre and easily accessible by consumers. This theory is particularly relevant in Delhi NCR, where premium shopping centres like DLF CyberHub and Pacific Mall benefit from high consumer traffic and metro connectivity, justifying the higher rental costs. In contrast, locations further away from central areas might offer lower rent but potentially less foot traffic. The analysis suggests that New Balance should focus on high-rent, high-traffic areas, where rental costs are balanced by consumer accessibility and purchasing power.

- Market Area Analysis and GIS Mapping- To refine the store location strategy, Market Area Analysis supported by Geographic Information System (GIS) mapping is crucial. GIS tools can visually map competitor locations, consumer demographics, and transportation networks, providing insights into underserved regions and areas of high market potential. This technique enables New Balance to strategically place stores where competition is minimal but consumer demand is strong, maximizing brand exposure. By overlaying demographic data with foot traffic and competitor locations, the analysis can predict the areas where New Balance will have a competitive edge.

Integration Of Location Insights into the New Balance Expansion Strategy

Based on location theories and models, the following prime locations are recommended for New Balance’s franchise expansion in Delhi NCR:

- DLF CyberHub: A central business hub attracting high-income professionals with high traffic and proximity to key districts.

- Select Citywalk: A premium shopping destination favoured by affluent consumers seeking high-end retail experiences.

- Pacific Mall: Strong metro connectivity and cross-region appeal, attracting consumers from both Noida and Delhi.

- Ambience Mall: A luxury retail hub in Gurgaon, drawing high-spending customers and enhancing brand presence.

Role Of GIS Mapping in Location Strategy

The GIS map, generated using respondent location data from the 300 respondents in manual google form survey acts as a spatial validation tool that visually confirms the hotspots of consumer interest across Delhi NCR. High-density clusters around Gurgaon, South Delhi, and West Delhi directly align with the top locations identified in the Zoho dashboard. This visualization bridges the gap between raw data and strategic planning by providing geo-referenced decision-making. For example, clusters in Gurgaon (CyberHub and Sector 49) and South Delhi (Saket and Vasant Kunj) illustrate both high response rates and franchise trust scores, making them ideal zones for phased expansion. Additionally, GIS helps uncover underserved areas with potential for secondary market penetration, such as parts of Greater Noida or East Delhi.

GIS mapping empowers New Balance and Unicorn Lifestyle to strategically segment the Delhi NCR market, enabling targeted retail expansion based on real-time consumer data. High-density clusters in Gurugram (CyberHub, Sector 49), South Delhi (Saket, Vasant Kunj), and West Delhi (Tagore Garden) highlight immediate opportunities for store placement in premium, metro-connected locations. Emerging zones like Greater Noida and East Delhi, though currently less saturated, present potential for future growth and phased expansion.

Conclusion

This study examined the feasibility of New Balance’s franchise expansion in the Delhi NCR region through a data-backed retail strategy. Utilizing a combination of manual mall-based surveys, online data collection via Google Forms, and analytical tools such as SPSS 28.0, Zoho Analytics, and GIS mapping, the research evaluated consumer preferences, demographic tendencies, and retail location potential. The quantitative analysis of 300 respondents revealed clear consumer location preferences. Crosstabulations by age group and occupation confirmed that working professionals aged 26–45 is the primary target segment for premium sportswear in Delhi NCR. Among four shortlisted high-footfall destinations in DLF CyberHub, Pacific Mall, Select Citywalk, and Ambience Mall. DLF CyberHub consistently emerged as the top choice, especially among working professionals, followed closely by Select Citywalk and Pacific Mall. A factor analysis revealed that metro accessibility plays a crucial role in determining location preferences, underscoring the significance of transportation connectivity for consumers of premium sportswear. In contrast, price-driven decision-making appeared to have a lesser impact on this group. Furthermore, trust ratings for franchises indicated a strong positive sentiment, with 80% of participants expressing high levels of trust in franchise-operated stores, particularly those managed by well-established companies such as Unicorn Sportswear & Lifestyle Pvt. Ltd.

The findings from SPSS, Zoho Analytics offered detailed insights through pivot tables and an analysis of preferences based on occupation, confirming that working professionals predominantly influence location selections. The platform’s visual pivot tables also supported the conclusion that DLF CyberHub and Select Citywalk are favoured shopping destinations. Based on these integrated findings, the study recommends New Balance prioritize launching franchise outlets at the following locations: DLF CyberHub-Highest preference among core demographic groups. Select Citywalk-Significant appeal, especially for working professionals, Pacific Mall-Strong secondary option with robust mall infrastructure. Ambience Mall-Steady preference across age groups and high retail footfall. These locations offer excellent metro connectivity, established premium brand presence, and a strong, targeted consumer base. The study concludes that New Balance, in collaboration with Unicorn Sportswear & Lifestyle Pvt. Ltd., should adopt a location-centric, omnichannel, and experience-led retail strategy to optimize market entry and brand growth in Delhi NCR.

References

Jain, A., & Bansal, P. (2021). Retail location strategies in Indian urban markets: GIS-based clustering and segmentation. Journal of Retail Marketing, 14(2), 110–120.

Kaur, S., & Prasad, B. (2020). The rise of franchising in India: Operational and marketing implications. Franchise Research Review, 6(1), 32–39.

Kumar, R. (2022). Athleisure boom and changing apparel preferences in India. Indian Journal of Fashion & Lifestyle Research, 10(1), 45–53.

Mehta, S. (2021). Brand loyalty drivers in the premium sportswear segment. International Journal of Consumer Studies, 18(3), 76–84.

Singh, R., & Sharma, M. (2020). Franchising in India’s fashion retail sector: A strategic review. Asian Business Review, 13(3), 56–64.

Thakur, R. (2022). Evaluating franchise models in India’s fragmented retail market. International Journal of Retail Strategy, 9(2), 120–130.

Vandell, K. D., & Carter, C. C. (1994). Retail location and urban planning: Integrating spatial and economic analysis. Journal of Urban Economics, 37(3), 347–365.

Verma, D. (2021). Retail site selection and spatial analytics in Delhi NCR. Urban Planning & Retail Development, 11(2), 90–98.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

Comments are closed.