Our Terms & Conditions | Our Privacy Policy

A Solid Play for Profiting from Utility Sector M&A

There have been literally thousands of utility mergers in the 125 years or so since electricity, heat, communications, and water became essential services. The key motivation for 2025 utility M&A is a quest for scale. The best way to bet on it is to build positions in the strongest companies that are on track to grow with or without a deal – like Brookfield Renewable Partners LP (BEP), explains Roger Conrad, editor of Conrad’s Utility Investor.

Not one union of regulated US utilities has ever failed to ultimately create a financially stronger, efficient, and more resilient company. That includes one I proclaimed a “mindless merger” earlier in my career: The former Centerior Energy and Ohio Edison to form the precursor company to FirstEnergy Corp. (FE).

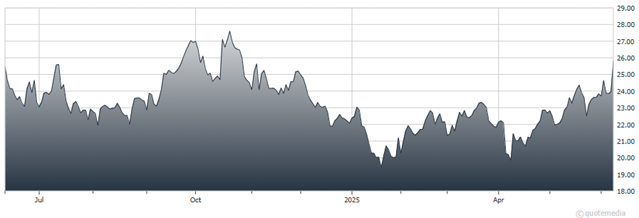

Brookfield Renewable Partners LP (BEP)

The reason for that unblemished record of success: Essential services are always cheaper, cleaner, safer, and more abundant when provided at scale. And that applies even when the underlying technology is fundamentally local like rooftop solar — the proof being the mass bankruptcies and consolidation of market share to a handful of companies the past few years.

BEP has now closed its purchase of National Grid Transco Plc’s (NGG) US renewable energy assets. That adds 3.9 GW of contracted generation either operating or in advanced stages of construction to enter service in the next year. And it has acquired another GW that’s “construction ready” as well as a 30 GW “development pipeline” — all for an enterprise value of just $1.74 billion.

Brookfield Renewable is an extremely high percentage bet to continue reaping the benefits of accessing a deep pocketed source of private capital. And both the BEP partnership units and C-Corp shares traded under the BEPC symbol are quite cheap at current levels, largely because of misplaced worries about earnings exposure to tariffs and losing tax credits.

Recommended Action: Buy BEP or BEPC.

Subscribe to the Conrad’s Utility Investor here…

[ad_1]

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their legal original owners.

[ad_2]

Comments are closed.